Polyethylene wax market to be extensively driven by the increasing PVC production, APAC to drive the regional landscape

Publisher : Fractovia | Published Date : 2018-02-23Request Sample

Boasting of an all-encompassing application landscape including packaging, candles, and plastics additives & lubricants sectors, polyethylene wax market, is poised to carve a profitable roadmap over the ensuing years. Polyethylene waxes are basically low molecular weight polymers, widely utilized for improving the process properties and parameters of finished products closely linked to plastic industry. It therefore comes as no surprise that changing polyethylene wax industry trends are meticulously hinged to the massive growth in plastic sector. For the records, world plastics production, in the year 2016, was almost around 335 million metric tons, and has witnessed an estimated CAGR of 8.6% over 1950-2015. In fact, over 9 billion tons of plastic has been produced since 1950, claim reliable sources. Quite vividly evident from the aforementioned statistics, plastic industry has witnessed a paramount upswing over the years, subsequently opening up a plethora of new opportunities for polyethylene wax industry players.

Having said that, it is imperative to mention that the competitive hierarchy of polyethylene wax market is rather consolidated, with few large-scale manufacturers having procured almost 50% of the global share in 2016. These giants, as it is observed lately, have been readily inclining toward integrating their operational capabilities throughout the supply chain model of the product ecosystem, in a bid to stronghold their presence in the global business space. For instance, renowned biggies like SCG Chemicals and Westlake Corporation, have not limited their production facilities to PE wax, but also PVC, given the fact that these lubricants are extensively deployed in polyvinylchloride production.

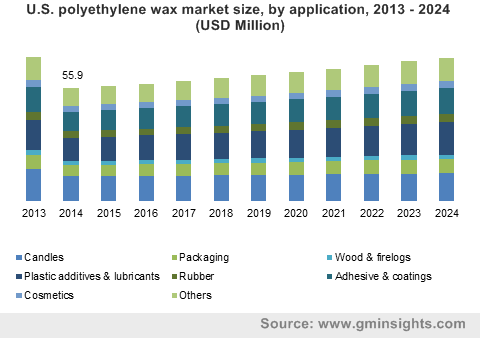

U.S. polyethylene wax market size, by application, 2013 - 2024 (USD Million)

In PVC processing industry, the deployment of lubricants is extremely essential. Several rationales like machine melt pressure, productivity, energy consumption of the processing equipment, and gelation of PVC, are directly affected by the right combination, selection, and dosage of lubricants. Probably, pertaining to its capabilities of improving molding complexity and abrasion resistance, PE wax has been universally recognized as an efficient external lubricant for PVC processing. With global PVC market estimated to exceed a valuation of 55 million tons by 2024, in terms of volume, polyethylene wax market is deemed to witness substantial gains over the coming years. Add to it, increasing construction spending especially across APAC belt has tremendously upscaled PVC demand, leaving a parallel impact on the regional polyethylene wax market.

Already having witnessed a percentage of authority in the global polyethylene wax industry share, Asia Pacific undoubtedly stands as one of the most opportunistic avenues for overall business growth. In fact, as claimed by Global Market Insights, Inc., the belt covered almost 30% of the overall market in terms of volume in 2016. The massive scope that APAC Polyethylene wax market holds in terms of growth mainly grounds on the fact that the region has shown immense growth in construction, automotive, and food sectors over the past few years. The region, for instance, accounted for almost 35% of the overall construction spending in 2016, and is likely to cover nearly 60% of the global share by 2025. Inherently stimulated by the fact that PVCs have been increasingly replacing traditional building materials on grounds of its cost effectiveness and versatility, APAC polyethylene wax industry size is slated to generate a substantial momentum in the coming timeframe. Add to it, the expansive automotive sector is also claimed to be another pivotal factor complementing the business growth.

The problem associated with the waste management of plastics especially those that are produced by petrochemical industry, has turned out to be a global concern of late. However, research shows that oxidized polyethylene wax can be a potential carbon source for bacterial PHA production, in turn, producing environmentally viable and biodegradable polymers. The sheer popularity of polyethylene wax industry can also be attributed to this sustainability aspect. Experts claim, oxidation of polyethylene, in the form of oxidized PE wax, can produce valuable feedstock that are rich in hydrocarbons. Pertaining to these numerous benefits, plastics additives & lubricants application is certainly one of the major growth grounds for polyethylene wax market share. However, strong substitute threat from FT (Fischer-Tropsch) wax along with fluctuating crude oil price trends are two major deterring issues that market giants are presently dealing with. Nonetheless, with increasing research in the competitive ground not only to widen its application horizon but also to overcome these challenges, polyethylene wax industry is forecast to cross a valuation of USD 370 million by 2024.

The controlled molecular weight and narrow poly disparity of PE wax provide diverse benefits such as low melt viscosity, narrow melt range and formulating flexibility.