Polyoxymethylene (POM) market to accumulate commendable gains via extensive product demand from the automotive sector over 2017-2024, APAC to remain a prominent revenue pocket

Publisher : Fractovia | Published Date : 2018-02-06Request Sample

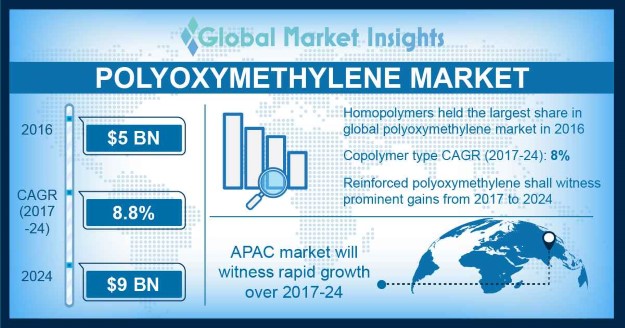

Thriving on the cusp of the robustly expanding automotive industry, polyoxymethylene market is poised to traverse along a rather profitable roadmap in the coming years. Given the vital role that high-performance plastics play in designing advanced lightweight materials for automotive manufacturing, it comes as no surprise that polyoxymethylene industry has already established its name in the billion-dollar fraternity. Elaborating further, it is imperative to state that the deployment of plastics in vehicle production is indeed witnessing a massive ascent by the day. According to reliable estimates, an average car will incorporate about 350 kg of plastics by 2020, a significant rise from 200 kg in 2014. Moreover, the market for carbon fiber, particularly in car manufacturing is projected to increase threefold in the coming years, owing to extensive usage of this material in car component designs. This data clearly reflects the colossal commercialization potential of the polyoxymethylene market in the years ahead. A study report compiled by Global Market Insights, Inc., claims polyoxymethylene (POM) market size to grow at a Y-O-Y rate of 8.8% over 2017-2024.

U.S. polyoxymethylene market size, by grade, 2013 - 2024 (USD Million)

How the automotive domain will act as the principal growth avenue for POM market

Speaking of the end-use spectrum of POM industry, it is indeed justified to state that the automotive sector is the most lucrative growth ground for this business, given that plastics have been substituting metals in vehicle bodies. Polyoxymethylene, is this regard, is gaining tremendous traction owing to its phenomenal material properties such as wide end-use temperature range, chemical resistance, outstanding fatigue endurance, and excellent resistance to moisture & solvents. These unmatched functional properties of POM have enabled car manufacturers to produce entirely new designs and shapes for better vehicle aesthetics as well as performance. The product also finds myriad usage in the manufacturing of brackets, switches, seatbelt components, and latches in automobiles, on account of which, POM market share from the automotive sector is expected to be considerably high.

While the growth of polyoxymethylene market is quite evident in the automotive sector, it is also prudent to mention that other application arenas of this business sphere including consumer goods & electronics, industrial, electrical, and medical devices sectors are also slated to witness lucrative expansion prospects. Continuous R&D activities and material enhancement projects in these sectors have brought forth tremendous demand for homopolymers & copolymers, thereby augmenting the revenue graph of polyoxymethylene industry. In fact, estimates claim copolymer polyoxymethylene market to register a CAGR of 8% over 2017-2024, owing to the product’s affordable quotient and extensive usage in manufacturing medical & automotive components. Homopolymers on other hand, held the largest share in POM industry in 2016, as are further expected to witness extensive growth ahead, driven by numerous R&D activities for sustainable product development.

Speaking along the same lines, it is imperative to cite a instance demonstrating the efforts undertaken by industry players with respect to the innovation and research conducted for homopolymers. As early as September 2017, DuPont and Regina together launched a new Regina E-F.A.S.T. (ecological, friction abating sliding thermoplastic) material with a new grade of DuPont™ Delrin® acetal homopolymer that is designed to offer higher productivity and more sustainable & environmentally friendly solutions. Reports cite that this innovative product launch marks the fruition of a 4-year long development project between the two companies. Indeed, this product has been claimed to be bring about a major breakthrough in the POM market, that would enable designers to achieve cost efficiency, low maintenance, longer life span & eco-friendly components. Additionally, this collaboration perfectly exemplifies how POM industry players are pooling resources and expertise to strengthen their position in the dynamic polyoxymethylene market. Some of the other prominent companies working toward transforming POM industry trends include DuPont, Asahi Kasei Corporation, A. Schulman Inc and LG Chem and Mitsubishi Engineering Plastics Corporation. These companies have also been involved in several R&D activities and collaborations to gain an edge over their rivals and expand their reach in myriad geographies.

Speaking of the geographical spectrum, Asia Pacific is indeed being touted as the emerging market for polyoxymethylene industry, as these new materials hold great promise in the region’s aggressively expanding automotive sector. If reports are to be believed, APAC may be the largest market for automotive plastics, with China alone being a major producer of 24 million passenger cars and 3.5 million commercial vehicles in 2016. Moreover, the surging consumer goods industry in the region is also poised to drive APAC polyoxymethylene industry share, in terms of volume & revenue in the coming years.

It is rather overt that POM market is on its way to establish itself as one of the most lucrative industry verticals. The escalating growth of the automotive industry and the involvement of companies in product innovation indeed, are the two prime driving forces of POM industry. Not to mention, the growing commercialization of the product in myriad regions will also unlock potential growth opportunities for the players of this business space, massively impelling polyoxymethylene market size in the years ahead.