APAC to push Aeroderivative Gas Turbine Market over 2016-2024, China to emerge as a major revenue pocket

Publisher : Fractovia | Published Date : 2017-04-06Request Sample

Large-scale adoption of cogeneration systems to satisfy the growing demand for electricity globally will propel Aeroderivative Gas Turbine Market. With rapid industrialization and urbanization across the globe, the requirement for power has observed a massive upswing, which will drive product demand. On-going exploration and production activities in oil & gas coupled with strict environmental regulations regarding GHG emissions will also be a major factor driving aeroderivative gas turbine industry. According to Global Market Insights, Inc., “Worldwide aeroderivative gas turbine market was worth USD 2 billion in 2015 and will generate a power of more than 21 GW capacity by 2024.”

Taking into account the technological bifurcation, aeroderivative gas turbine industry comprises combined and open cycle technologies. Combined cycle aeroderivative gas turbines generated more than 5 GW in 2015 and is anticipated to exhibit a lucrative roadmap over the coming seven years. The escalating efforts by various countries to strengthen and expand the naval and defense sectors will favor the industry growth significantly. Open cycle aeroderivative gas turbine market will collect a revenue of over USD 1 billion by 2024, owing to its high working efficiency and increasing demand.

UK Aeroderivative Gas Turbine Market, By Capacity, 2013 - 2024 (MW)

Aviation, power generation, marine, industrial, and oil & gas are the prominent application areas of aeroderivative gas turbine industry. Oil & gas is also an attractive application segment, which will witness an annual growth rate of over 10% during the coming years of 2016 to 2024. Aeroderivative gas turbine market size from power generation application is projected to cross 9 GW by 2024, owing to the growing preferences for unconventional energy sources as opposed to conventional sources.

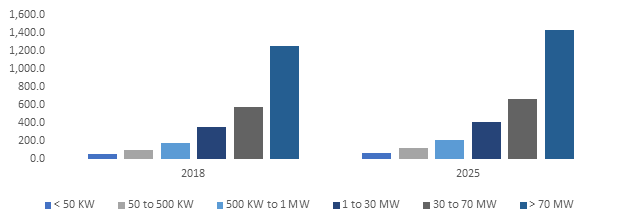

Based on the capacity, this industry is mainly segmented into two types - >18 MW and ≤ 18 MW. Aeroderivative gas turbine market size for >18 MW capacity was more than USD 1 billion in 2015 and will grow substantially over the coming timeframe. Huge investments in electricity generation activities across the globe will augment the industry growth notably.

Aeroderivative gas turbine market for ≤18 MW capacity will record a CAGR of more than 8% over the period of 2016 to 2024, owing to its increasing requirement across the small-scale industries. In addition, this type of turbine is in high demand across the mobility sector.

Regional analysis of this industry is illustrated below:

- China aeroderivative gas turbine market will register an annual growth rate of more than 12% over the period of 2016 to 2024, owing to the shifting trends toward the sustainable technology.

- U.S. aeroderivative gas turbine industry size was worth USD 250 million in 2015 and will exhibit an annual growth rate of more than 11% over the coming seven years. The growth can be attributed to the growing implementation of cogeneration technology across this region.

- Brazil aeroderivative gas turbine market share is predicted to grow at a CAGR of more than 10% over 2016 to 2024, primarily driven by the escalating development of small and medium-sized industries.

Market players are investing heavily in various R&D activities to innovate cost effective and sustainable technologies. Major companies operating in aeroderivative gas turbine market are Siemens AG, Rolls-Royce, General Electric, ABB, Mitsubishi Hitachi Power Systems Ltd., Capstone Turbine Corporation, NPO Saturn, Ansaldo Energia, Harbin Electric International Company Limited, Opra Turbines, and Kawasaki Heavy Industries.