North America Aerospace Composites Market to garner appreciable momentum over 2016-2024, U.S. to emerge as a key revenue contributor

Publisher : Fractovia | Published Date : 2017-10-05Request Sample

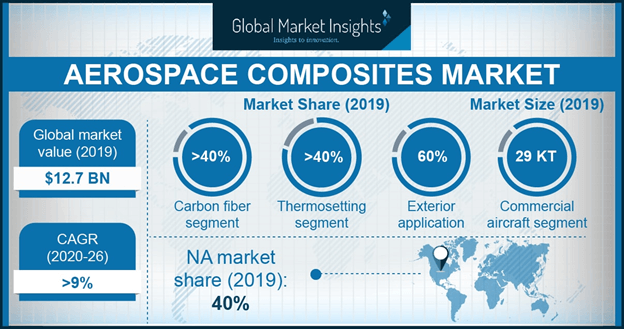

The competitive landscape of aerospace composites market, inherently characterized by numerous integration strategies, is set to witness intense rivalry in the years ahead. The emergence of this prospective scenario can be primarily attributed to the fact that companies have been continuously striving to consolidate their position across the value chain, in a bid to reduce operational costs. Some of the biggest firms partaking in aerospace composites industry share, including the likes of BASF, Lee Aerospace, and Hexcel, have adopted the strategy of forward or backward integration between the composites manufacturers, raw material manufacturers, and distributors. Furthermore, enhancement of productivity and production capacity are other vital strategies that companies have been deploying of late, pertaining to the rising demand from the commercial, business, and military aviation sectors. Unquestionably, the adoption of such tactics would cause quite a furor in aerospace composites market, on the grounds that all the companies partaking in the business share would be pressurized to come up with a range of unique products at reasonable costs, right from obtaining the raw material to developing and commercializing the products. Despite the pressure, it has been observed that companies are going the whole hog to strengthen their position in this fraternity, which has been predicted to surpass commendable heights of success in the years ahead. Estimates in fact, forecast aerospace composites market size to have been pegged at USD 2.5 billion in 2016.

U.S. Aerospace Composites Market, By Aircraft, 2016 & 2024, (USD Million)

An outline of North America aerospace composites market trends

North America has been touted to emerge as one of the most lucrative growth grounds for aerospace composites industry, perhaps on the grounds of the ever-expanding commercial and military airline sectors. The region in fact, accounted for the manufacture of close to 9,300 aircraft in 2016 alone. The extensive product penetration in the continent can be credited to the massive requirement of commercial aircraft and the marginally high consumer spending of late. Pertaining to the high demand for fuel efficiency and lightweight aircraft, North America aerospace composites market size was worth more than USD 1.17 billion in 2016.

The United States is one of principal regions fulfilling the product demand in North America. The country is renowned for its extensive defense expenditure, which would be a major driving force for U.S. aerospace composites industry. Another significant reason for the development of the U.S. business space is the fact that most of the prominent players in aerospace composites market have their headquarters in the country. Having been housed in the nation, it goes without saying that the contributions of these firms toward the revenue of the aerospace composites market would have a considerable impact on the regional aerospace composites market outlook. A couple of such instances have been demonstrated below:

- The Washington-based Stratolaunch Systems Corporation has scarcely rolled out its long-awaited brainchild, the Stratolaunch aircraft, which has been rumored to be the world’s largest aircraft by wingspan. Reportedly, it is almost entirely developed from composite materials to enable the aircraft to be light, stiff, and tremendously strong. Powered by six engines that would help the aircraft carry a payload of close to 550,000 lbs, the Stratolaunch is also endowed with two fuselages connected by a giant single wing. Stratolaunch’s innovation is likely to impel other aerospace composites market players to brainstorm state-of-the-art products that would be rapidly deployed across major airline manufacturing sectors.

- The Connecticut-based aerospace composites industry giant, Hexcel, has recently announced the launch of a new R&D project - Multi Axial Infused Materials (MAXIM), funded by the UK government, for a valuation of close to GBP 7.4 million (approximately USD 10 million). The project, spanning for four years, has also been backed by the UK Aerospace Technology Institute (ATI). With this project, Hexcel aims to expand its manufacturing facility at Leicester as well, in addition to firmly consolidating its presence across the UK aerospace composites market.

The U.S. certainly holds an upper hand in the development of North America aerospace composites industry, though other regional economies boast of substantial contributions too. In consequence, it has been forecast that North America aerospace composites market size would be pegged at USD 2 billion by 2024, with a CAGR estimation of almost 7% over 2016-2024.

While North America is likely to remain one of the key contributors toward aerospace composites industry share, the geographies of APAC and Europe are not that far behind either. In fact, with major aerospace composites market players earnestly striving to expand their presence across multiple regions, this business space is likely to establish itself across major geographies. Pertaining to the ever-expanding aerospace and defense sectors and the robust requirement for lightweight, cost-effective, sturdy components, aerospace composites market has been projected to scale an appreciable growth rate, with a target valuation of more than 70.5 kilo tons in terms of volume, by 2024.