North America aerospace landing gear market to accrue massive revenues over 2018-2024, expansion of regional jets to add momentum to the industry growth

Publisher : Fractovia | Published Date : 2018-10-23Request Sample

The global aerospace landing gear market has experienced augmented growth in years, as higher consumer spending combined with the rising frequency of air travel has amplified the production of new aircrafts. While operating in different surroundings and the most challenging conditions, efficient landing gears bear the entire weight of an aircraft and allow for a comfortable and safe landing. Undoubtedly, the aerospace landing gears plays a vital part in ensuring the safety of passengers and enhance the overall value of an aircraft thought its life cycle.

Innovations in the field of light-weight and composite materials for manufacturing the products have permitted the integration of components that reduce the weight of an aircraft, improving the fuel economy. Directives put forth by governing bodies to regularly improve the safety performance of existing airplanes will certainly bolster the aerospace landing gear market, which boasted of a revenue of around USD 14 billion in 2017.

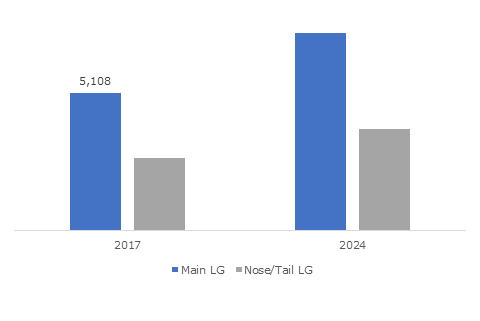

U.S. Aerospace Landing Gear Market, By Position, 2013-2024, (Units)

Referring to a report by the Air Safety Network (ASN), 2017 was supposedly the safest year in the history of commercial aviation, with only 10 fatal airline accidents and 44 deaths on airlines recorded globally. Since landing a flight poses one of the most difficult tasks for pilots, strong and reliable landing gear systems have helped the airline industry to almost eliminate a category of fatal risk. Subsequently, the aerospace landing gear market has been widely propagated through the development of the tourism sector, with air travel considered as one of the safest transport options available and gradually becoming more affordable. Globalization of businesses and growth of international trade have further caused the subsidization of air fares and fuel costs, instigating expansion activities by airlines for accommodating larger volume of passengers and cargo.

Demonstrating the massive earning potential of the aerospace landing gear market from the OEM segment, at a recent airshow Boeing reportedly won orders for 673 new aircrafts in total, worth nearly USD 100 billion. In addition, Airbus revealed it had agreed upon delivery of 431 new commercial aircrafts that would be built over the next few years. Evidently, the growing popularity of airlines and the need for economically improved operations have spurred investments towards extending the fleet size. Yearly rise in air traffic has also inspired several start-ups to enter the aviation services industry, which would eventually lead to escalation in the number of aircrafts being constructed and needless to say, would secure a lucrative growth avenue for the aerospace landing gear industry.

Accentuating the fact, a U.S. airline start-up has formed an agreement with Airbus to buy 60 new A220 aircrafts, indicating the revenue prospects of the aerospace landing gear market in North America, which is also home to Boeing, the leading aircraft manufacturing company based in Chicago, U.S. The region has several airline businesses serving to a variety of customers and majority of the cities are interconnected by air transport facilities. In particular, the U.S. consists of the highest number of airports in the world, which is about 14,712, and has an extensive network of regional airlines that provide cheap, convenient air travel. The powerful economic status of the nation has boosted the capacity of common people to utilize regional airline services whereas the technological progress achieved by its manufacturing industries has attracted an inflow of foreign buyers.

Speaking further, regional aircrafts have tremendously contributed to the development of the aerospace landing gear market and many U.S. airlines such as South West, United Airlines, have been ordering large number of new aircrafts. North American companies have also received interest from other countries to purchase regional jets to fortify their domestic air traffic capacities. These customers not only include developed nations but also emerging economies that want to build a modernized transport network and supplement their fast-paced commercial progress. For instance, Canada-based Bombardier, which has a strong portfolio of regional jets, namely the C-series in partnership with Airbus, has earned a contract for the supply of four CRJ900s to Uganda National Airlines.

The North America aerospace landing gear market is slated to amass hefty proceeds from the regional aircraft segment as many Asian and African nations will look to expand their domestic fleet size and service capabilities. To elaborate, a 2017 report forecast that over the next 15 years, approx. 5,728 regional aircrafts valued at USD 212.9 billion could be manufactured, including jets and turboprops. Consequently, the aerospace landing gear industry will directly gain substantial momentum as these estimates show a significant increase over current numbers.

As per estimates, North America was the dominant regional ground for aerospace landing gear market in 2017, holding close to 55% of the volume share. Powered by the presence of myriad airports handling air freight and passenger traffic and the launch of light weight components for improved efficiency, North America aerospace landing gear market is expected to continue retaining its dominance over 2018-2024.

Driven by the presence of prominent industry players such as Safran Landing System, AAR Corporation, Triumph Group, Eaton Corporation, SPP Canada, UTC Aerospace, among others the aerospace landing gear market is anticipated to witness around 6% CAGR from 2018 to 2024.