Aerospace plastics market to garner substantial proceeds via increasing military aircraft demand, development of innovative light-weight aircrafts to characterize industry growth

Publisher : Fractovia | Published Date : 2017-05-03Request Sample

Increasing demand of light-weight materials in the aerospace sector has helped in fueling the aerospace plastics market share over the last few decades. Undoubtedly, there is unremitting growth in commercial air transport and military aircraft across the globe. Success of aerospace plastic industry is heavily relied upon persistent innovation in reducing fuel costs and improving aircraft performance. Unsurprisingly, the usage of plastic in aircrafts has grown at an astounding rate in recent years owing to the fast and substantial improvement in manufacturing quality. Utilizing plastic can reduce manufacturing and operating costs which makes it cost-effective to use in aircrafts and fuel aerospace plastics market growth.

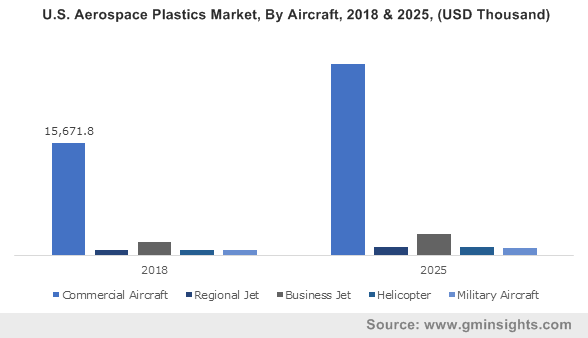

U.S. Aerospace Plastics Market, By Aircraft, 2018 & 2025, (USD Thousand)

Numerous advantages of plastics in aircrafts, like cost-effective, lightweight, durable etc., are benefitting manufacturers to fulfil product demand which has propelled the growth of aerospace plastic industry. Aerospace industry uses plastics in aircraft interior parts like luggage compartments, trays seats and panels; ventilation ducting and seals; rudders, fuselages and landing components; and to craft future airplanes. High degree of thermo-stability, heavy-duty strength, lightweight density and malleability are some added benefits which has made it the perfect application for aircrafts. Although several innovations have been made, many are in the works which would aid plastics with complementary properties and further advance its usage, driving aerospace plastics market growth.

How will the rising demand for military aircraft propel the remuneration scale of aerospace plastics industry?

Manufacturing of military aircrafts and rotary aircrafts contribute to the growth momentum of aerospace plastics market. Military aircrafts demands for light weight aircrafts as the U.S. soldiers carry loads of protective gear and equipment that can weigh anywhere from 45 to 130 pounds with limited fuel on board. Earlier, metals were the preferred choice for military aircrafts. However, metals have lost their prominence to plastics as they invariably contributed to the aircraft weight. Now, injection-molded plastic parts made from advanced materials are rapidly replacing metals in military applications.

Plastics also help increase stealth in aircrafts as they are light weight. The matte finish of the plastic surface reduces glare to a camouflage pattern, making it an ideal component in military aircraft applications. Plastics also help reduce painting and coating costs as any color can be virtually created over the surface while production. Many innovations are still awaited to benefit the aircraft manufacturing which are likely to propel aerospace plastics industry growth.

Apart from injection-molded plastic, there are various other plastics available in the market which can be used as per the requirement. For instance, the carbon-reinforced plastic composite available in market is being used for manufacturing A350 XWB of Airbus. More than 50 percent of A350 XWB is manufactured from this composite to make the aircraft fuel efficient. Likewise, Boeing 787 is also made up of nearly 50 percent composite. Not only Boeing and Airbus, but also BAE Systems, Bombardier, GE Aviation, Lockheed Martin and Raytheon use composite to manufacture lighter and fuel-efficient aircrafts. Aircraft companies are putting their best efforts to build high performance and unbeatable aircrafts – a factor that is elevating the revenue graph of the aerospace plastics market.

The flexibility and customizable characteristics of plastics make them especially useful for demanding applications in the aerospace industry. Plastics can even be developed with specific properties in mind, such as shock resistance, thermal resistance, high strength-to-weight ratio, chemical resistance, low smoke and toxicity, and flame retardant. Upcoming product advancements and increasing demand for lightweight and durable material in future aircraft manufacturing is likely to boost the aerospace plastics market size which is forecast to surpass USD 75 million by 2025.