Animal parasiticides market to witness phenomenal proceeds in the developing economies, global valuation to hit USD 6.5 billion by 2024

Publisher : Fractovia | Published Date : 2017-10-27Request Sample

One of the most principal factors driving the global animal parasiticides market is the rising awareness about the risk of epidemics caused by animal-borne parasites. The detection of the bluetongue virus in cattle imported to Northern Ireland has recently made it to the headlines, where the farmers have been advised to remain watchful for the signs of the virus. Bluetongue is a virus that generally spreads through midges from animal to animal. Reportedly, this virus affects animals such as goats, cattle, deer, and sheep. In order to prevent the spread of disease, the Animal and Plant Health Agency in Great Britain is working closely with the livestock keepers at the affected premises. The incidence, reportedly, has brought a remarkable transformation in the regional animal parasiticides market trends. Speaking along similar lines, such increasing number of animal welfare programs and government initiatives coupled with the rising awareness about the zoonotic diseases are certain to provide a substantial push to the global animal parasiticides market size, which as per reports was valued at USD 5 billion in 2016.

U.S Animal Parasiticides Market size, by Product, 2013-2024 (USD Million)

Animal parasiticides are the products that kill the parasiticides infesting upon livestock, pets, and other animals. The most common animal parasiticide which finds extensive usage in animal infection treatments is Ectoparasiticides. Of late, the use of sprays, collars, pour-on, and spot-on formulations has witnessed extensive popularity, which in extension has elevated the product demand. As per the estimates, in 2016, ectoparasiticides held 70% of the overall animal parasiticides market share and is further projected to attain a CAGR of 4% over 2017-2024. Furthermore, extensive focus on new product development to address the growing parasitic infections in farm and pet animals have is expected to bode well in the expansion of animal parasiticides industry share.

Despite animal parasiticides market witnessing a plethora of product innovations and advancements, the fact that these products have not yet majorly entered into the developing and under-developed regions, remains a major restraint for the industry growth. Lack of awareness about the presence of advanced animal health products and concerns regarding the use of parasiticides in food producing animals have further impeded the product demand. Nevertheless, in order to trim down such roadblocks, several animal parasiticides industry players along with governmental bodies are initiating awareness programs and regimes for veterinary care. One such recent move that has resulted into commendable growth in the regional animal parasiticides market was the Australian government’s initiative to implement a massive Big Data project to record clinical data for animal diseases and treatments. Elaborating further, the program collects real-time clinical records on the veterinary care of companion & farm animals and can further provide unparalleled access to data with regards to key diseases and treatments of these faunas, majorly comprising dogs, cats, and horses. For the record, Australia is one of the leading countries that has a massive rate of pet ownership in the world. Statistics claim that almost 38.5% of the 8 million Australian households owns at least one dog and 29.2% owns a cat. The Big Data veterinary care project that has been rolled out in Australia, has resulted into increased sales of feed additives, orals, and injectables, in turn propelling regional animal parasiticides market profoundly.

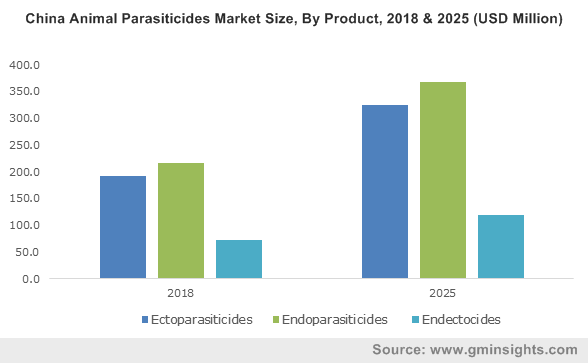

Speaking of the geographical terrain, developed regions such as North America and Europe have registered themselves as lucrative growth grounds for the expansion of animal parasiticides market. The growth in these regions can be mainly credited to the quick adoption tendency of neoteric products and stringent regulatory frameworks. Owing to the increased number of pet population and large scale industrial animal farming, North America accounted for more than 25% of the overall animal parasiticides market in 2016. Furthermore, animal parasiticides industry has also proliferated rapidly in the developing regions of Asia Pacific and Latin America. Increasing population of livestock and companion animals coupled with rise in disposable income are some of the prominent factors favoring Asia Pacific animal parasiticides market trends.

The fierce competitive landscape of animal parasiticides industry is strongly characterized by contemporary growth strategies such as mergers & acquisitions, regional expansion, and product innovations and developments. Backing the fact with an instance, Merial recently teamed up with a leading German company Boehringer Ingelheim to expand the production capacity of its animal health manufacturing unit.

Another major trend anticipated to underline the strategic landscape of the industry is the exploitation of developing economies which carry a pool of opportunities for the animal parasiticides market players. Though, currently a major portion of the industry share is accrued from the developed regions, the aforementioned trend is like to gain vital prominence in the coming years with the shifting focus of the industry players toward greener avenues. With a wide application spectrum and new growth arenas explored by the market participants, it is rather overt for the animal parasiticides industry to witness remarkable proceeds in the coming timeframe. Global Market Insights, Inc., claims the worldwide animal parasiticides market to attain a valuation of USD 6.5 billion by 2024.