NFC technology-based Asia Pacific mobile wallet market to register commendable remuneration by 2025

Publisher : Fractovia | Published Date : 2019-07-12Request Sample

Increasing pace of digital transactions across numerous business verticals has driven the Asia Pacific mobile wallet market size in recent years, essentially emerging as a significant component of the global e-commerce industry. With each passing year, more and more people are utilizing digital wallets to store debit card, credit card, and even loyalty card information on their smartphones as they provide greater flexibility and convenience in payment choice. Moreover, mobile wallets enable users to easily and quickly make purchases in-stores and online, send money peer to peer, and withdraw cash from ATMs.

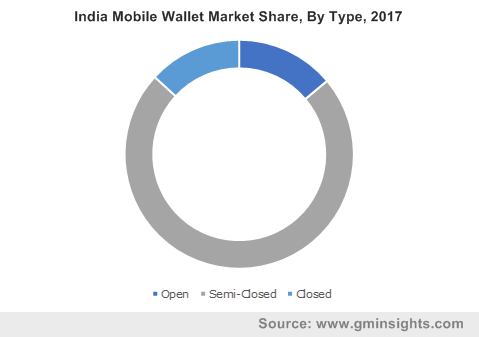

India Mobile Wallet Market Share, By Type, 2017

With increasing number of cyber-attacks, the security aspect of smartphones has become crucial over the past few years. From biometric authentication to the ability to lock a stolen or lost phone, digital wallets provide greater security. In fact, some mobile wallet providers require biometric authentication like a fingerprint to make a purchase, while others require a selfie to authenticate a transaction. These security features have resulted in increasing the adoption of mobile wallets across various geographies in the recent times.

The NFC (near field communications) technology being used by mobile wallet providers is another factor that has favored the growth of Asia Pacific mobile wallet industry share. Apparently, NFC interactions and payments work in a manner that is considered largely secure as they cannot be easily interfered with. For instance, an NFC-enabled smartphone has to be held fairly close to a contactless payment reader in order for NFC payment to work. This makes it highly secure as the user’s phone cannot be scanned from halfway across the store.

The increasing uptake of non-contact payment solution along with integration of NFC chips in the smart devices (such as wearables and smartphones) is proving to be beneficial for transforming Asia Pacific mobile wallet market outlook. In fact, NFC technology-enabled APAC mobile wallet market size is projected to expand at an annual growth rate of more than 29 percent over the forecast timeframe.

The continued success of mobile wallets in the Asia Pacific region can be attributed to the presence of financial powerhouses such as India and China. While bill payments, mobile recharges, taxi bookings remain the strong digital payment opportunities in these nations, numerous e-payment service providers are trying to expand into other sectors as well. Few of the mobile wallets are trying to add their interface to hotels, coffee shops, small retail enterprises, and much more, even going to the extent of branching into the education sector by enabling students to pay for coaching classes through digital payment platforms.

Moreover, increasing number of supportive government policies and initiatives across APAC countries has resulted in a swift rise in the mobile wallet transactions over the past few years. Reportedly, the India mobile wallet market is forecast to expand at a CAGR of close to 30 percent in the upcoming years. With an aim to promote the penetration of financial services via digital channels, the Indian government had launched the Digital India Campaign in 2015. Additionally, the demonetization of Indian rupee announced by the government in 2016 benefited the mobile wallet providers immensely.

The aforementioned initiatives are being backed by significant policy changes in the financial ecosystem of India. For instance, the Finance Minister recently announced in the union budget 2019 that the government would levy TDS of 2 percent on cash withdrawals surpassing INR 1 crore annually from a bank account. This would discourage business payments in cash and promote digital payments, impelling India mobile wallet market trends.

Improving digital infrastructure, data plans, better communication systems, and stable networks would be integral to the continued success of mobile wallets in the Asia Pacific region. Moreover, the gradual increase in the awareness regarding the benefits of e-payments is getting a greater number of people on the digital payment bandwagon. Amazon Pay, Paypal, Apple, Samsung, Google, Union Pay, Paytm, Wechat Pay, Alipay, Rakuten Pay, Xiaomi, and Vodafone Pay are some of the key players constituting the competitive hierarchy of the industry. Reports predict that the Asia Pacific mobile wallet market size will exceed USD 140 billion by 2025.