Collision repair market to amass a mammoth revenue of over $275bn by 2024, rising efforts by technology giants to stimulate the product demand

Publisher : Fractovia | Latest Update: 2018-12-05 | Published Date : 2018-06-19Request Sample

The ever-increasing deployment of electronic components in modern automobiles has stimulated collision repair market, owing to the rise in design complexity and technological advancements. In the last few years, the implementation of pre and post-scanning technology seems to have had a positive impact on vehicle repair post collision. In accordance, it has been observed that more and more collision repair shops have been deploying electronic equipment to repair bumpers, headlamps, and sheet metal body of vehicles. Considering the vast expanse of the automotive sector and the consequent long-term business opportunities in collision repair industry, many leading players are looking forward to extending their regional reach across this vertical.

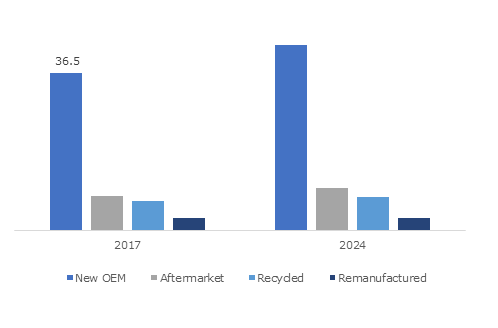

U.S. Automotive Collision Repair Market, By End Use, 2017 & 2024, (USD Billion)

Taking into account the growing adoption of vehicles across the globe, many training centers and technical institutes are putting in commendable efforts to educate people about several collision repair technologies. Validating the abovementioned fact, the North America based purchasing group, Leader Auto Resources (LAR) established a new Collision Technology Institute in Montreal in 2017. In this newly established training center, LAR plans to facilitate various procedures and processes, right from metalwork repair to aesthetic finishing. Through this training program, the company even offered theoretical classes for OEM certifications. In essence, the company is contributing toward bringing forth a number of well-trained professionals who will in due course, contribute significantly toward pushing collision repair industry trends in the future.

Collision repair market is lately replete with a slew of collaborations between leading automakers & OEMs. For instance, last year, the Volkswagen Group of America collaborated with one of the top providers of supply chain management solutions for collision repair market - Overall Parts Solutions (OPS). Through this deal, OPS plans to integrate its advanced technologies in Volkswagen’s dealerships across the U.S. that will enable effective identification, location, and delivery of repair parts very quickly. The deployment of such programs will add immense value to Volkswagen’s customer approach, as the dealer can serve customers effectively with the assistance of advanced technology software.

Currently, collision repair industry players are facing considerable rework problems pertaining to the complexity associated with the newly implemented electronics systems in the modern vehicles. In order to overcome the issues associated with modern vehicular systems, automotive repair work centers are aiming to deploy advanced tools and solutions for efficient and accurate work output. In addition, the rising number of ADAS equipped vehicles and smart cars have also had a positive impact on advanced aftermarket collision repair. Post accidents, modern vehicles require proper refurbishment to set in place all damaged mechanical as well as electronics systems. In this regard, to provide reliable and efficient service to the customers, most of the giants in collision repair market are deploying advanced software-based solutions at their service stations. Aided by these initiatives, these companies are looking forward to achieving long-term revenue benefits in the automotive aftermarket.

In order to provide advanced technology to the collision repair service centers, software companies have been continuously involved in research and development activities. Recently, an America-based software company, Mitchell International, Inc. has developed a new scanning system, which will improve the capability of U.S. collision repair technicians. With the help of this software, users could scan the entire vehicle and detect the issue associated with the vehicular system. Mitchell International, Inc., also looks forward to becoming a technology leader in collision repair. In this regard, it has collaborated with Bosch, which developed new collision repair tools to carry out refurbishment of the tire pressure monitoring system (TPMS), ADAS, and electronic control unit (ECU). This research-oriented approach of technology companies to bring forth a slew of new products is poised to boost collision repair market share over the years ahead.

The extensive requirement of aftermarket facilities to perform numerous repair works including painting, metal work, and electronic system failures is slated to fuel the demand for collision repair products over the years ahead. The emergence of start-up companies and efforts put forth by training centers to develop skilled technicians will also transform collision repair market outlook. The advent of technologically advanced vehicles is remarkably encouraging players in collision repair industry to adopt several modern repairing facilities to extend their customer base. Collectively, the appreciable efforts of OEMs, tech giants, and automakers is certain to impact collision repair market size, anticipated to cross USD 275 billion by 2024.