A brief overview of global automotive decorative exterior trim market: The adoption of strategic growth tactics to augment the industry landscape

Publisher : Fractovia | Published Date : 2018-01-18Request Sample

Over the past few years, automotive decorative exterior trim market has traversed along a rather profitable growth path, driven by the massively increasing demand for luxury automobiles. The growing importance for vehicle aesthetics have led automakers to explore newer ways of fulfilling consumer demands with novel innovations and developments. Automotive firms have also been implementing new manufacturing technologies to improve the quality of automotive components, which has undeniably led to the generation of novel growth avenues for automotive decorative exterior trim industry players. In recent times, there has been a robust increase in the deployment of strong yet lightweight materials such as carbon fiber, to manufacture automotive components. In addition, luxury vehicles also demand the installation of low weight raw material that is cost-effective and easily moldable, which would further generate lucrative opportunities for automotive decorative exterior trim market behemoths.

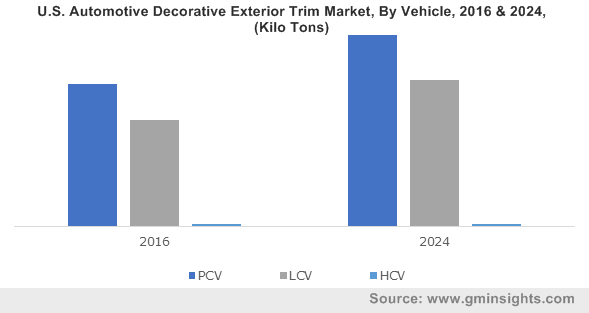

U.S. Automotive Decorative Exterior Trim Market, By Vehicle, 2016 & 2024, (Kilo Tons)

Most of the big shots in automotive decorative exterior trim industry have been developing new automotive solutions in order to improve the design of exterior trim. Many companies have even implemented an advanced CAD environment to deliver high quality trim components and meet high end customer demands. Currently, most of the automakers are focusing on enhancing the performance of the vehicles mainly by reducing the weight. The growing popularity of sports cars as well as the shifting trends toward adoption of EVs are the major factors favoring the production of light weight vehicles. Additionally, it has been observed that durability, weight, and environmental aspects are the prominent design considerations for trim materials. While designing the trim parts, renowned participants in automotive decorative exterior trim industry have been concentrating on studying manufacturability properties, surface finish, and material characteristics. For instance, the research team of DURA has been involved in the development of high performance and lightweight modules and systems for automotive exterior trims for a while now. It has also installed frame technologies to manufacture exterior parts of hybrid and electric vehicles, while simultaneously adopting numerous strategies to combat the fierce competition in automotive decorative exterior trim market.

Speaking of which, another one of the renowned companies in automotive decorative exterior trim market, ABC Group Inc., in 2014, had invested USD 25.5 million in new equipment and infrastructure developments to capture more business space. In fact, it had expanded its Gallatin based production facility in order to fulfill the increasing demand for automotive products. This strategic business expansion had mainly benefited GM’s vehicle manufacturing plants for Cadillac and GMC, providing a boost to the U.S. automotive decorative exterior trim industry. Regional governments had also welcomed the significant steps taken by the ABC Group, which generated more than 200 job opportunities post the expansion. Currently, ABC Group is one of the leading automotive decorative exterior trim market players in North America. Over the coming years, as per the research, increasing investments in the trim manufacturing processes such as thermoforming, injection molding, sheet extrusion, exterior painting, material compounding, and blow molding are likely to have a positive influence on the regional automotive decorative exterior trim industry share.

The availability of software based solutions with optimized design strategies have apparently had quite an impact on the product portfolio of automotive decorative exterior trim market, pertaining to the high precision level of software assisted products. Taking into account the importance of software solutions for automotive exterior trim suppliers and manufacturers including 3M Automotive, 3M Company, ABC Group, Inc., ABC INOAC Exterior Systems, LLC, ADAC Automotive, Inc., Anchor Manufacturing Group, Inc. Magna International, and CIE Automotive, software developers like Siemens PLM are investing heavily to develop an innovative toolset of exterior and interior trim designs. The availability of software solutions has improved the production capability and minimized the overall cost associated with the product. With speedy optimization and product analysis aided by software-based toolsets, most of the biggies in automotive decorative exterior trim market have also successfully painted a positive picture of the product spectrum of this industry in the ensuing years.

Many leading automotive products manufacturers have been establishing collaborations with software developers to enhance their production capacities. For instance, one of the leading automotive suppliers, ADAC Automotive, which primarily focuses on new product development, innovation, and production of sensors, mirrors, door handles, electronics, and trims, has partnered with Epicor Software Corporation, one of the well-known providers of enterprise software, to improve production capacity and minimize scrap. The deployment of enterprise software is likely to help automotive companies identify the areas where they can make efficient changes in production processes. In fact, the penetration of automation in automotive decorative exterior trim market has indeed had a significant impact on product costs. The changing trends in the automotive sector are certain to augment the revenue graph of automotive decorative exterior trim market, forecast to surpass a revenue collection of USD 27 billion by the end of 2024.