Auto electronics market to be highly influenced by a strong regulatory framework, ADAS systems to drive the application landscape

Publisher : Fractovia | Latest Update: 2018-12-05 | Published Date : 2016-12-05Request Sample

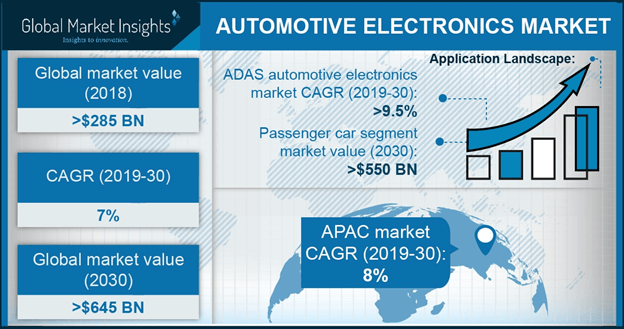

‘Connected cars’, over the years, have been one of the profound buzzwords in the IoT domain. The meteoric rise in auto electronics market demand can be quite effectively credited to the aforementioned aspect. As estimated by Global Market Insights, Inc, overall auto electronics industry is touted to cross a massive valuation of USD 400 billion by 2024. Renowned automotive giants across the globe are shifting their focus from conventional plain vanilla manufacturing methods toward technological improvisations, on account of which the use of electronic components have significantly soared up in the designing of the vehicles over the past few years.

China automotive electronics market size, by application, 2017 & 2024 (USD Million)

Recently, Arbe Robotics, one of the leading names in auto electronics market, conducted a fundraising round, where the company raised almost USD 9 million to bring high resolution radar systems into full production. Reportedly, the Tel Aviv startup is planning to empower its radar technology with enhanced capabilities so that these hi-tech systems can be readily incorporated in self-driving cars in the years ahead.

Citing another instance that has practically fetched all the attention lately is NVIDIA’s Drive PX automotive line. NVIDIA, the Silicon Valley based graphics chipmaker has recently come up with a ground-breaking chip technology that has the capability to develop fully autonomous vehicles. Having held a reputation of handling almost 320 trillion operations/sec, which is roughly around 13-fold increase in its calculating power than the present PX 2 class, NVIDIA’s third generation chip is certainly one of the biggest breakthroughs of recent times in auto electronics industry.

Of late, renowned automotive giants have been striving hard to meet the technological demands from potential buyers. In an era where proliferation of IoT has practically revolutionized almost every business sphere, auto electronics market size is sure to upscale in the coming years, given the increasing demand for smart vehicles. Speaking of application landscape, ADAS is expected to be a prominent frontier where auto electronics market players are heavily investing in. The fundamental reason behind ADAS to be a profound application area for market players is the growing governmental regulations emphasizing on vehicle safety.

Speaking of regulatory framework, Europe stands as one of the most prominent regions where strict legislations pertaining to vehicle safety and fuel consumption have proved to be transformational for auto electronics market dynamics. The European Commission, under the revised Regulation(EC) No 661/2009, has mandated the incorporation of advanced safety features such as ISOFIX child seat anchorages, driver seatbelt reminders, and tire pressure monitoring systems for every vehicle that would be sold in the European Union.

Having been already effective from November 2015, all buses and trucks sold in the EU are equipped with advanced safety facilities. And the dynamic impact of these mandatory roll outs is already underway. As per recent estimates, today, in Europe almost 40% of the onboard devices in the vehicles are based on electronic facilities and looking at the pace of innovations, the percentage is claimed to witness a sharp rise in near future, which by extension, will proliferate regional auto electronics industry share. Germany is forecast to be a major revenue pocket for Europe auto electronics market.

Primarily influenced by the regulatory trends, North America also procured a sizable portion of the overall auto electronics industry share in 2017. Several governmental initiatives with regards to vehicle as well as pedestrians’ safety have pushed majority of the regional automakers to incorporate automatic safety features as a default offering. For instance, the U.S. NCAP (New Car Assessment Program) has mandated deployment of emergency braking system and lane departure warning system in the vehicle to fall under the category of five star rating passenger cars. Needless to say, this will open up ample business opportunities for auto electronics market in terms of profitability quotient.

Extensively driven by innovations & continuous technological advancements, auto electronics industry at a global scale is claimed to be fiercely competitive with host of the biggies like Altera, Avago, Hitachi automotive systems, Dow Corning, Texas Instruments, Panasonic , and Wipro. These companies are heavily investing in R&D activities to come up with sustainable differentiated solutions to score a competitive advantage over their rivals.

While it is quite obvious that integration of electronic modules definitely adds up new complexity in the overall designing of the vehicle, auto electronics market demand is expected to upscale over the ensuing years, subject to the fact that these products also have an influence on the supply chain value with regards to commercial feasibility, fuel consumption, and reliability.