Automotive filter market to nearly double in revenue by 2023, Air filters to lead the overall product landscape

Publisher : Fractovia | Published Date : 2017-05-15Request Sample

Rising instances of global warming have necessitated the deployment of filters in vehicles to reduce emissions, thus fueling Automotive filter market. These products have the ability to absorb dust, dirt, particulate particles, and pollutants, and are known to enhance gas mileage, reduce emissions, and offer a high-grade fuel performance. Automotive Filter Market is globally characterized by stringent norms from regulatory bodies such as the CCC and EPA that demand the usage of environmental friendly alternatives to fuel-powered vehicles.

Leading companies often engage in mergers and acquisitions to enhance productivity, improve product quality, and expand their product portfolio. In 2014, Mann+Hummel acquired Vokes Air, a Swedish firm that specialized in manufacturing air filtration systems, from The Riverside Company. In 2015, Mann+Hummel continued its acquisition spree, and went on to take over Affinia Group, thereby consolidating their position in Automotive filter industry. Many other players have been engaging in similar tactics, which is bound to lead to the growth of this market. A report by Global Market Insights, Inc., states that Automotive filter industry, worth USD 5 billion in 2015, is anticipated to hit USD 9.79 billion in 2023, with a CAGR estimation of 8.4% over 2016-2023.

China Automotive Filters Market size, by product, 2012-2023 (USD Million)

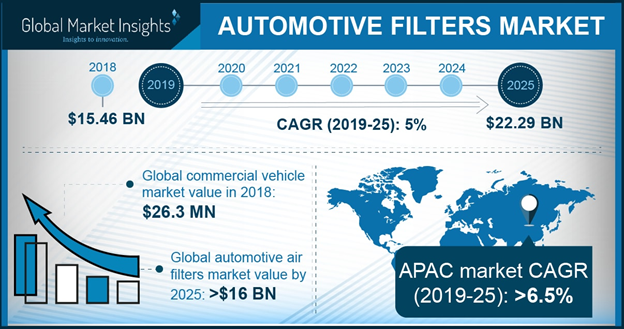

The automotive sector in the APAC has been on a remarkable high over the last few years. Asia Pacific air filtration market is expected to grow at an annual rate of 8.6%, with automotive air filters having occupied more than 55% of the overall revenue in 2015. This significant growth will lead to Automotive filter industry earning heavily from the Asia Pacific region. In 2015, APAC contributed to more than 45% of the overall revenue and is expected to grow at a rate of 9% over 2016-2023. The massively growing automotive sector across the emerging economies such as India, Japan, and China will drive the regional growth. In addition, the government has mandated strict legislations regarding vehicular emissions in these regions, which will further drive APAC Automotive filter market.

Having spoken of APAC air filtration industry, it is to be noted that these products are segregated into intake filters and cabin filters even in global automotive market. Automotive air filters industry, having been the dominant product segment in 2015, is anticipated to continue dominating the product landscape, with a CAGR estimation of 7.8% over 2016-2023. Impure cabin air has of late, been leading to numerous health disorders, which has fueled the necessity of cabin air filter installations. Public awareness for good quality, purified air will spur Automotive filter market from cabin filters over 2016-2023.

Fuel filters help filter out the dirt, dust, and rusted particulates from the fuel line in the engine-based fuel systems of automobiles. Pertaining to the high demand for two-wheeler vehicles and passenger cars, especially across the BRICS countries, Automotive filter industry size from fuel filters is projected to grow at a rate 10.5% over 2016-2023. With impure air leading to numerous lung disorders and other diseases, the public is consciously aware of the health benefits that would arise as a result of installing car filters, which will stimulate Automotive filter market size from oil and fuel filters. In addition, oil Automotive filter industry will earn considerable revenue subject to the fact that these products remarkably enhance the engine performance and elongate its lifespan.

Automotive filter are heavily deployed in OEMs and the automotive aftermarket. OEM’s offer the benefits of warranty and high quality construction, subject to which Automotive filter market from OEMs is expected to earn remarkably over the next few years. High demand for OEM filters will also lead to Europe Automotive filter industry earning a revenue of more than USD 2 billion by 2023. Having held more than 23% of global Automotive filter market share in 2015, Europe will grow at a significant CAGR over 2016-2023, primarily due to the existence of a huge number of prominent auto manufacturers in the region and stringent norms related to environmental pollution.

Automotive filter industry from aftermarket was worth USD 3.7 billion in 2015 and is anticipated to grow at a rate of 8.7% over 2016-2023. Surging demand for replacement filters will lead aftermarket holding more than 70% of overall Automotive filter market by 2023.

Of late, the trend in the automotive sector is that of electric powered vehicles. EV powered automobiles are a rage, especially across developed economies such as the U.S. and Europe. Subject to this factor, U.S. Automotive filter industry will experience a modest growth, since EV powered cars do not require replacement filters. However, they will need to be periodically installed with cabin filters, owing to which U.S. Automotive filter market size from cabin filters will rise significantly over 2016-2023.

Automotive filter are widely used in two wheeler vehicles, light & heavy duty commercial vehicles, and passenger cars, to reduce harmful emissions and improve engine performance. Two wheelers held more than 13% of the total Automotive filter market share in 2015, and are expected to grow at a CAGR of 8.5% over 2016-2023. Heavy demand for two wheelers across countries such as India and China will stimulate Automotive filter industry from two wheelers.

Passenger cars contributed to more than 50% of the total Automotive filter market in 2015. Subject to the rising health disorders due to emissions and improper cabin ventilation, Automotive filter industry from passenger cars is predicted to grow at a rate of 8.9% over 2016-2023. In addition, rising disposable incomes of consumers is also anticipated to be a key driving factor for this application.

Automotive filter prevent wear & tear of internal engine parts by means of improving engine performance and supplying air flow. However, they need to be replaced after every 12,000 to 15,000 miles. Companies operating in Automotive filter market have been striving to develop products that offer high efficiency and improve the car mileage. Key players include Ahlstrom, Mann+Hummel, Mahle, Denso, Toyota Boshoku, Roki, Parker Hannifin, Lydall, Cummins, and K&N Engineering. Companies occasionally collaborate and form alliances to improve their product portfolio and strengthen their regional presences. Mahle Group of Companies is one of the many corporations that has recently been adopting the strategy of mergers & acquisitions to consolidate its position in global Automotive filter industry.