Global automotive pedestrian protection systems market to register a double-digit CAGR over 2018-2024, rising number of pedestrian fatalities to stimulate the industry growth

Publisher : Fractovia | Published Date : 2018-09-07Request Sample

The growing frequency of accidents involving automobiles has propelled the automotive pedestrian protection systems market, which registered a valuation of about USD 1.5 billion in 2017. Driven by the pressure to curb the intensity of collisions, automakers have been developing systems to not only help a driver avoid smashing into a pedestrian but also to minimize the damage cause to the pedestrian and the vehicle after a collision.

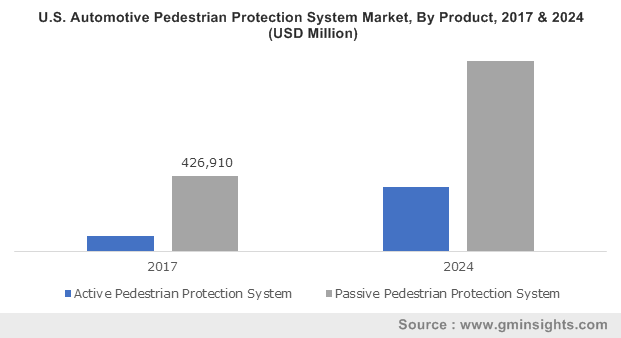

U.S. Automotive Pedestrian Protection System Market, By Product, 2017 & 2024 (USD Million)

The global automotive pedestrian protection systems industry has been able to capitalize on the advancing electronic control unit (ECU) technologies as well as accurate sensors, special cameras and innovative safety features. The rising disposable income of the working-class population has encouraged OEMs to incorporate safety systems into these vehicles, which generally come optional at additional costs, proliferating the automotive pedestrian protection systems market.

Apart from automakers and their technology partners seeking to develop systems that make driving easier, governments around the world had also raised initial concerns regarding occurrence of pedestrian fatalities. Local authorities in the U.S. recently unveiled data which indicated the death of pedestrians has been rising nationwide, and the popularity of vehicles such as SUVs have influenced the rate of accidents. According to the data, the fatality of SUV-pedestrian collisions went up by 81% from 2009 to 2016 as compared to 46% for all vehicles, while for passenger cars the rate increased by 41% and 32% for trucks. The automotive pedestrian protection systems market has subsequently seen tremendous demand over the period, especially in passenger cars as the segment still accounted for the highest number of pedestrian deaths in the U.S.

Automobile manufacturers have been deploying different protection techniques like crumple zones, deformable components for reducing the impact of collision on the pedestrian, defining the basic options in the automotive pedestrian protection systems industry. Various New Car Assessment Programmes (NCAP) across regions are responsible for the testing of safety systems, which involves intense and detailed tests. The Europe NCAP is considered to be the most stringent one, and the presence of major industry players such as BMW, Audi, Bosch, Continental and Mercedes has extremely benefited the Europe automotive pedestrian protection systems market. The Euro NCAP has significantly raised the standards for consumer protection tests and legal requirements, instigating the development of reliable pedestrian detection systems.

The electronic protection system provided by Bosch, for instance, delivers an effective method to reduce the impact of a collision on the pedestrian and engine components, representing the advancement of the automotive pedestrian protection systems industry. The system comprises peripheral sensors, located in the front part of a vehicle, and an airbag control unit for launching the airbags in the vehicle’s A pillars. On impact, actuators are triggered which can lift the engine hood within milliseconds and the pedestrian is allowed to collide against a more effective crumple zone, minimizing injury risks. As such, Bosch’s electronic protection system is cost-effective, active impact protection that also fulfills all the legal requirements associated with the automotive pedestrian protection systems market in Europe.

It was estimated that in 2016, nearly 448 pedestrians were killed in road accidents in Great Britain, which made up 25% of all road deaths in the country. Similar rise in pedestrian fatality rates in all European countries have made it mandatory for American car manufactures to integrate safety features into vehicles sold in Europe, transforming the regional automotive pedestrian protection system market dynamics. Tesla has been one such company and its Model S exported to Europe and Australia has a pyrotechnically-assisted protection system that is aimed at reducing head injuries for pedestrians and cyclists. Following the trend, the system also involves front bumper sensors that can detect impact with a pedestrian when the Model S is travelling at 19 to 53km/h speeds, post which the rear portion of the hood is raised by about 80mm.

Although minimizing the physical damage cause to pedestrians is important, it is even better to avoid collisions, on the grounds of which systems are integrated within modern cars that continuously monitor road activity using sensors and inform a driver of any collision possibilities. Highlighting the current requirement of the automotive pedestrian protection systems industry, some cars are equipped with two different systems with daytime and nighttime sensing capabilities. In such systems, the pedestrian warning systems employ a standard camera during the day to detect pedestrian movement and also apply brakes to avoid collisions, whereas the night system utilizes infrared cameras for the purpose.

Anticipated to record a 10.5% CAGR over 2018 to 2024, the global automotive pedestrian protection systems market outlook is slated to witness a transformative change owing to increased production of electric vehicles and influx of smart ECU technologies. Driven by the robust rise in accidental collisions, the overall automotive pedestrian protection system industry size is expected to be pegged at USD 3 billion by 2024.