Increased defense expenditure to outline armor protection market trends

Publisher : Fractovia | Published Date : 2019-07-26Request Sample

Rising threat from militants globally and other safety concerns will influence the growth of armor protection market size. Increase in terrorism activities and geopolitical tensions across both national and international boundaries of several countries have created the need for adopting protective gears for both the citizens and military personnel. Evolving technology has also helped augment ballistic protection materials and equipment industry outlook over past several decades, with continuous enhancements to weapons creating the need for better ballistic materials having lower weights.

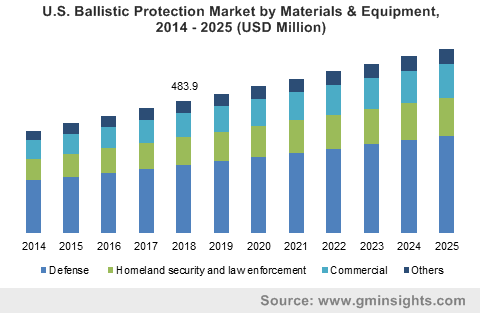

U.S. Ballistic Protection Market by Materials & Equipment, 2014 - 2025 (USD Million)

The U.S Army seemingly began exploring the potential of composites for application of ballistic material following the end of Vietnam War. The Army, in 1989 got its first composite helmet in Panama combat which was made from Kevlar fiber, made hard with the help of thermostat resin matrix. The latest innovation from the Army is the enhanced combat helmet (ECH) built with UHMWPE that happens to improve ballistic protection by 35% compared to all previous generations of the Kevlar helmet. Similar development of other products will outline ballistic protection materials and equipment industry trends.

U.S. military research centers are looking into novel development designs, materials and methods that could lighten armors. Ceramics have been considered as an important material to be used in body armor owing to the material’s unique features. For instance, ceramic plate made from boron carbide weighs around one third the steel’s weight. They are hard and will be effective at preventing incoming rounds. Aramid materials used in military equipment has had a considerable influence on the overall armor protection market share and is slated to rise with a CAGR of 5% over the forecast period.

Steady commercial investments towards synthetic diamond and other composite material has pushed its price down that may make it cost effective in the use of body armor. The material will be modified and hardened which will significantly improve the performance of those armors beyond the intrinsic nature of individual components and subsequently raise the demand for these protection options. North America ballistic protection materials and equipment industry revenues are majorly contributed by the defense community as they invest hefty amounts for procurement of safety gears. .

Government initiatives have help reinforce the demand for the ballistic protection equipment significantly. In a research by the U.S. National Institute of Justice (NIJ), law enforcement agencies having over 100 officers have now made mandatory policies to wear body armors, growing from 58% in 2007 to 78% in 2013. All of the equipment used are selected according to body armor standards and undergo inspection testing. Evidently, ensuring quality of protective gear will be a crucial driver for armor protection market expansion.

Rise in crime rates and security challenges have surged the demand for bullet resistant cars used by high profile celebrities and business owners. Auto manufacturer BMW, for instance, has started offering their products armed with ballistic protection characteristics. The President of U.S’ car has 8-inch thick doors and 5-inch thick bullet-proof glass that protects the car from rocket induced grenades. North America armor protection market reportedly held 30% of overall share in 2018, owing to increased importance of strengthening safety standards and highly military spending.

Globally, the market for armored vehicle has been increasing steadily with large number of vehicles being manufactured equipped with gears having different protection ratings. Automotive giant Volvo has received several requests to develop an armored car over the past few years and has been developing a XC90 model to provide a comfortable travel and high level of personal safety for the occupants. The car will be providing high quality protection ratings and will go on sale by the first half of the year 2020.

Major players manufacturing protective materials and offering crucial anti-ballistic equipment worldwide include DSM, Armor Holdings, DuPont, Honeywell International, Texas Armoring Corporation, Teijin Limited and Protective Enterprises LLC. Global armor protection market size is projected to reach USD 2.4 billion by 2025 owing to rising concerns for personal and national protection against the crime and terrorism.