Barite Market to witness strong demand from oil & gas drilling sector, U.S. and China to be lucrative revenue pockets

Publisher : Fractovia | Published Date : 2017-08-02Request Sample

The global barite market has been experiencing impressive growth prospects of late and is predicted to double its revenue generation in coming seven years from USD 2.2 billion in 2016 to over USD 4 billion by 2024. Rising dependency on alternative energy sources has propelled the drilling activities for shale gas reserves and has thus positively impacted barite market growth. Barite is prominently used as a weighing agent in drilling fluids that finds application in the oil & gas exploration. Barite industry is witnessing tremendous application scope, owing to its key properties which include high specific gravity, non-toxicity, chemically & physically non-reactive nature. Barite’s high density and chemical inertness has made it an ideal mineral for several applications. A report on barite market put forth by Global Market Insights, Inc., estimates the industry to record a CAGR of 6% over 2017-2024.

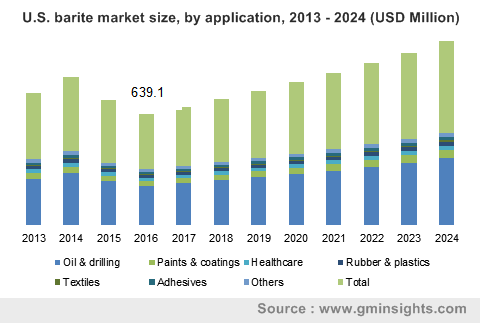

U.S. barite market size, by application, 2013 - 2024 (USD Million)

Below mentioned is the application spectrum of global barite industry

Oil drilling & gas industry

Barite is primarily used by the petroleum industry as a weighing material in the formulation of drilling mud. Around 70% of the global usage of barite is as a weighing agent for drilling fluids in oil & gas exploration. The reason for barite’s use over other materials is its non-magnetic, neutrally chemically reactive, and physical properties. This makes the material environmentally acceptable as a profound part of drilling fluids activities. It is far less abrasive than other drilling materials and does little damage to drilling equipment. A significant upsurge is witnessed in drilling & production activities in the U.S. and China to meet the energy demand and reduce their oil dependency from the middle east. In 2010, the U.S. oil shale production was around 500 thousand barrels per day and has reached to 3100 thousand barrels per day in 2016. Similar trends are likely to continue over the coming seven years which will considerably multiply barite industry share. From the oil & drilling application, barite market size is projected to record an annual growth rate of 4.5% over 2017-2024. Barites with specific gravity grade 4.2 is the most extensively used grade type in the oil drilling industry and is also consider optimum as per the American Association of Drilling Engineers. This has chiefly impelled the 4.2 grade demand as a weighing agent in oil drilling industry. Barite market driven by the extensive demand for 4.2 grade, is set to carve a lucrative roadmap with a projected CAGR of 4% by 2024.

Paper-making and Paints & Coatings Industry

Barite is a key ingredient in preparing white pigments that are used in papermaking and paints & coatings industry. Because of its clean and white color, it is widely used in filling white paperboards and coated paper. This material is also a superior alternative to expensive materials used in dope and paintings. It proves highly beneficial in improving the viscosity, stability, and brightness to the paints. The global barite industry from the paints & coatings application is anticipated to register a CAGR of 3.5% over 2017-2024. The paints & coatings industry is witnessing huge demand from the soaring end-use industries such as consumer electronics, automotive, and construction in Asia Pacific.

Rubber & Plastic industry

Barite is very effective in making the rubber water proof and acid & alkali proof as well. Barite market from the rubber and plastic application is set to register a growth rate of 3% over 2017-2024, subject to strong growth outlook from the automotive and consumer goods sector. Thus, the uses of barite in the rubber industry makes the product highly durable and helps in improving the intensity of rubber. Barite grades above 4.3 is widely used in rubber, plastics, and paints & coatings application and hence is likely to make prominent contribution to barite industry share. Subject to this fact, barite market for grades above 4.3 is estimated to witness a growth rate of 3% over 2017-2024. The price of higher grade barite is relatively high as it is mined from deeper earth crust.

Cosmetics and Pharmaceutical industry

Barite in the cosmetic industry can be used as a substitute of titanium dioxide, owing to its gentle and mild effect on the skin. This has strongly impacted the growth of barite market in the cosmetics application. The white & off-white color barite is significantly used in the cosmetics, rubber, and medical application. As per estimates, the white and off-white barite market is foreseen to register 3% CAGR over 2024

Barite has a unique ability to strongly absorb gamma rays and X-rays and therefore finds extensive application in the medical sector. It is majorly used for distinct x-ray tests on the colon and intestines. Another important usage of barite is in filling of plaster and dope to extend plaster period. Such strong application outlook from the pharmaceutical sector has prominently fueled the growth of barite industry share.

The overall production of barite is broadly related to the oil-well drilling activity across the globe. A significant surge was seen from 6.0-6.5Mtpa in the early 2000s to 9.7 Mt in 2014. However, due to low oil process and decrease in drilling activities, the barite industry witnessed a fall from 8Mt in 2015 to 7.3Mt in 2016. In the global barite industry landscape, China alone accounts for more than 40% of the overall production and India, USA, Russia, Mexico, Thailand, Morocco, Iran, and Kazakhstan accounts for over 50% of the worldwide production collectively. Middle East countries were the largest consumers of barite at around 1.70Mtpa in 2016, followed by USA and China with 1.60Mtpa and 1.50Mtpa respectively.

In 2016, the global barite industry share was highly consolidated as key players including Deutsche Baryt Industrie, New Riverside Ochre Company, Inc., Spectrum Chemical Manufacturing Corporation, Excalibar Minerals LLC, and Anglo Pacific Minerals accounted for more than half of the overall business stake. Prominent barite industry players are making generous amounts of investments in upgrading their plant facilities and production capacities. CIMBAR Performance Minerals, for instance has invested up to USD 6 million in its two barite production plants. This upgradation and expansion strategy has brought a remarkable increase in the production capacities of CIMBAR, close to 400,000 tons every year.

Another trend in the barite industry is the efforts by the players focusing on R&D to bring possible substitute for barite in the oil drilling industry. They are aggressively investigating on other similar minerals such as iron ore and celestite as an alternative and cost-effective material, to gain competitive edge over other participants. One such successful attempt was of a German company, in producing synthetic iron ore called hematite. This synthetic iron ore is proving to be a good alternative for barite. However, these barite substitutes are yet to be commonly used in the oil & drilling industry and hence barite, with its strong production & application scope, remains to be a preferred commodity. With the influx of numerous application domains, the global barite industry is poised to witness commendable growth prospects over the years to come.