Bentonite market to accumulate a major chunk of the global valuation from foundry sand applications, capacity expansions to emerge as the next steadfast growth strategy for industry players

Publisher : Fractovia | Published Date : 2018-10-30Request Sample

Endowed with a vast application landscape comprising manufacturing, pharmaceutical, cosmetics, construction, and paper industries, bentonite market has indeed been experiencing a remarkable growth rate. The surging deployment of environmental reforms to control the use of hazardous raw materials in the aforementioned industrial sectors has also been endorsing the use of bentonite clay on a large scale. In the manufacturing sector, the popularity of green sand molding for meeting the future requirement of new-generation foundries has been depicting quite some growth, further propelling bentonite industry share.

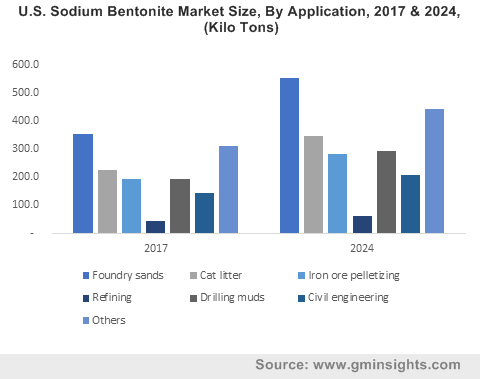

U.S. Sodium Bentonite Market Size, By Application, 2017 & 2024, (Kilo Tons)

In order to manufacture various cosmetic and pharmaceutical products, bentonite clay has been prominently preferred in recent times, pertaining to its appreciable paste formation capability. In line with the surging use of bentonite for numerous applications, the key contributors in the bentonite market have been looking forward to establishing new production facilities across the globe.

Recently, in order to target the surging demand for bentonite clay, Imerys decided to increase its production capacity, on the grounds of which the European company has tied up with various small-scale companies mainly based in China to improve its sales across several Asian Countries. With the deployment of such joint ventures, it is planning to increase the product supply for the paper, foundry, and construction industries. Moreover, for strengthening its presence in the bentonite industry, it has also established research and development facilities and business development department to innovate high-performance solutions.

Citing another instance, in the U.S., American Bentonite International, Inc., in 2017, decided to build two new warehouses to meet the growing demand for bentonite clay. With the construction of new warehouses, it is looking forward to upholding the business to customers (B2C) relations by reducing investments in third-party facilities such as trucks.

Bentonite clay has been gaining popularity even in the metal product manufacturing industry, for foundry applications, pertaining to its capability to develop high-quality casting products. The rise in customers’ requirement for low cost, high dimensional quality, and quick delivery is another factor encouraging the industry players to use bentonite. The efforts put in by the players in the bentonite market to fulfil consumer requirements by improving the product methodology is poised to propel the industry growth over the years ahead.

Unveiling bentonite market trends from foundry sand applications

In the last few years, increasing concerns among the regulators and industrialists about the adverse effect of sand molding processes on human health and environment has encouraged foundries to adopt green sand molding for manufacturing various casting products including engine blocks, brake discs, drive shafts, suspension components, and pivot bearings. In addition, most of the countries have been implementing strict regulatory norms to enforce pressure on the foundries for improving the ecological footprints of green sand molding. In order to comply with the regulatory policies, several companies have been investing in the research and development activities to innovate a new range of eco-friendly sand molding technologies.

In 2017, one of the leading specialty chemical producers, Clariant, developed a new low emission additive technology that reduces emissions from bentonite based green sand molding system approximately by 80%. The chemical giant claimed that with the help of newly developed technology, it is possible to produce high-quality castings having excellent surface quality. The methodology developed by Clariant to control the emissions from bentonite-based green sand has set a benchmark for the other companies that have been continuously striving to launch modern testing methodologies for reducing emissions from various foundry processes.

The innovative approach of chemical companies to improve the applicability of bentonite for foundry processes is likely to stimulate bentonite industry outlook from foundry applications over the years ahead. Indeed, sodium bentonite, one of the many types of bentonite products, encompasses the ability to absorb a considerable amount of water and depict increased volume, high alkalinity, appreciable thermal stability, high strength formation, and excellent viscosity. On these grounds, sodium bentonite is extensively deployed in foundries as a binder to enhance productivity, product quality, and reduce scrap generation. As per estimates, sodium bentonite market size from foundry sands applications was pegged at USD 190 million in 2017.

Yet another bentonite product – Sulphur bentonite, also finds applications in foundries. The product, in conjunction with aggregate and water, forms a pivotal ingredient of green sand. It also helps sand particles stick to each other, while imparting excellent green and hot strength to the end-product. On account of its beneficial swelling property, Sulphur bentonite is massively used in foundries – in fact, Sulphur bentonite market share from foundry sand applications was pegged at 680 kilo tons in 2017.

In the future, there will be a lot of potential growth opportunities for bentonite market players, driven by the increasing investments in the manufacturing as well as oil & gas industries. The shifting focus of the end-use companies toward the development of high-quality but sustainable products is likely to enhance the product demand over the years ahead. For the record, by the end of 2024, bentonite market will surpass a revenue collection of USD 1.95 billion.