APAC beverage refrigeration market to witness remarkable growth over 2017-2024, mandatory roll-outs pertaining to ozone layer depletion to stimulate the business sphere

Publisher : Fractovia | Published Date : 2017-10-06Request Sample

The commercialization matrix of beverage refrigeration market is forecast to be positively high over the forthcoming years with the continuous modernization of food preservation techniques. Along with provision of cooling at a diversified storage conditions, beverage refrigeration industry participants are increasingly focusing on curbing the detrimental impact of the refrigerants on the environment. In this regard, it is prudent to mention that Frigel’s ingress in the business with its engineered refrigeration system has significantly impacted the overall competitive landscape of the industry. Reportedly, Frigel’s modular approach of engineered cooling system which was launched in the year 2015 can perform precise beverage cooling that require zero contaminants. Mandatory roll outs, especially implemented across developed nations, relating to the banning of fluorocarbon based refrigeration, is expected to influence global beverage refrigeration industry trends in the years ahead.

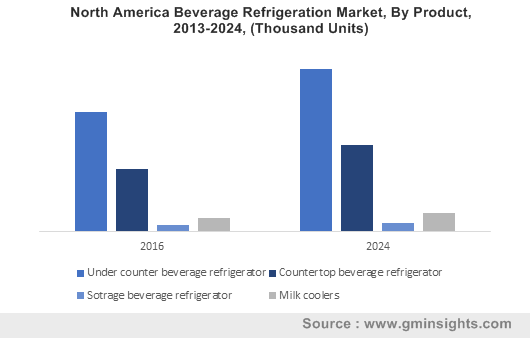

North America Beverage Refrigeration Market, By Product, 2013-2024, (Thousand Units)

For instance, upgradation of energy standards by the U.S. Department of Energy (DoE) along with EPA’s revised regulations on Refrigerant Management System under section 608 to reduce the ozone depletion have brought a new dimension to beverage refrigeration market outlook. Under this section, EPA has extended a couple of energy efficient substitute refrigerants like HFCs (hydrofluorocarbons) that would reduce the climate damaging emissions from refrigeration equipment by a huge amount. In fact, if experts are to be relied, this program would reduce the emission of approximately 7.3 million metric tons of CO2 equivalent and around 114 ODP tons (ozone-depletion weighted metric tons) per year. Although most of these regulations have been implemented in U.S. alone, the impact of these compliances is at a global level and has contributed immensely to the overall beverage refrigeration industry share.

With U.S. at its foray, it is no surprise that North America beverage refrigeration industry has carved profitable roadmap over the recent years. This can be primarily credited to the escalating consumption of refreshment drinks in this belt as well as the technological affluency of the countries under its veil. In fact, statistics claim that U.S. liquid refreshment beverage market recorded a volume coverage of almost 33 billion gallons in 2016. As the consumer trend toward liquid beverages continues to upsurge, it is quite overt that the demand for safer and sustainable refrigeration techniques would witness a meteoric rise. Global Market Insights, Inc., estimates that North America beverage refrigeration market size will surpass a revenue collection of USD 1 billion by 2024.

Other than North America, the extensive growth of beverage refrigeration industry is quite vivid across APAC belt. Increased packaged drink consumption is deemed to be the preliminary drive stimulating the regional market outlook. As per a recent statistic, global consumption of packaged drink in the year 2016 was approximately 1.05 trillion liters, of which China alone accounted for almost 178.6 billion liters. The figure itself is a testament of the humongous business opportunities that APAC industry holds for the investors in the coming years. Procuring almost 20% of the overall beverage refrigeration industry share in 2016, it is anticipated that the region will cover a major chunk of the global business landscape by 2024. Moreover, with a population coverage of almost 60% of the global count, experts believe that APAC will certainly witness an upper hand in the overall beverage refrigeration industry over 2017-2024.

As far as the competitive profiling is concerned, beverage refrigeration industry is highly fragmented in nature and is still at its initial stages of development. Some of the prominent players involved in the industry include Electrolux, Dover Corporation, Whirlpool Corporation, Daikin Industries, Coca-cola, KingsBottle, HABCO, Danfoss, Liebherr, Kenmore, and General Electrics. These players are heavily investing in product innovations toward the development of advanced technologies endowed with more environmentally viable properties. Mergers & Acquisitions is another strategy widely adopted by the beverage refrigeration market biggies for sustaining the competition. For instance, the acquisition of Belgium Chemical Group, Solvay S.A. by Daikin Industries in 2015 allowed the Japanese conglomerate to expand its business profile in Europe.

Nowadays, consumers are increasingly becoming health conscious, a factor that has completely changed the overall dynamics of food refrigeration industry, leaving a perpetual impact on beverage refrigeration market as well. In addition, increasing penetration of supermarkets and hypermarkets in the retail space is propelling commercial refrigeration equipment market demand across the globe. With increasing appetite for technological advancements in this particular business arena, beverage refrigeration market despite accounting for a minor fraction of the colossal HVAC industry, has a lucrative growth path ahead in terms of profitability landscape. A recent report put forth by Global Market Insights, Inc., claims beverage refrigeration industry size to surpass a valuation of USD 4.5 billion by 2024, with a volume coverage of 7.4 million units over the coming years.