Bio-based polyethylene terephthalate (PET) industry to experience a massive growth of 40% over 2016-2023, surging demand from packaging applications to boost the revenue

Publisher : Fractovia | Published Date : 2017-05-26Request Sample

Bio-based PET Market size is anticipated to carve out a profitable growth path in the years ahead, subject to the growing product usage for controlling the carbon emissions coupled with the rising use of bioplastics as an alternative across packaging & automotive sectors. This thermoplastic polymer resin is used by large multinational corporations to manufacture Bio-based packaging products. For instance, to safeguard the environment, Coca-Cola had introduced the world’s first 100% Bio-based PET plastic bottle in 2015 at the World Expo held at Milan in Italy as a part of its sustainable packaging strategy. Such measures will support the initiative to maintain a green environment and will favorably influence global Bio-based PET market trends. Worldwide sustainable packaging sector, worth USD 150 billion in 2015, is projected to hit a revenue of USD 250 billion by 2023. The massive growth of this sector will also influence Bio-based PET industry. According to Global Market Insights, Inc., “Bio-based Polyethylene Terephthalate (PET) market revenue is predicted to hit USD 13 billion by 2023, registering a growth of more than 40% during 2016-2023.”

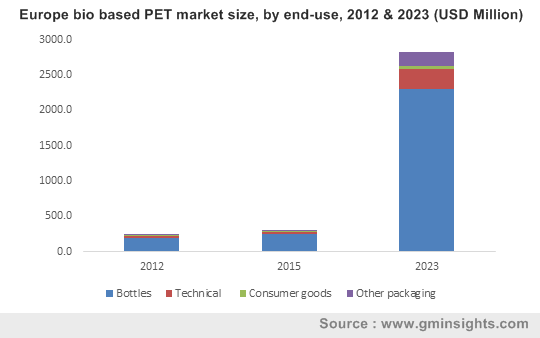

Europe bio based PET market size, by end-use, 2012 & 2023 (USD Million)

Bio-based polyethylene terephthalate finds wide applications in bottles, consumer goods, and other technical applications. High bottle production is expected to contribute notably towards Bio-based polyethylene terephthalate market value and will surpass the figure of USD 10.5 billion by 2023. Rise in the intake of food & beverages across the BRICS nations along with initiatives taken by established firms to promote the usage of green technology as a part of their corporate social responsibility policy will benefit the business.

Bio-based PET industry share from technical applications is forecast to grow at a rate of more than 35% over 2016-2023, subject to its light weight and high shatter resistance features, which will drive its usage in the production of technical parts.

Taking into consideration the geographical trends, Asia Pacific Bio-based PET industry, which accounted for more than 32.5% of the global demand in 2015, is forecast to witness a remarkable growth over the years to come. Increase in the consumption of soft drinks & alcoholic beverages have led to escalated packaging requirement, which will positively influence Bio-based PET industry landscape across the region. India, China, and Japan are projected to be the key regional growth drivers. Japan has set a goal of producing 20% of bioplastics in the plastic sector by 2020. Such initiatives will undeniably unleash growth opportunities for Bio-based PET market. In addition, Australia has formed the APC (Australian Packaging Covenant) body to promote sustainable packaging, thereby promoting the business trends.

Latin America Bio-based PET market revenue is projected to hit USD 1.5 billion by 2023, growing at a CAGR of 46.5% over the coming six years. The growth can be attributed to the growing product usage across the bottles sector, as LATAM Bio-based PET market from bottling applications will surpass USD 1.5 billion by 2023. Brazil is also projected to contribute considerably toward the business space.

Bio-based PET industry in North America is estimated to record notable gains of more than 40% over the coming timeframe, determined by rising consumer inclination toward green packaging along with high grade technological breakthroughs. Technical applications in North America are predicted to contribute more than USD 235 million by 2023. The U.S. is likely to be the major revenue driver.

Europe Bio-based PET market size is anticipated to grow at a substantial rate subject to the rise in the production & usage of bottles and the thriving food & beverages sector, and is predicted to hit a revenue of more than USD 2.8 billion by 2023. Europe Bio-based PET industry size in the bottles sector, which is set to register a CAGR of over 37% during the duration of 2016-2023, will attain a revenue margin of USD 2.3 billion by 2023. UK, Germany, and France are forecast to boost the regional share.

Market players will try to increase their ROI through new product launches, product differentiation, and strategic partnerships. Firms such as Toray industries and Coca-Cola have formed strategic alliances with Bio-based product manufacturers such as Virent and Gevo to produce 100% Bio-based PET products, thereby making major contributions towards the global green environment initiative.

Toyota Motor Corporation, Danone, Plastipak Holdings Incorporation, The Coca-Cola Company, Toray Industries Incorporation, M&G Chemicals S.A., PepsiCo Incorporation, and Teijin Limited are the key participants of Bio-based PET industry.