MEA to drive global biostimulants market over 2017-2024, turf & ornamental crops to account for a sizable industry share

Publisher : Fractovia | Published Date : 2017-07-05Request Sample

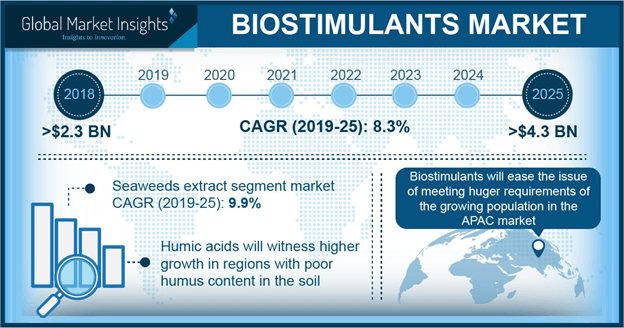

The tag of the latest trend in the F&B sector can be rightly awarded to organic food consumption, a fad that is slated to drive Biostimulants market. Several parameters, including but not limited to health problems, awareness regarding unhealthy eating, green innovation, environmental safety, plant conservation, etc., will lead to the growth of biostimulants industry over the course of the coming years. The governments of various geographies have been setting up numerous initiatives and providing monetary support to promote the growth of biological agrochemicals. In addition, regulatory agencies have undertaken the mammoth task of convincing farmers to adopt biostimulants in agricultural processes. For instance, the EBIC (European Biostimulants Industry Consortium) was conceptualized in 2011 with an aim to bolster the role that biostimulants play in agriculture, viz., improving product yield with minimum resources. In addition, the institute aimed to promote green innovation and sustainable agricultural production. The humongous efforts by many such regulatory bodies will catapult biostimulants market, anticipated to cross a valuation of USD 4 billion in terms of revenue and 1,200 kilo tons in terms of volume, by 2024.

Biostimulants are a tenacious combination of microorganisms, trace elements, and enzymes, and they help deliver nutrients to plants, improve their metabolism, and increase their water holding capacity. They are supplied in small quantities to enhance the crop yield, which is being affected globally due to irrational weather changes pertaining to global warming, thereby augmenting global biostimulants market. In addition to boosting crop yield, biostimulants also enhance land fertility, and are preferred over their synthetic counterparts. Estimates prove that the deployment of biostimulants has increased from 18% in 2013 to 21% in 2016.

Europe Biostimulants Market Size, By Crop, 2016-2024 (USD Million)

Extract based ingredients contribute toward abiotic and biotic tension tolerance, advanced soil structure & aeration, and attractive seed germination. On these grounds extract based biostimulants market size, valued for more than USD 550 million in 2016, will observe a CAGR of more than 10.5% CAGR over 2017-2024. These ingredients find applications in soil and foliar treatments. Speaking along similar lines, biostimulants industry from soil treatment applications is anticipated to register a valuation of more than USD 400 million by 2024. This is essentially because biostimulants, when used for soil treatments, help to upgrade the physical, nutritional, and biological outline of soil. This provides a plethora of benefits – it reinstates soil microbial activity, maintains moisture, accumulates organic matter, reduces compaction, and balances the pH levels and eventually helps to generate a favorable soil environment for seed germination and crop growth. The contribution of biostimulants in soil treatment applications is immense, leading to increased product penetration and the subsequent augmentation of biostimulants market.

Europe has long since been a pioneer as far as the deployment of advanced techniques for agricultural processes is concerned. It comes as no surprise therefore, that this continent is one of the foremost regions that will contribute positively to the growth of biostimulants industry. Numerous regulatory bodies have enforced stringent rules with regards to food safety and hygiene in this continent, which will propel the regional market over the coming years. In addition, the continent is witnessing shifting consumer trends toward for chemical free fruits & vegetables. On these grounds, Europe biostimulants market will grow significantly over the years ahead, having held more than 36% of the total revenue share in 2016.

Biostimulants are also used for foliar treatments, on account of the increasing acceptance of high grade farming technologies and biological microbes. In consequence, biostimulants industry from foliar treatment applications will grow at a rate of 10% over 2017-2024, having held a valuation of USD 1.4 million in 2016. This application is particularly prevalent across the APAC belt, due to the fact that this region is experiencing a growth as far as the adoption of enhanced farming techniques is concerned. In addition, the surging demand to improve agricultural yield and land fertility coupled with the escalating need for food will propel Asia Pacific biostimulants market, slated to exhibit a CAGR of 12.5% over 2017-2024.

Biostimulants are used for the production of fruits & vegetables, row crops, and ornamental crops. Of late, there has been a rapid surge in sustainable farming techniques, pertaining to environmental safety, limited land availability, and reduced water availability. This has led to the development of row crops, which dominated the overall biostimulants industry in 2016. With a view to fulfill the global food demands, the production of oilseeds and food grains has substantially increased, thereby augmenting biostimulants market from row crops, slated to cross USD 2 billion by 2024.

Ornamental plants, on the other hand, are primarily used in commercial nurseries, sports turf, home gardens, and golf courses for the purpose of leisure and status affiliated brandishing. Turf & ornamentals held more than 11% of the overall biostimulants market share in 2016, and are likely to exhibit a positive growth rate over 2017-2024. Rising expenditure on pleasure gardening is one of key factors driving the segment growth.

MEA is one the lucrative emerging regions contributing toward the growth of biostimulants industry. This is primarily due to the rise in the production of nontraditional crops that are being exported to the developed economies such as U.S. and Europe. The rising need to promote the export of these crops will increase the demand for biostimulants. Essentially influenced by Tunisia, Egypt, and Saudi Arabia, MEA biostimulants market, thus, will generate more than USD 155 million by 2024.

These products are majorly available in liquid and dry forms. Of the two, biostimulants industry from dry formulation was valued at USD 1 billion in 2016, subject to easy handling and transportation. Dry formulations also ensure delayed plant aging, cell division, plant respiration, improved lateral bud development, and photosynthesis. Furthermore, this segment has a wider application landscape, on account of which biostimulants market from dry formulation will witness massive growth potential over 2017-2024.

While liquid formulation does not exactly offer the advantages like that of its counterpart, it is still deployed heavily, owing to its elongated shelf life and comparatively low labor costs. Biostimulants industry from liquid formulation is projected to observe a CAGR of 12% over 2017-2024, and will open up lucrative opportunities for business players to invest heavily in this market in the years ahead.

Biostimulants industry is still in the developmental stage of progress. Nonetheless, numerous companies have been eagerly partaking in this market, including Artal Agronutrients, Evergrow, Valagro, Cairochem, Tradecorp Nutri Performance, Mahafeed Specialty Fertilizers, Seipasa SA. These firms are actively engaged in periodic mergers and acquisitions to increase their valuation in biostimulants industry share. The 2016 acquisition of Sri Biotech Laboratories India Limited by Valagro is one such instance demonstrating the action undertaken by these companies to increase their production capacities.

Companies operating in biostimulants market are required to comply with the rules and regulations defined by the U.S. Department of Agriculture (USDA). USDA’s organic certification is a tangible proof that the farm facility in question complies with the delineated USDA norms. The USDA is governed by the National Organic program (NOP) as far as the production, handling, and labelling of its approved products are concerned. In addition, the NOP maintains a manual that enlists the guidelines, instructions, and memos related to the approved standards. This lengthy product approval process is likely to pose a major hindrance to global biostimulants industry. Another restraint is the extensive expenditure on research and development activities that are undertaken by companies to expand the product line. However, despite the constraints, global biostimulants market is likely to establish a positive growth graph over the years ahead, pertaining to the fierce competition and low white space availability for patents.