U.S. to account for a substantial share of breast milk substitutes market

Publisher : Fractovia | Published Date : 2019-07-19Request Sample

The robust growth of breast milk substitutes market is likely to be influenced by the escalating number of working women. As a substantial proportion of the female populace is being inducted in the workforce, hectic lifestyles have been demanding the need for breast milk alternatives so as to ensure adequate nutrition for babies. That apart, development of retail stores that specially stock baby food products is also going to enhance the revenue share of breast milk substitute industry, in tandem with the consistent efforts of companies to develop different formula types of breast milk.

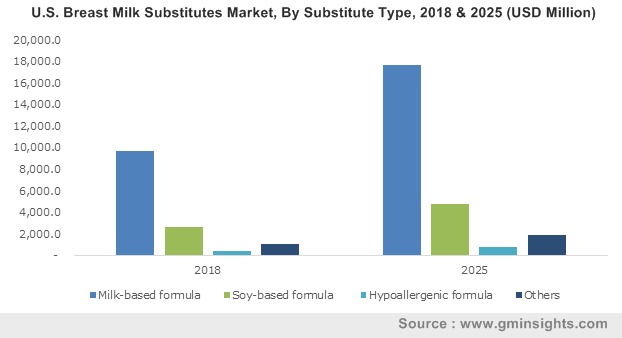

U.S. Breast Milk Substitutes Market, By Substitute Type, 2018 & 2025 (USD Million)

Among various formula types of breast milk substitutes, powdered formula is the most popular and least expensive form of baby formula. The product is to be mixed with water before feeding and can be administered during breast feeding to satisfy nutritional needs of infants. Powdered baby formula substitutes are also easy-to-use and will witness high adoption in the years to come. As per estimates, powdered breast milk substitutes market size is expected to register the highest CAGR of 10.0% over 2019-2025.

Due to lack of nutrition, infants face many diseases which can negatively affect their life ahead. Some diseases are also caused due to genetic mutations in babies which restricts the mother to breast feed babies. One of those diseases is galactosemia, which is caused by mutations in genes and deficiency of enzymes – lactose free supplements are mostly recommended for infants with galactosemia. Rising occurrence of galactosemia will thus raise breast milk substitutes market share in the years ahead.

The occurrence of classic galactosemia has been noted in 1 in 30,000 to 60,000 newborns. Type II has been reported to affect fewer than 1 in 100,000 newborns and Type III appears to be very rare. Nonetheless, the scenario of such diseases hindering nutrition intake of babies from breast milk has been proving to help increase breast milk substitutes market size, driven by the need to fulfil nutritional requirements through supplements.

Increasing number of working-class women is a major aspect influencing breast milk substitutes market outlook in the developed nations. Gender empowerment, especially in the U.S., has shown considerable outcomes and has helped increase women labor force in the country. In 2018, there were 75,978,000 women aged 16 and more, working in the U.S., representing 46.9% of the total labor force. In the same year, women held 51.5% of all professional, management, and related occupations.

The increasing number of women in the labor force is leading to working-class women opting for infant food, given the lesser time to consistently breastfeed the baby. Owing to the reduction in feeding cycles, the demand for alternatives has substantially increased in the U.S. As per estimates, U.S. breast milk substitutes industry size is expected to be pegged at $22.1 billion by 2025.

The U.S. based healthcare companies are also bringing forth innovations in infant foods to improve infant health and increase breast milk substitutes market share. Say for instance, in 2017, Abbott had announced the launch of pioneering products in child nutrition containing Human Milk Oligosaccharides (HMO) to support digestive and immune health. Abbott was the first company to bring this innovation to the world, adding HMOs, the third most abundant solid component of breast milk, to its infant formula products. The appreciable efforts by industry contenders and the expansion of infant formula market worldwide will also help surge breast milk substitutes market share.

Infant food producing companies have lately been planning to pave ways towards expanding customer base through acquisitions. Citing an instance, in 2017, Mead Johnson, US-based baby formula maker was acquired by Reckitt Benckiser in a deal worth $16.6 billion. The merger was expected to result in a medium to long-term growth of 3 to 5 percent for the company’s nutrition portfolio for children and the global infant category of Mead Johnson – a popular breast milk substitutes industry player.

The 2017 merger of Mead Johnson and Reckitt Benckiser was expected to majorly benefit China breast milk substitutes market, since the nation is the second largest market for RB and Mead Johnson collectively. As a matter of fact, China recorded 15.23 million births in the year 2018. China's population is expected to peak at 1.4 billion in 2029 which will proliferate the demand for the regional the market. High birth rate and rising working women populace are lowering the ratio of exclusive breast feeding, driving China market trends.

Breast milk substitutes market has been witnessing exponential growth on account of the emergence of numerous distribution channels, such as retail stores and pharmacies. Speaking of retail, the India retail sector valuation reached $672 billion in 2017 and is anticipated to exceed $1 trillion mark by 2020. The rising need to market breast milk substitute products via retail stores and the expanding retail industry will push market size from the retail distribution channel. As per estimates, retail stores segment accounted for over 45% of breast milk substitutes market share in 2018 and is estimated to grow considerably over 2019-2025.

Key industry players have been striving to bring about innovations in the market and have also been forging collaborations to enhance the revenue share of the business. Estimates claim that breast milk substitutes market size will exceed $119 billion by 2025.