Chlorinated Paraffin Market to gain remarkable proceeds in APAC, go-green notion to drive the product landscape

Publisher : Fractovia | Published Date : 2017-12-08Request Sample

The U.S. Environmental Protection Agency’s recent consent orders release to top three chlorinated paraffin market giants is indicative of the developments prevalent in this business space. Chlorinated paraffin market, having established itself as one of the most opportunistic business verticals of specialty chemical sector, stands to witness significant impetus from this green signal. As per the news snippet, EPA has apparently given green signal to Inovyn, Dover Chemical, and Qualice LLC for the manufacture and import of a wide range of chlorinated paraffin substances. In fact, this is claimed to be a sharp turn that would prove to be disruptive for the overall business landscape, given the fact that two years back, EPA was almost on the verge of banning medium and long-chain chlorinated paraffins, under the scrutinizing Toxic Substance Control Act.

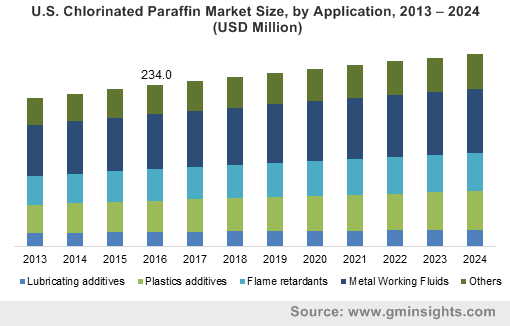

U.S. Chlorinated Paraffin Market Size, by Application, 2013 – 2024 (USD Million)

In the context of the alarming declaration by EPA in 2015, majority of the CPs manufacturers apparently faced a major blow, until recently when Inovyn, Dover Chemical, and Qualice LLC signed the consent orders that approve all the chlorinated paraffin pre-manufacture notices. Reportedly, EPA is expected to set Significant New Use Rule in near future that would mandate the requirements of consent orders for any manufacturer to import and produce these substances. Quite coherent from the aforementioned precedent, a strict regulatory frame of reference has much to contribute to the overall chlorinated paraffin industry trends. Emerging economies have implemented various mandatory rollouts with regards to fire safety in building infrastructure such as NFPA 255, NFPA 703, NFPA 220, and CFPA, which in effect has immensely upscaled CPs demand, with a subsequent impact on chlorinated paraffin market size.

The profitability quotient of chlorinated paraffin market is forecast to be positively high, primarily augmented by the manufacturing sector. Thriving on the robust growth in manufacturing space, it is quite imperative that related business spheres are bound to observe similar expansion in terms of revenue. In fact, experts believe, enterprises that are closely linked to the manufacturing of automobiles, metal products, equipment & machinery would be the prime growth drivers for chlorinated paraffin industry, especially across APAC belt. Statistics depict, in the year 2016, Indian manufacturing domain contributed more than USD 310 billion to GDP and the FDI investment reached over USD 70 billion in the present year. These figures draw a vivid picture of the growth potential of regional chlorinated paraffin market from manufacturing applications.

Speaking along the similar lines, APAC chlorinated paraffin industry is forecast to record a CAGR of 3.5% over 2017-2024, having held a sizable portion of the overall business space in 2016. As mentioned above, the regional chlorinated paraffin market is heavily influenced by the changing trends in manufacturing and construction domain. Therefore, it goes without saying that a large number of macroeconomic factors- such as an upsurge in buying power, significant economic growth, and an extensive population growth, that have profoundly stimulated the aforementioned verticals across APAC belt, by extension has left a perpetual impact on chlorinated paraffin industry as well. It is noteworthy to mention that rubber is emerging as another opportunistic end-use domain making a mark in chlorinated paraffin industry landscape. Subject to the products’ widespread acceptance as lubricative additive, flame retardant, softening agent, and water repellant fabric treatment agent, rubber and manufacturing applications, as reported, will collectively procure almost 50% of the overall chlorinated paraffin industry share by 2024.

Despite having a diversified application spectrum, chlorinated paraffin market giants have been facing a wide array of daunting challenges lately, growing governmental focus on creating green environment being at the pinnacle. In consequence of these initiations, short-chain chlorinated paraffins are getting banned in many of the emerging countries. Say for instance, recently, Singapore’s NEA (National Environmental Agency) has extended a notification to WTO with regards to its plan of banning SCCPs (short-chain chlorinated paraffins) and products containing them. Reportedly, the new regulation would be in effect from the second quarter of 2018. Nonetheless, having recognized the dire need to attain environmental sustainability, renowned companies engaged in the business space have been vying up with one another to bring up innovative sustainable solutions. In this regard, it is prudent to mention that Dover Chemical has been on the roll since for a while now, given the company’s pronounced investment in biodegradable chlorinated paraffins in sync with the sustainability trends. Driven by the appreciable developments at the product front, in tandem with the diversifying application landscape, chlorinated paraffin industry is forecast to exceed a valuation of USD 2 billion by 2024.