Cochlear implant systems market to gain substantial proceeds from the pediatric population base, government backing to drive the industry expansion over 2017-2024

Publisher : Fractovia | Published Date : 2018-03-22Request Sample

Apple’s yesteryear tie-up with Cochlear to launch the iPhone cochlear implant depicts the developments underlining cochlear implant systems market. Approved by the U.S. FDA, Cochlear’s Nucleus 7 Sound Processor is designed to stream sound from a compatible iPhone, iPod, or iPad touch to the sound processor. The sound can also be controlled from the iPhone by those with a surgically embedded implant. Indeed, the device has been touted as one of the most futuristic ones to have been launched in cochlear implant systems market last year – one that is likely to aid millions of people afflicted with a permanent hearing defect.

As per statistics released by the WHO, close to 900 million of the global populace is likely to suffer from hearing disability by 2050. Presently, around 466 million people suffer from hearing loss across the globe, 34 million of which are children. The figure depicts a staggering rise from the 360 million recorded half a decade ago, increasing the demand for hearing implants. In consequence, this would have a highly remunerative impact on cochlear implant systems industry size in the ensuing years.

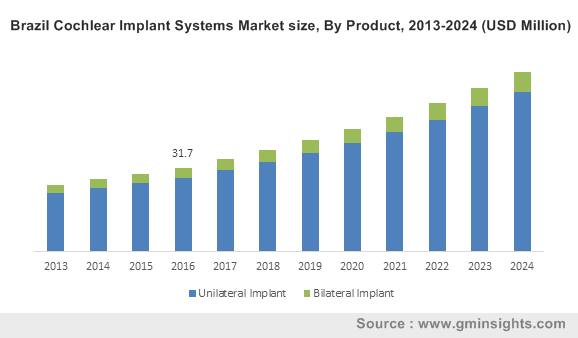

Brazil Cochlear Implant Systems Market size, By Product, 2013-2024 (USD Million)

The role that regulatory bodies play in impelling cochlear implant market

Being one of the most pivotal verticals of the medical devices domain, cochlear implant systems industry is strictly controlled by a regulatory frame of reference. The FDA takes it upon itself to approve or reject every new implant that debuts in the healthcare space, given the sensitivity of medical devices and their impact on the human body. Incidentally, the Nucleus 22-channel was the first cochlear implant to officially receive approval from the FDA to be safely used in adults and children.

The initial dominance of the FDA disregarded congenitally deaf children and deemed then unsuitable for cochlear implantation. However, the FDA soon approved the usage of hearing implants in children lesser than 2 years of age. Lately in fact, the FDA has approved multichannel cochlear implants to be used for prelingually deaf children as young as a year. This has provided quite a boost to cochlear implant systems industry players, encouraging them to experiment with safe and advanced implants for children and adults alike.

Another recent instance demonstrating the FDA’s involvement in cochlear implant systems market is its approval for the first telehealth program to remotely operate these implants. Cochlear Limited – the global leader in cochlear implant systems industry, has received the FDA nod for the prime remote feature that would enable follow-up programming sessions for Nucleus® Cochlear Implant System via a telemedicine platform. Indeed, this approval is the first of its kind in cochlear implant systems industry and also demonstrates the efforts Cochlear has been undertaking to ensure remote care for the recipients of the Nucleus Cochlear Implant.

How the pediatric populace is contributing toward cochlear implant systems industry growth

In the last decade or so, the rise in the pediatric population afflicted with hearing disabilities has increased dramatically. Reliable estimates claim that more than 24,000 children born in the U.S. every year suffer from some level of hearing loss. In fact, one in every 22 infants suffers from a hearing problem. The NCRA claims that more than 70,000 kids with hearing impairments were registered as a part of special education programs during the year 1998-99. The figure seems to have increased strikingly in the last few years. This scenario has undeniably given rise to a new growth avenue for industry players. As the prevalence of hearing disabilities rises among the pediatric populace, the revenue graph of cochlear implant systems industry is likely to observe a major spike.

The pediatric segment in fact, held a substantially large proportion of cochlear implant systems market share in the year 2016. Regional governments have been investing considerably in newborn screening programs to identify hearing loss incidences. The governmental bodies have also been working toward providing financial aid to economically backward families to help them afford expensive implants. With government support and novel product advancements, cochlear implant systems industry size from the pediatric populace is expected to soar high over the coming years.

Considering the alarming statistics related to hearing loss, it is rather overt that the demand for hearing implants will observe a meteoric rise in the years ahead. This would, in consequence, encourage companies partaking in market share to bring forth a range of highly advanced and innovative products. For instance, recently, MED-EL Medical Electronics, one of leading contenders of cochlear implant systems industry, and CAScination, specialists in surgical navigation solutions, announced the launch of a unique surgical planning software called OTOPLAN. In case of implant surgeries, OTOPLAN is likely to enable surgeons to visualize the most optimal implant electrode array from MED-EL’s electrode portfolio.

The aforementioned collaboration is seemingly the tip of the iceberg, given that modern medical technologies have made it possible for revolutionary developments in cochlear implant systems industry. Aided by an expanding geriatric population base susceptible to hearing disabilities and the rising prevalence of childhood deafness, cochlear implant systems industry is likely to chart out a lucrative growth path in the years ahead. Indeed, a study conducted by Global Market Insights, Inc., reveals that cochlear implant systems market size will cross USD 2.5 billion by 2024, with a CAGR anticipation of 8.5% over 2017-2024.