Commercial Refrigeration Equipment Market to be characterized by the deployment of energy efficient regulatory policies, rising adoption of time-tested growth tactics to augment the industry landscape over 2018-2024

Publisher : Fractovia | Published Date : 2018-09-14Request Sample

The increasing importance of cold storage for preserving consumable products has been a major factor propelling commercial refrigeration equipment market. Numerous businesses dealing with perishables comprising meat, fish, and other food items, mostly give preference for large cold rooms while beverages and cold drink businesses give preference for small size refrigerators, as is observed. Quite overtly, the subsequent use of refrigerators across several businesses for storing food products is poised to enhance commercial refrigeration equipment industry share.

The increasing adoption of refrigerators across commercial sectors has also encouraged biggies to capture quite some business share with the adoption of strategies such as new product development. In this regard, they have been focusing on quality, cost, suitability, and efficiency of the commercial use refrigerators. The incorporation of new advanced features in refrigeration equipment for gaining revenue as well as competitive benefits is slated to enhance commercial refrigeration equipment market over the years ahead.

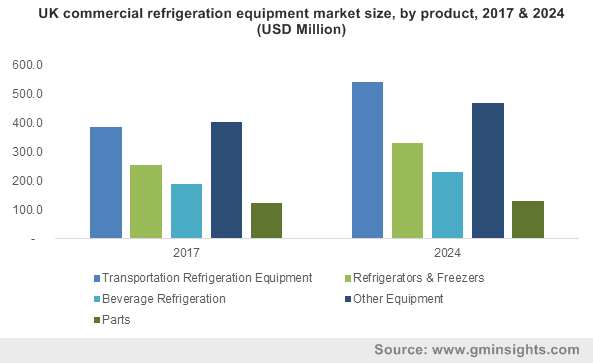

UK commercial refrigeration equipment market size, by product, 2017 & 2024 (USD Million)

As of now, the growing concern among the masses about energy efficiency is remarkably encouraging the contributors in the commercial refrigeration equipment market to invest in research and development activities. In order to develop energy efficient products, the maintenance of certain design standards and quality is essential, that would eventually lead to using effective alternatives over less energy efficient equipment. In addition, the deployment of energy efficient commercial refrigeration equipment at various business centers is proving to be quite cost-efficient, owing to its capability to consume lesser energy that results in lower energy bills. The development of energy efficient product ranges will thus significantly push business trends in commercial refrigeration equipment industry.

Speaking along the same lines, in most of the countries, refrigeration systems deployed across various commercial and business sector account for more than half of the overall energy consumption. In this regard, many regional governments have also taken initiatives to promote the businesses to use energy efficient refrigeration systems that could have lower global warming potential (GWP) refrigerants. Accordingly, the use of natural refrigerants has increased tremendously which could have minimum impact on the environment. For instance, currently, in U.S., with the growing consciousness about the energy consumption and environmental impact, many supermarket owners are trying to adopt environmental stewardship practices that will further fuel commercial refrigeration equipment market.

With the increasing compliance requirements, the rising demand for commercial refrigerators with hydrofluorocarbon (HFC) refrigerants that could have a negative impact on the environment is being better understood, on the grounds of which some companies have developed natural refrigerant-based refrigeration for commercial use. The U.S. Environmental Protection Agency in fact has recently awarded the ENERGY STAR to Welbilt, Inc., and True Manufacturing which develops propane-based commercial refrigeration equipment. One of those companies has set a new benchmark ahead for other industry players with the development of highly efficient refrigeration equipment by using only sustainable materials. The surging acceptance of ENERGY STAR products across supermarket and retail chains sectors is thus poised to propel the product demand over the years ahead.

Companies that have not been involved in new product developments are looking forward to taking over already established companies that would prove to be beneficial for them to gain access to the parent company’s research expertise, customer base, and product portfolio. Validating the aforementioned fact, in the first quarter of 2018, the Danish refrigeration company, Tefcold Group acquired the UK based supplier of refrigeration equipment, Interlevin Refrigeration. From the last 50 years, Interlevin Refrigeration has been a pivotal contender of commercial refrigeration equipment market, specializing in distribution, repair, and maintenance. The acquisition has helped the Danish refrigeration company increase its product ranges and customer base across the UK. This approach of leading companies to obtain long-term revenue benefits with such business tactics is likely to influence commercial refrigeration equipment industry outlook over the years ahead.

On-going innovations and developments in commercial refrigeration equipment market will further stimulate the product demand in the future. The strategic approach of biggies toward business expansion, by specifically focusing on the surging product demand could help them to achieve a fairly strong market position. The deployment of strict regulatory norms to promote the use of energy efficient equipment is also slated have a positive influence on commercial refrigeration equipment market which will surpass revenue collection of USD 35 billion by the end of 2024.