China commercial satellite launch service market to amass hefty gains over 2018-2024, extensive investments in novel product development to stimulate the regional industry growth

Publisher : Fractovia | Published Date : 2018-05-31Request Sample

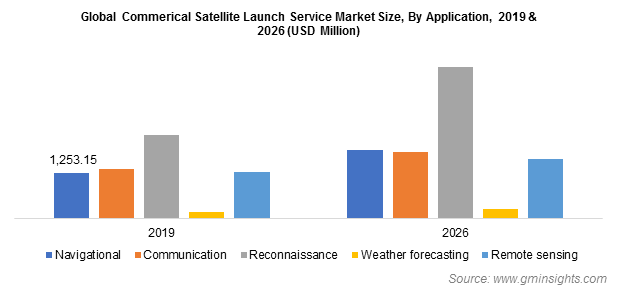

Powered by the shifting trends toward improved communication networks, commercial satellite launch service market is likely to gain substantial traction in the ensuing years. As the demand for navigation facilities to detect destinations across the globe has been escalating, many private technology companies and regional governments have involved themselves in the development of diverse spacecraft, boosting commercial satellite launch service industry share. An instance justifying the aforementioned is that of the American private space research company SpaceX, that launched five commercial communication satellites from California. The increasing investments in missions conducted for unveiling climatic behavioral changes will quite overtly have a favorable impact on commercial satellite launch service industry share.

U.S. Commercial Satellite Launch Service Market, By Orbit, 2017 & 2024, (USD Million)

The increasing connectivity between various countries has led to a surging demand for an improved communication network across the globe. In this regard, recently, a Hong Kong-based operator launched a satellite from Southwest China to increase connectivity with other countries across the Asia Pacific. Titled Apstar 6C, the satellite is deemed to be useful for maintaining in-flight connectivity, DTH television broadcasts, video distribution services, and cellular backhaul capacity across Southeast Asia, Mongolia, and China. Having been propelled in a geostationary orbit over 22,000 miles over the equator, Apstar 6C is indicative of the fact that satellite launches in the geostationary equatorial orbits will hold commendable precedence with time. As per estimates, GEO commercial satellite launch service market size will cross USD 2 billion by the end of 2024.

China has indeed, been attempting to remain at the forefront as far as satellite launches are considered. Recently, APT Satellite Holdings collaborated with China Great Wall Industry Corporation and arranged for spacecraft & launch services in the nation. As early as April 2018, China successfully sent five small remote sensing satellites through a solid-propellant rocket into orbit, while in June 2018, the country announced to have planned to launch a couple of remote sensing satellites for Pakistan. China’s efforts to enhance Pakistan’s space capability and ensure that it emerges self-reliant with regards to remote sensing satellites for multi-spectral imaging is likely to fuel the regional commercial satellite launch service industry outlook.

Most of the Chinese companies are increasingly working on remote sensing satellites, owing to its numerous benefits for various practical applications. Remote sensing satellites are prominently useful for disaster management, forestry, agriculture, water management, urban planning, and weather forecast. As the Chinese aerospace and technology companies continue to brainstorm new ideas about the deployment of satellites for practical purposes, the regional commercial satellite launch service market share is likely to witness an incline.

Regional governments have currently been giving extraordinary preference for strengthening their defense sector and emerging dominant in terms of boasting of a powerful defense force. The surging investments on the defense sector have thus created a pool of opportunities for the players in commercial satellite launch service industry. Speaking of an instance, Airbus Defense and Space recently launched an Earth-observation satellite, which can be used for high-resolution imagery in UAV applications. Since commercial satellites have higher bandwidth capacity than military WGS satellite, the defense sectors of most countries are looking forward to using commercial satellite technologies for military applications.

Many spacecraft companies have been making heavy investments to develop next-generation satellites by 2020. In addition, many governments are implementing several product innovation strategies to encourage satellite manufacturers to get involved in novel product development. Validating the aforementioned fact, the U.S. government recently deployed a policy to reduce the cost and stimulate innovations that would impact the future of commercial satellite launch service market.

For the record, in 2015, the global spending on space activity reached USD 323 billion, out of which about 37% was held by commercial infrastructure companies and 40% was held by commercial space products and services. Moreover, the U.S. government alone accounted for 14% of the worldwide spending on space research and satellite manufacturing, making the United States a viable growth ground for commercial satellite launch service market.

Several companies across the private sector have been developing novel spacecraft for commercial purposes, aided by a supportive governmental framework. The U.S. Federal Aviation Administration (FAA) for instance, recommends changes in the policies, regulations, plans, procedures, treaties, and federal statutes and approves commercial satellite launches in the United States. It also ensures the expansion of the required infrastructure and promotes commercial spacecraft launches by the private sector.

The escalating need of digitization across the globe is expected to encourage companies to develop satellites for improving communication, weather broadcasting, television broadcasting, and more. Powered by technologically advanced industrial scenario and a strong regulatory framework, commercial satellite launch service industry is anticipated to register a CAGR of 2.5% over 2018-2024.