U.S. commercial water heater market to accumulate substantial returns over 2018-2024, rising deployment of energy-efficient technologies to augment the product demand

Publisher : Fractovia | Published Date : 2018-10-26Request Sample

Global commercial water market outlook is likely to experience a transformation of sorts, driven by the rapidly increasing demand for luxury homes and apartments along with adoption of advanced heating technologies that comply with stringent commercial construction standards and codes. Commercial water heaters comprise gas water boilers, solar water heaters, oil fired water heaters, and electric water heaters, and are seemingly used in diverse applications across hospitals, hotels, resorts, spas, and restaurants.

Robust expansion towards development of smart cities is another pivotal factor that will augment the growth of commercial water heater industry. As per the India Brand Equity Foundation (IBEF) 2018 reports, the real estate market of India is expected to reach $853 billion by 2028, increasing from $126 billion in 2015. Reportedly, demand for residential properties has surged due to increased urbanization and rising household incomes. Major residential projects now provide 24X7 hot water supply due to availability of high-quality, low energy consuming solar water heaters, a factor that is likely to stimulate the regional commercial water heater market share.

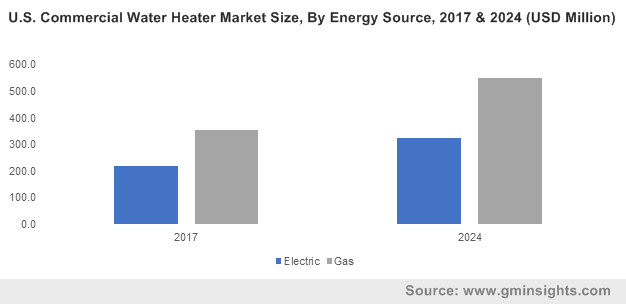

U.S. Commercial Water Heater Market Size, By Energy Source, 2017 & 2024 (USD Million)

Rising adoption of solar power as an energy source to drive commercial water heater market

Concerns over the impact of fossil fuels on the environment, combined with soaring energy prices, have triggered increased interest in the use of solar water heater globally. SWHs are proven to be most suitable alternative for commercial water heating applications where load demand is low or medium. According to Florida Solar Energy Center, a family of 4 using a SWH along with an electric backup element could save between $200-$300 a year in lower water heating costs. Due to the high use of electricity for electric water heater, a solar water heater rollout works better financially, as the system begin to pay for itself over a short period of time.

Reportedly, government organizations are taking efforts to encourage use of solar water heater by offering subsidies and bank loan facilities to consumers. For instance, the Government of India’s nodal agencies and channel partners now offer 30% cost subsidy on SWH to consumers in general category states, while the scheme provides 60% subsidy to special category states such as North-East states and hilly terrains.

An insight into U.S. commercial water heater market trends

Extreme climatic conditions along with substantial growth across the service industry will drive the U.S. commercial water heater market. Being a highly renowned technological hub in itself, the U.S. commercial water heater industry has witnessed the introduction of advanced heating technologies like integrated remote monitoring and automatic control systems that will substantially amp up the product’s heating s performance.

Another essential factor that will drive U.S. commercial water heater market is the replacement and upgradation of existing systems with more efficient and compact designs such as heat pump water heaters (HPWH). According to US Department of Energy (DoE), converting all electric resistance water heaters (ERWHs) to HPWHs could save around $7.81 billion annually (USD 182 for every household) in water heater operating costs for American consumers and curb annual residential source energy consumption for water heating by 0.70 quads. With the rising adoption of advanced, energy efficient technologies, U.S. commercial water market size will surpass $850 million by 2024.

Hospitals are likely to emerge as one of the most reliable end-use domains of commercial water heater industry. Hot water is liberally used in hospitals for desterilizing medical equipment and for maintaining patient hygiene. As per Energy Star, on an average hospital supplies 315 gallons of water to each bed every day. Hospitals usually prefer the use of electric tankless water heaters, as they utilize thermal optic sensors to heat the water running through the system instead of heating a whole tank at once. This keeps the warmth of the water at a safe and reliable temperature for patients, hospital staff and visitors alike.

The Department of Energy (DoE) noted that a home can save at least $100 a year on its utility bills by switching to an electric tankless water heater. These savings would consequently incline across larger private establishments such as hospitals. Additionally, it has also been observed that hospitals do seem to prefer SWHs as well as to reduce energy consumption. As per sources, in Malaysia, hospitals and hotels utilized over 30% of the total energy consumption for water heating. By switching to SWHs, a massive amount of electricity could be saved, on the grounds of which hospitals have been adopting SWHs on a large scale, expanding the scope of the overall commercial water heater industry.

Being one of the most profound, basic appliances across the commercial sector today, water heaters have been finding expanding applications across establishments such as hotels, resorts, hospitals, restaurants, and more. The demand for these products is on an incline in colder countries such as Canada, U.S, Europe, and Russia, however, the emerging economies have also been on the development radar, holding a significant share of the global commercial water heater market. Powered by the development of smart cities and the rising number of subsidies provided by regional governments, global commercial water heater industry size is likely to be pegged at $7 billion by 2024.