Compounding pharmacies market from geriatric applications to account for a massive chunk of global revenue by 2024, Japan to heavily influence the regional growth

Publisher : Fractovia | Published Date : 2018-07-23Request Sample

The 2015 acquisition of JCB Laboratories by Fagron North America marked the genesis of a remarkable transformation in compounding pharmacies market in the United States. The new entity, then named as Fagron Sterile Services, worth USD 15 million, was until 2015, Fagron’s largest capital investment made in more than 20 years. The same year also witnessed Slade Pharmacy Services partnering with Fresenius Kabi to buy out its oncology compounding segment in Australia, thereby strengthening its foothold in the regional compounding pharmacies industry. The agreement granted exclusive rights to Slade for manufacturing compounded parenteral nutrition products for Fresenius Kabi in Australia.

Germany Compounding Pharmacies Market, By Product, 2013 – 2024 (USD Million)

The aforementioned instances aptly validate the fact that compounding pharmacies market is defined by a plethora of strategic collaborations, joint ventures, and acquisitions across most of the topographies worldwide. Other biggies that are actively partaking in global compounding pharmacies industry include B.Braun Medical, Cantrell Drug Company, Pencol Compounding Pharmacy, and Institutional Pharmacy Solutions.

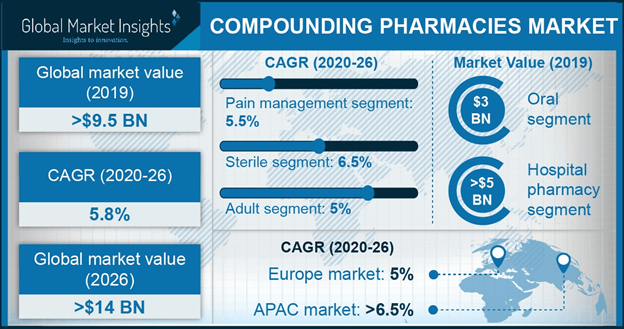

Pharmacy compounding is essentially the discipline of preparing personalized medications for patients that are prescribed by a medical expert. Compounded medication formed by mixing individual ingredients with the required dosage has been researched and found to be rather beneficial for patients, consequently emerging as the driving force of compounding pharmacies market since the last decade. The methodology is perpetually common across most medical faculties, including geriatrics, pediatrics, and even veterinary. Prescriptions are usually provided for a host of disorders, including oncology, hormone replacement, and pain management. The modest success rate of compounded prescriptions will lead compounding pharmacies industry size to cross USD 12.5 billion by 2024, claim reports.

Personalized medication is one of the latest trends of the healthcare sector, a fad that will, in all probability contribute toward the growth of compounding pharmacies market. The rapidly growing elderly population across the globe susceptible to numerous disorders has led medical experts and researchers to develop a range of medication derived from alternate formulations. In addition, drug shortage leads to delayed patient care and subsequently enables the requirement of replicated but commercialized and legally approved drugs that can prove to be godsend for critically ill patients. Thus, the rising drug shortage pertaining to manufacturing and quality issues will spur compounding pharmacies industry size in the ensuing years across various geographies, especially the developed economies such as the United States and Japan.

As per statistics, U.S. held dominated the overall compounding pharmacies market share in 2017 and is anticipated to grow with a remarkable rate over the years ahead. This growth can be attributed to the rising awareness regarding the benefits of compounded medication and the rising trend of using personalized medicines. Drug shortages leading to increased prescription drug prices will also augment U.S. compounding pharmacies industry share over 2017-2024.

Most patients prefer consuming compounded medication through the oral route, such as tablets, capsules, and pills. Attesting to this very fact, oral products dominated the overall compounding pharmacies market share in 2017 with a valuation of USD 2,872.5 million. On occasion though, it has been observed that elderly patients find difficulty in swallowing pills and tablets, owing to which other products are likely to capture a sizable share of the business. Topical formulations for instance, may witness an appreciable growth rate over the coming six years, as per a reliable compounding pharmacies industry report.

With the rise in the production of topical formulations as opposed to oral medication, especially for the elderly patients, compounding pharmacies industry share from the geriatric patient base will observe a profound growth over 2018-2024. The rapidly increasing occurrence of chronic diseases among the geriatric patients necessitates the requirement of commercialized medication, which consequently increases the demand for compounded medicines.

Speaking of a growing elderly patient base, Japan is one of those regions that will act as a major growth ground for the development of compounding pharmacies market. The country has already established its footprints in advanced disciplines such as robotics and automation. Apparently, the country deploys superior technology, i.e., robots in the manufacturing process of compounding medication, thereby augmenting compounding pharmacies industry. The geriatric population vulnerable to chronic ailments and the advanced pharma sector in the nation will be the key driving factors that will suitably impel Japan compounding pharmacies market share over the years to come.

The dearth of skilled personnel for the compounding methodologies is one of the key restraints of compounding pharmacies industry. In addition, compounded medication is likely to be exposed to risks such as adulteration and contamination. The fact that it is not FDA-approved makes it all the more vulnerable. However, reputed research and academic institutes are being established across the globe, with a view to provide a formal training in compound processing and pharmacy operations, which may give rise to a slew of trained technicians in the future. This step is a major leap toward reducing the restraints of compounding pharmacies market and steering it toward a positive growth chart.