Construction Composites Market to experience significant growth in Asia Pacific belt, Fiberglass to drive the product landscape

Publisher : Fractovia | Published Date : 2018-06-04Request Sample

Exel Composites’ recent takeover of Diversified Structural Composites has been lately hogging all the attention in construction composites market. Keeping in line with the competitive spectrum, Exel reportedly has penned down an agreement with Teijin Carbon America Inc., a subsidiary of globally acclaimed carbon manufacturer Teijin, in a bid to acquire 100% share of DSC. The merger mainly centers around integrating DSC’s excellent pultrusion related technical know-how with Exel’s existing growth strategy. Incidentally, this would make the Finnish composite manufacturer the one and only pultrusion firm that has a significant presence in three other neighbor continents. Armed with an intent to strengthen its stance in industry space, Exel Composites is apparently planning to leverage DSC’s profitability into its supply chain.

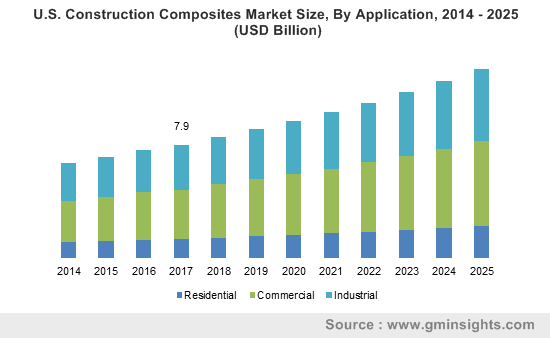

U.S. Construction Composites Market Size, By Application, 2014 - 2025 (USD Billion)

Exel’s initiative is just one of the many strategies that construction composites market giants have been lately adopting to diversify the product landscape. Globally acclaimed manufacturers have been increasingly investing in the production of value added solutions that are highly customized. Speaking of the extensive product spectrum defining construction composites industry, it would not be incorrect to say that the industry players have been garnering substantial profits from the sale of construction fiber glasses. Statistics claim that the global demand for fiberglass in the year 2016 was close to 10 billion pounds in terms of shipments, while the capacity was of valuation 11 billion pounds.

Owing to some of its exceptional properties like high strength and light weight, construction glass fiber has become the go-to product for various electrical and thermal insulation purposes across industrial, commercial, and residential sectors. Add to it, considering the immense growth prospect of fiberglass based construction composites market, renowned construction players are also pouring hefty amount in its large scale production. CNBM (China National Building Material) Company, say for instance, in conjunction with the IDRO Group (Industrial Development and Renovation Organization of Iran) has signed a deal of USD 74 million to establish a massive fiberglass and composite manufacturing unit in Marand, which claims to hold a capacity of nearly 30 kilo tons. It therefore goes without saying that fiberglass will procure a major portion of construction composites market share over the ensuing years.

Given the fact that the business space mainly thrives on the changing trends of construction sector, the Asia Pacific turf substantially stands as one of the most opportunistic growth grounds of construction composites industry. China and India, two of the most advancing nations of APAC belt, are claimed to be the most prominent revenue avenues of the regional market. This can be possibly attributed to the extensive governmental investments across these regions to improve public infrastructure. For example the Indian Government has invested almost USD 2.4 billion in Navi Mumbai International Airport Project in 2015, which is expected to be completed by 2019.

According to reliable estimates, India is slated to peg third position in global construction industry by 2025 with a forecast valuation of USD 1 trillion, which by extension also ensure its stance in construction composite market in the years ahead. The mammoth valuation indeed can be credited to the flurry of projects with regards to road & building construction, railways, urban infrastructure, and the like. China’s construction sector is also expanding at a remarkable pace. With China and India at the growth front, Asia Pacific construction domain is likely to procure 60% of the global infrastructure spending by 2025, claim reports. Undoubtedly, this growth demands the requirement of advanced reinforced materials, which would eventually propel APAC construction composites industry.

However, with the recent spike in raw materials and production process price trends, the business space is likely to experience a sluggish growth. Another trend that is somewhat considered as a stumbling block in industry expansion is the strong regulatory framework with regards to reinforced materials utilization. In a bid to overcome this challenge, construction composites market giants have been readily engaging themselves in developing products that are completely in compliance with the regulatory standards. Aided by the unprecedented investments in infrastructural projects across the world, construction composites industry is poised to record a massive valuation of USD 65 billion by 2025.