APAC Corrosion Inhibitors Market to observe maximum gains over 2016-2023, surging demand from the oil & gas sector to accelerate the global industry growth

Publisher : Fractovia | Published Date : 2017-07-05Request Sample

With a plethora of uses across the oil & gas, chemicals, power generation, metal processing, and pulp & paper sectors, Corrosion Inhibitors Market is no doubt, anticipated to depict a positive growth trend over the forthcoming years. Estimates state that oil and gas account for more than 55% of the energy demand worldwide. However, corrosion accounts for a large portion of the operational and maintenance costs of the oil & gas sector. On that note, it is apparent to declare that anti-corrosive products find extensive applications in the oil & gas sector, which will indirectly propel corrosion inhibitors industry. The construction sector has also been gaining global momentum – as per research, global construction market will cross a valuation of USD 13 trillion by 2023, a factor which will be responsible for the growth of corrosion inhibitors market, subject to the product usage while manufacturing components such as metal attachments, nuts, bolts, and steel bars. On these grounds, Global Market Insights, Inc., estimates corrosion inhibitors industry size to surpass USD 8 billion by 2023, with a CAGR projection of 4.9% over 2016-2023.

Corrosion inhibitors are basically chemical compounds that stop corrosion and rusting from taking place or spreading in metallic components. They are highly durable and are designed to provide between 90% to 96% protection at a concentration range between 78 ppm to 42 ppm. This has widened their application scope across myriad end-use sectors, thereby fueling global corrosion inhibitors market. These products provide protection against carbon dioxide, brine and fresh water, hydrogen sulfide, and biological deposits, in the oil & gas sector. They are also heavily utilized as chemicals for water treatment, especially across the medical, electronics, and chemicals sectors, to fulfill the demand for clean water. As per estimates, wastewater treatment chemicals industry is estimated to exceed USD 35 billion by 2023, which will act as one of the key drivers for the growth of corrosion inhibitors market.

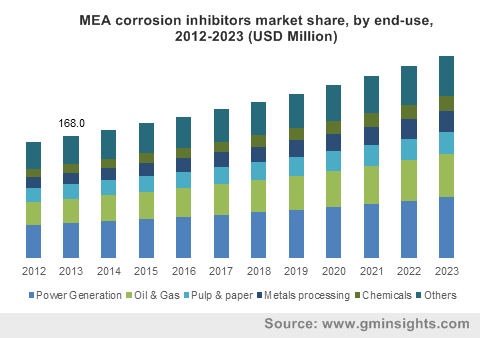

MEA corrosion inhibitors market share, by end-use, 2012-2023 (USD Million)

Corrosion inhibitors industry share is principally distributed across Middle East & Africa, North America, Asia Pacific, Europe, and Latin America. In 2015, APAC had dominated the overall corrosion inhibitors market, owing to the robust growth of the construction sector. In addition, the regional governments have been providing financial support for the development of public infrastructure across the continent. Furthermore, the region has been witnessing escalated spending on the residential and commercial sectors by consumers with disposable incomes. On these grounds, it has been forecast that APAC corrosion inhibitors market, led by India and China, will observe the highest gains over 2016-2023.

Corrosion inhibitors can be organic or inorganic. While the latter provide reliable stability in harsh weather conditions, they are infamous for the detrimental effects they have on the environment. On these grounds, it is forecast that inorganic corrosion inhibitors industry will register a growth rate of 3% over 2016-2023. Organic products, on the other hand, led the overall corrosion inhibitors market in 2015, owing to their superior characteristics, and are anticipated to witness the highest growth over 2016-2023. Key products classified under the organic domain include benzotriazole, organic amines, mercaptobenzothiazole, tolyltriazole, and phosphonates.

Corrosion inhibitors find extensive applications in the power generation and oil & gas sectors. The latter in fact, is one of the most lucrative business grounds for the growth of corrosion inhibitors industry, especially since the field is witnessing a profitable upswing of late. The product is used in the manufacture of most of the essential components of the oil sector, as they are mostly exposed to adverse climate. Corrosion inhibitors market from the oil & gas sector is forecast to observe gains of around 5.5% over 2016-2023, pertaining to the rising shale gas exploration activities in Russia and the United States.

The inhibitors used in professional domains can be water-based or oil-based, with the former being principally used across the water treatment chemicals sector. Water based products dominated the overall corrosion inhibitors industry in 2015 and are slated to experience massive growth over the coming years. The surging demand for these products from the construction, power generation, refining, and mining sectors will further impel the market trends.

Oil based products essentially involve steel, aluminum, copper, and zinc. These inhibitors are known to provide high performance for a longer duration, over their water counterparts, owing to which oil-based corrosion inhibitors industry will experience a growth rate of 4% over 2016-2023. However, their usage is avoided across closed systems due to their high flammability features.

Worldwide corrosion inhibitors market is strictly governed by rules and regulations enforced by environmental agencies, with regards to product exposure to humans and their disposal. Technically, the more the product is used, larger is the disposal quantity of raw material such as zinc, phosphorus, and chromium. Prolonged exposure to these chemicals can cause severe health hazards, owing to which it is important for manufacturers to keep abreast of the product disposal techniques. In the event that this problem is not taken care of, corrosion inhibitors market is likely to face possible growth hindrances. Nonetheless, companies have been undertaking incessant efforts to increase investments in R&D activities for developing environment friendly inhibitors. In addition, they have also been paying attention to commercialize heavily, the already existing eco-friendly inhibitors in the product portfolio. Pertaining to these efforts, it is expected that global corrosion inhibitors market will chart out a positive growth graph in the ensuing years.