APAC dicyclopentadiene (DCPD) market to acquire sizable returns by 2024, automotive and electronics sectors to emerge as pivotal remuneration avenues

Publisher : Fractovia | Published Date : 2018-03-21Request Sample

A strong niche vertical in itself, DCPD market stands as one of the most lucrative businesses in the chemicals space. One of the most pivotal reasons this business has gained so much traction is because of the product’s massive deployment in the production of specialty resins. With such resins being used abundantly across a plethora of mainstream sectors, DCPD industry has observed a meteoric rise in the recent years. A section of chemical companies therefore, exclusively place their focus on expanding resin capacity, so as to ultimately call their bets on DCPD market.

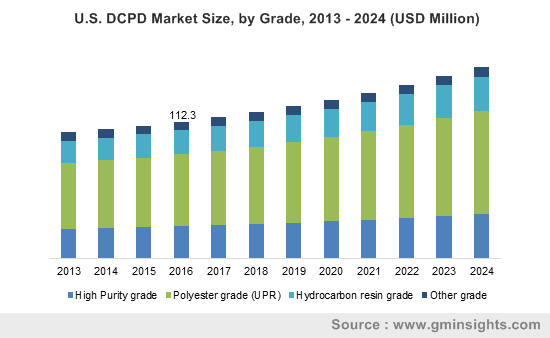

U.S. DCPD Market Size, by Grade, 2013 – 2024 (USD Million)

An instance validating the authenticity of the aforementioned statement is when SABIC, the Saudi Arabia headquartered DCPD industry leader, announced resin-based projects in the Asian and European zones. In a bid to satisfy its consumer base, SABIC recently declared that it intends to launch two projects targeted toward increasing the global capacity for two of its resins. Incidentally, these are SABIC’s high-performance thermoplastic materials – the Noryl and Ultem resins. The facility in Singapore is expected to go onboard by the end of Q2 2021. The firm also aims to recommission operations at its Netherlands plant by 2019 end for manufacturing PPE (polyphenylene ether) – the base resin required for the Noryl resin line. SABIC’s project launch reiterates the commitment of chemical firms toward impelling dicyclopentadiene market. Additionally, it also depicts that it is solely through specialty resin production and deployment that DCPD industry has witnessed such a commendable growth rate so far.

The rise of the automotive industry across APAC and its impact on the regional dicyclopentadiene (DCPD) market trends

The automotive sector is one of the foremost recipients of DCPD industry, given that the manufacturing of automotive parts and components often demand the deployment of specialty resins produced from DCPD. Resin systems are extensively used for automotive composites. Add to it, the trend of lightweight vehicles has been catching on immensely, further expanding the scope for these resin-based composites to be used in automotive production. Hexion Inc., for instance, introduced a specialty epoxy resin system last year for styrene-free, sheet molding compound (SMC) manufacturing of high-performance automotive composites. This new product is designed to be used for the production of lightweight structural EV battery enclosures, floors, hood inners, spare wheel tubs, and seat structures. In essence, the expansion of DCPD market is directly proportional to the robust growth of the automotive industry.

Adhering to the very fact mentioned above, DCPD industry is expected to have profitable prospects across the Asia Pacific. Indeed, the automotive sector in the region has been growing at an unprecedented pace since the last decade or so. India, China, South Korea, Japan, and Australia have emerged to be some of the most industrially developed areas of the Asia Pacific zone. Indeed, China and India have been on the forefront as far as the automotive sector is concerned. Estimates claim that last year, more than 4,782,000 cars and commercial vehicles were manufactured in India alone, while China boasted of a vehicle production that surpassed 2,90,15,000. It is rather overt that DCPD market will find APAC to be a highly lucrative investment destination over the years ahead, primarily on account of the expanding automotive domain.

The rise of the electronics industry across APAC and its impact on the regional dicyclopentadiene (DCPD) industry trends

The electronics sector, while having reigned supreme in the developed economies of the West, has lately found its serendipity across the Asian turf. Indeed, a yesteryear statistical survey reveals that Asia electronics and electrical industry will depict a growth rate of 5% in 2018. With a highly tech-savvy population in place and the emergence of startups all over, aided by a favorable regulatory landscape, the APAC electronics industry is projected to register commendable progress in the ensuing years. In consequence, this would have a pivotal impact on APAC DCPD market, given that urethane, epoxy, and silicone resins are massively used for encapsulation and potting in the electronics companies.

Countries such as India, China, Taiwan, and Japan have emerged as forerunners as far as the dominance of APAC in the global electronics sector is concerned. Just recently, the Taiwanese company Eternal, transformed itself to own a diversified portfolio of resins and electronic chemicals to cater to the region’s growing dominance in mainstream businesses. India electronics industry has been long touted as one of the most developmental regions across the APAC. A reliable estimate claims that the total electronics hardware production in India will cross USD 100 billion by 2020. Indeed, the country’s governmental norms also allow an increased inflow of FDIs that have facilitated the electronics companies to cater comfortably to a domestic and overseas consumer base. Gradually, this would lead to a growing consumption of electronic chemicals and resin systems, propelling the regional DCPD market share.

Incidentally, APAC held more than 45% of the overall dicyclopentadiene industry size in 2016 and is anticipated to emerge as a vital revenue contributor by 2024. This growth can be primarily attributed to the humongous expansion of the automotive and electronics sectors in the region. Not to mention, the growing paints & coatings, packaging, construction, and printing inks sectors have also done their bit in contributing toward augmenting the regional DCPD market outlook.

Equipped with a widespread end-use spectrum, DCPD industry is likely to traverse a rather lucrative growth path in the years ahead. The business space has also been witnessing the proactive participation of core chemical companies and end-use firms, striving to consolidate their foothold amidst fierce competition. Having garnered a valuation if USD 550 million 2016, DCPD market size is anticipated to cross USD 800 million by 2024, as per a report by Global Market Insights, Inc.