Rising demand for modern electricity infrastructure to drive distribution lines and poles market size

Publisher : Fractovia | Published Date : 2019-08-07Request Sample

Rising demand for energy across remote areas and in developing regions will drive distribution lines and poles market trends over the forthcoming years. Government expenditure on power infrastructure will provide a reliable growth platform for companies supplying energy generation and transmission equipment. Growing population in emerging economies has particularly escalated the need for expansion of power grids. The Government of India, for example, had spent around Rs 24,890 crore (over USD 3.58 billion) on rural electrification over four years up to 2018 under the new government.

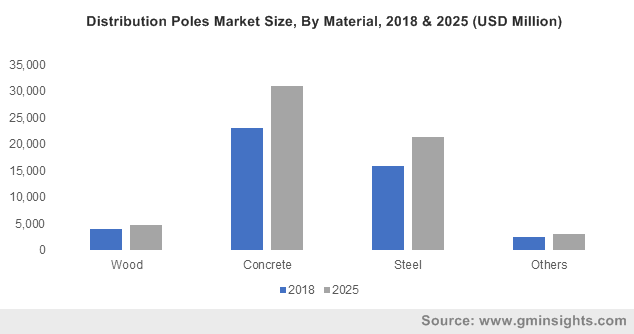

Distribution Poles Market Size, By Material, 2018 & 2025 (USD Million)

A modern electric grid system is critical for every economy and for the overall national security, with energy ministries worldwide spending hundreds of billions on grid modernization initiatives to improve the reliability, resiliency, and security of electricity delivery system. Moreover, global electrical power sector is looking to replace and upgrade infrastructure to meet the adoption of renewable energy in the traditional grid. This could result in an upsurge in investments for high quality electric distribution system, reinforcing distribution lines and poles industry forecast.

Nexans, a global player in the cable and optical fiber industry has reportedly launched the Asset Electrical software for power grid asset management in collaboration with Cosmo Tech. The major purpose of the platform is to alleviate investments involved in electrical component maintenance and optimize renewal policy planning to meet the challenging demand of the future. Undoubtedly, latest innovations and collaborations to boost power distribution infrastructure capabilities will transform global distribution lines and poles market outlook.

Across the expanding distribution network systems designed to meet the growing power requirements, open wire distribution lines are highly preferable across developing and developed nations alike due to easy maintenance and low capital needs. Reports indicate that open wire distribution lines market volume is estimated to grow by more than 3% by 2025. It would result in an increasing number of opportunities for power industry players to come up with unique electrification projects and maintain grid stability as well as increase their revenue prospects.

The advanced electric power systems being adopted by developed economies like the US, Germany and U.K. have stimulated the development and deployment of energy efficient technologies. Implementation of regulatory frameworks that extensively bring incentives for system operators and utilities with key objective of eliminating price unpredictability and ensure system reliability will strengthen energy infrastructure. Rapid transition towards a modernized grid coupled with growing consumer demand will fuel distribution lines and poles industry size.

In terms of the geographical landscape, United States is considered to house some of the world’s most affordable, reliable and increasingly clean electricity supply systems. The country’s financial well-being, national security and public health is widely dependent on reliable sources of electricity supplying to commercial entities, industries, residential facilities, and military organizations. The U.S. Energy Information Administration has mentioned that the country had invested around USD 51 billion in 2017 on electricity distribution systems, massively expediting the product adoption regionwide, elevating U.S. distribution lines and poles market share.

Steel poles are becoming widely popular among utility companies in the U.S. for creating new distribution lines and replacing the traditional grid infrastructure. More than 300 electric utility companies across the U.S. were extensively using the steel distribution poles last year, to build a more safe, durable, reliable, and sustainable distribution system.

Reports suggest that steel distribution poles market size will surpass yearly installations of nearly 30 million units by 2025. Undeniably, innovations and advanced manufacturing methods will significantly impel the market growth.

Numerous companies and manufacturers are engaged in development of advanced electric power grids powered by government backing and private funding, which will help in boosting installation of distribution lines and poles over the ensuing years. Nexans, Riyadh Cables, Bell Lumber & Pole, ZTT, KEI, Versalec, Stresscrete, Lamifil, Stella Jones, Pelcoa and Valmont are some of the key players operating in the industry. Global Market Insights, Inc. has projected that distribution lines and poles market is expected to surpass USD 100 billion in annual revenues by 2025.