Five geographical trends driving global Drill Pipe Market over 2016-2025

Publisher : Fractovia | Published Date : 2017-04-06Request Sample

Drill Pipe Market representing a noteworthy share in the oil & gas industry is gaining tremendous momentum, owing to rapid developments made in the field of onshore & offshore drilling. Increasing exploration and production activities for unconventional resources within countries such as Canada, Russia, U.S., UAE, Saudi Arabia, Iran, China, Mexico, and Brazil, is likely to jack up the worldwide drill pipe industry trends. In addition to this, large scale bidding of contracts worth millions in offshore drilling projects is amplifying the overall industry outlook. As per a report by Global Market Insights Inc., in 2015, Drill pipe industry share was worth USD 1.7 billion and is set to record a CAGR of 2% over the timeframe of 2016-2025.

Taking in to account the geographic trends, the drill pipe industry is experiencing extensive adoption across the globe with heavy investments in oil & gas projects. Below are the regional highlights pertaining to the drill pipe industry over the coming eight years.

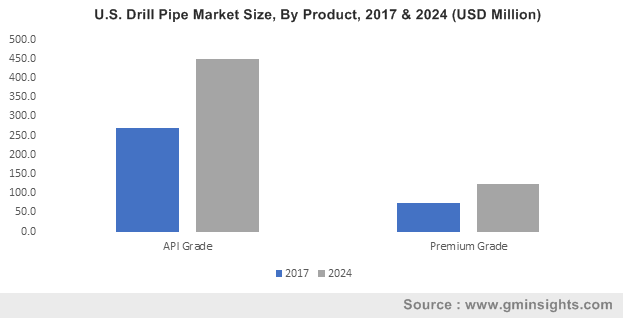

U.S. Drill Pipe market size, by grade, by revenue (USD Million), 2013-2025

- The Middle East is the biggest premium oil and gas market across the globe with 48% of world oil reserves and 43% of world gas reserves. Effective participation from Oman drill pipe market, is set to showcase significant growth prospects, backed by several large-scale contracts. Oman signed an agreement with Medco Energi of Indonesia of USD 660 million to develop 18 marginal fields in the southern Oman. Furthermore, escalating demand for oil and gas across the globe will fuel the Saudi Arabia drill pipe market share set to witness a growth rate of 3% from 2016-2025. Abu Dhabi is likely to increase its rig count over 100 to achieve the production rate of 3.5 million barrels per day.

- Africa drill pipe market worth USD 195 million in 2015, is set to grow at a CAGR of 3.5% in the coming eight years. The region’s growth is backed by several commercial handshakes with respect to drilling of oil fields. In response to this fact, Indonesia’s Pertamina has received approval from the Algerian oil and gas regulator to develop oil & gas wells in the North African countries which will be thriving the regional landscape.

- Rigorous investments in contracts and bidding for tenders is likely to generate lucrative growth for the Angola drill pipe industry. TOTAL is investing USD 16 billion to develop the ultra-deep offshore Kaombo project in Angola. This project is situated about 260 kilometers off Luanda, at a depth of 1400-1900 meters, with an expected daily production of 230,000 barrels as from 2017.

- Canada drill pipe market worth USD 130 million in 2015 is poised to register a y-o-y growth of 2.1% from 2016-2025. Moreover, rising shale gas exploration activities and increasing number of rig counts by 32 units to 449 rigs will complement the U.S. drill pipe industry.

- Intensive investments by Russia in developed fields will generate rolling demand for drill pipes in this region. Russia market is expected to grow at an annual rate of 3% over the period of 2016-2025. DEA oil & gas firm is prepared to invest a capital of USD 1.26 billion in order to mature the Davlin natural gas field of Norway. China drill pipe market is another lucrative ground, which has accomplished more than 80 appraisal wells in 2013 by capitalizing more than USD 1 billion on shale gas revolution.

Key participants in the drill pipe industry include TMK Group, Drill Pipe International, Hilong Group of Companies, Texas Steel Conversion, Inc., Oil Country Tubular Limited, and others. The dramatic turmoil in crude oil prices has resulted in waning of exploration activities, which could challenge the market growth. Due to fluctuating cost trends in the oil & gas industry, the drill pipe market is likely to experience a slowdown in capital expenditure. Nevertheless, increasing energy demand from emerging economies such as Asia Pacific will present bounteous opportunities for the market growth.