Automotive industry to significantly impact electronic thermal materials market trends over 2019-2025

Publisher : Fractovia | Published Date : 2019-08-02Request Sample

Increased functionality along with reducing size of consumer electronics is anticipated to augment electronic thermal management materials market size over 2019-2025. The demand for electronic thermal management materials has been propelled by the harmful heat generated by electronic components and systems. Currently, creation of miniaturized components with high power output is a challenge for engineers.

U.S. electronic thermal management materials market size, by end-user, 2014 - 2025 (USD Million)

Electronic thermal management materials are widely used in the electrical assemblies for the purpose of heat dissipation. These materials help in controlling heat generation within the electronic assembly and also support proper conduction of heat. Thermal management needs are expanding in products like LEDs and batteries, where increased component complexity, intensity and density are causing producers to seek new designs and materials for better thermal insulation, conductivity and dissipation.

In electrical products heat is generated and it is important to conduct heat away from the vital components of the electrical product. In applications where direct forced air or liquid cooling are not possible, a TIM (Thermal Interface Material) is often used to transfer heat without altering the physical properties of the device or affecting product performance. The mounting demand for consumer electronic products and application of Thermal Interface Material, mainly witnessed in developing economies, are projected to augment electronic thermal management materials market outlook.

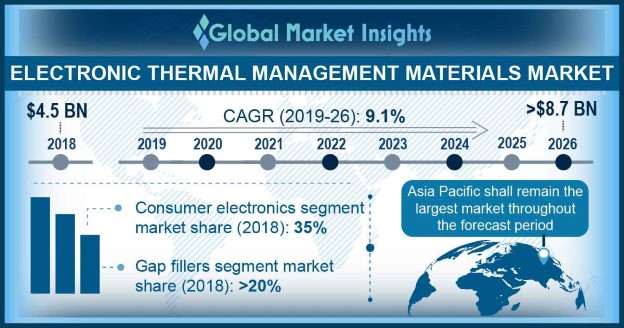

With growing population and mounting demand of electronic devices, Asia Pacific has emerged as a major contributor to global electronic thermal management materials market in 2018 and similar demand trends over 2019-2025 are anticipated to lead to a CAGR of 8% during the forecast timeline. The presence of major electronics manufacturing countries such as Taiwan, China, India and Japan among others, is estimated to positively influence the thermal management materials industry growth. Additionally, major manufacturing bases are shifting into the region will also propel the demand for electronic thermal management materials over 2019-2025.

Advances in electronics capability and the growing integration of technologies into modern vehicles have enhanced automotive innovation. The prioritization of superior performance, emission reduction, fuel efficiency, safety and high reliability has created a demand for high-functioning electronic automotive systems which subsequently in turn has augmented electronic thermal management materials market share.

Massive engine control capability, high-powered battery technology, densely occupied circuit boards and power steering modules demand durable thermal management for reliable functioning. Players in the automotive industry are trying to meet the challenging requirements for autonomous driving with safety-critical components, next-gen electric vehicles platforms and energy efficiency.

The U.S. is the biggest automotive market in the world, next to China. The U.S. automotive industry ended 2018 with sales of 17.3 million new vehicles and additional export of automotive parts valued at $88.5 billion. The industry has headed into 2019 with considerable investments, alliances and forays into electric vehicles and other newer technologies.

While Ford and Volkswagen are partnering to make pick-up trucks and commercial vans, General Motors and Honda are collaborating to manufacture autonomous vehicles and Toyota and Mazda are also entering a joint venture. All these industry leaders are bringing innovation to the automotive industry. With an open investment policy, a highly skilled workforce, a large consumer market, available infrastructure, and local/state government incentives, the United States is the foremost market for the 21st-century automotive industry.

Automotive industry trends in Europe and North America are therefore considerable contributors to electronic thermal management materials market growth. Large scale automotive & aerospace bases coupled with developed consumer electronics industry these regions are forecast to provide impetus to the electronic thermal management materials market share.

As the medical device and equipment industry continues to design faster, smaller, precise and reliable instruments, the need for thermal management materials increases. From huge equipment to small portable devices, all medical electronics require appropriate thermal management to meet the standards of the healthcare industry. The health and safety of patients and healthcare professionals rely on these devices. Thermal management materials used in healthcare industry include thermal fabrics (ceramic-filled polymer, fiberglass reinforced), elastomer pads, coated fabrics, silicone sponge materials, pressure-sensitive tapes, etc.

An instance that can underline the expansion of medical devices and equipment industry can be cited through the case in India where medical devices and equipment market is valued at $2.5 billion, which makes only 6% of India’s $40 billion healthcare industry. Also, it is growing at a faster annual rate in comparison with the healthcare industry growth rate, when seen in entirety. Rising number of hospitals along with growing requirement for healthcare facilities creates a large scope for medical equipment. The growing requirement of medical equipment is estimated to expand the electronic thermal management market over the forecast timespan.

Telecom, automotive and healthcare are the major end-user industries providing impetus to the growth of the electronic thermal management market. Global Market Insights, Inc., estimates electronic thermal management market size to surpass $3.1 billion by 2025.