A succinct overview of Europe oil filled distribution transformer market with a regional frame of reference, capacity expansion strategies to characterize industry growth over 2018-2024

Publisher : Fractovia | Published Date : 2018-05-22Request Sample

Over the recent years, Europe oil filled distribution transformer market share has been amplifying at a commendable pace owing to the expansion of cross-border distribution projects and massive investments directed toward modernizing the existing grid networks. The European Investment Bank has recently earmarked USD 5.1 billion for energy sector initiatives. The funds would be utilized to construct, expand, and revamp power generation projects across the nations such as France, Italy, Ireland, and Spain. Not to mention, Europe oil filled distribution transformer industry stands as one of the major recipients of these massive investments in the regional energy vertical. The overall industry share is forecast to surpass an annual installation of 200 thousand units by 2024.

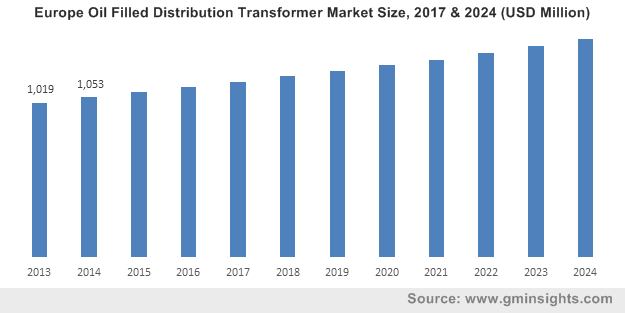

Europe Oil Filled Distribution Transformer Market Size, 2017 & 2024 (USD Million)

Regional outline of the Europe oil filled distribution transformer market:

Italy

Italy has laid favorable grounds for the expansion of effective energy networks which has, in turn, contributed toward Europe oil filled distribution transformer industry expansion. One of the most significant initiatives rolled out by Italian Government is the National Energy Strategy which aims to make the energy systems more secure, sustainable, and competitive. Instituted with core objectives such as strengthening supply security, narrowing the energy price gap, and ensuring a 28 percent share of renewables in total energy consumption by 2030, the program would undoubtedly propel Italy oil filled distribution transformer market in the times to come. The annual installation of oil filled distribution transformers across Italy is forecast to exceed 20,000 units by 2024, as per reliable estimates.

Germany

With the exponential rise in green energy projects in the nation and the synonymously increasing power generation demand, Germany holds a strong stance in terms of profitability matrix in the overall Europe oil filled distribution transformer market. The country has laid down ambitious energy transition goals in Energiewende, the revolutionary project which aims to transform Germany into an affordable energy supplier, environmentally sound, and a low carbon economy. Under the aegis of Energiewende, the nation has planned to incorporate renewable energy in half of all electricity grid network by the year 2030.

Capacity expansion bids to influence the Europe oil filled distribution transformer industry trends

ABB (ASEA Brown Boveri), the Swedish-Swiss electrical equipment manufacturer is the most typical example of the biggies undertaking facility expansion strategies to exercise their utmost potential in the Europe oil filled distribution transformer market. In the year 2016, the multinational giant announced to expand its production capacity and scope of its facility located at Lodz, Poland. The firm aims to leverage the skill and expertise of its employees and the existing infrastructure at the Lodz factory that currently manufactures oil filled distribution transformers rated from 30 to 2,300 kVA (kilovolt amperes).

Following the construction of factories to manufacture power electronics and electric motors, which are located close to Lodz, this is the third investment of ABB in Poland over the last few years. With such a strong pipeline with reference to infrastructural development and its latest facility expansion bid, the firm has indeed established a significant stance in the Europe oil filled distribution transformer market.

The aforementioned instance of ABB clearly depicts the fiercely competitive hierarchy of Europe oil filled distribution transformer industry space. For the record, some of the other prominent contenders in this business space are General Electric, Crompton Greaves, Schneider, Mitsubishi, Toshiba, Hyosung, Siemens, Eaton, Hyundai, SGB-SMIT, Imefy, Celme, Ruhstrat, and ABB. A vital trend to watch for remains how the competitive spectrum of Europe oil filled distribution transformer industry adapts to the new technological interventions and government schemes pertaining to the power distribution sector.

All in all, driven by an escalating demand for renewable energy-based grid infrastructure and environmentally sustainable T&D networks, the Europe oil filled distribution transformer market share is bound to proliferate at a remarkable pace in the years to come. In terms of commercialization, the Europe oil filled distribution transformer industry is estimated to surpass the billion-dollar benchmark by 2024, registering a valuation of USD 1.4 billion.