Europe warm edge spacer market to surpass USD 250 million by 2024, rising awareness regarding energy-efficient fenestration to drive the industry growth

Publisher : Fractovia | Published Date : 2017-04-28Request Sample

Europe warm edge spacer market is witnessing an appreciable level of commercialization in response to the region’s proactive approach toward the green movement. The residential and commercial infrastructures have a profound impact on the overall ecosystem with the building’s fenestration playing a key role in this regard. This fact has led the government and other regulatory bodies to deploy energy efficient fenestration techniques, in turn influencing the demand of warm edge spacers. The warm edge spacer technology has been in high demand over the recent years owing to its characteristics of lesser heat conduction than the traditional fenestration counterparts.

A recent study by the European Union depicts that around 40% of the total energy in Europe is consumed by the buildings. Windows play a pivotal role in this statistics on grounds of having a major influence on the energy loss through the building envelope. This has led to a paradigm shift in the designing and manufacturing of windows, where the new ones are focused on enhancing the thermal and energy performance of the buildings.

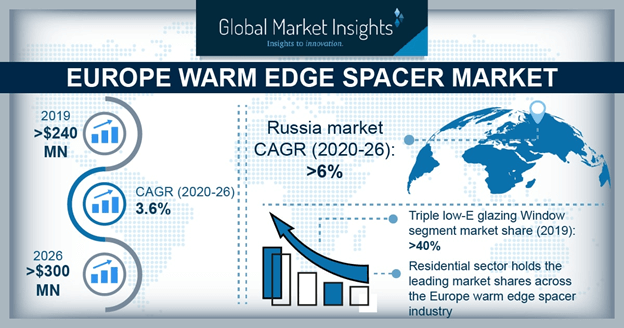

A report by Global Market Insights, Inc. estimates Europe Warm Edge Spacer market to account for a revenue of USD 250 million by 2024. Reportedly, the industry was worth USD 100 million in 2016 and is estimated to surpass 550 million meters by 2024, in terms of volume. High emphasis on energy conservation and the active participation of the regional regulatory bodies in this regard is a major factor influencing Europe warm edge spacer industry share.

Germany Warm Edge Spacer Market, By Product, 2016 (Million Meters)

The government backing for Europe warm edge spacer market is evident from the current Energy Performance of Buildings Directive under the EU legislation which emphasizes on the following norms to be followed by the member countries:

- All new buildings in the member countries must come under the category of zero energy buildings by 31 December 2020. The public buildings are given the deadline of 31 December 2018.

- Member countries must set energy performance requirements for the buildings in case they are newly constructed, renovated, or go through retrofit or replacements of existing building materials.

- All advertisements pertaining to the sale or rental of a building must include energy performance certificates.

These regulations have certainly impelled the window manufacturers to take a hard look at the traditional designing approach and are providing a substantial impetus to Europe warm edge spacer industry share.

The fast-paced industrialization is also leading to a significant expansion of Europe warm edge spacer market. On the one hand where the industrialization has resulted in a swift economic development, on the other hand, it has resulted in a noticeable increase in the GHG and CO2 emission rates. The demand for curbing these environmental hazards has generated a heavy momentum in Europe warm edge spacer industry. Expanding energy efficient windows industry is also creating a profitable roadmap for Europe warm edge spacer market and is providing ample opportunities to the manufacturers for developing windows with high thermal insulation, low conductivity, and enhanced energy performance.

Both the residential and commercial infrastructures are heftily contributing to Europe warm edge spacer industry share. Both the building structures are reported to be responsible for over 20% of the overall GHG emissions. Europe warm edge spacer market size in residential sector are forecast to register an annual growth rate of 12% over 2016-2024. Increasing focus toward curbing UV radiations, reducing environmental degradations, and enhancing temperature & energy performance are the key factors promoting the application demand. Commercial infrastructure will also be a major segment in the application landscape over the coming years with a target market size of 100 million meters by 2024.

In terms of products, stainless steel spacer is accumulating a noteworthy share of Europe warm edge spacer industry on account of its excellent UV protection capability. Other prominent warm edge spacer products include flexible spacers and metal/plastic hybrid spacers. Flexible spacer accounted for 25% of the overall Europe warm edge spacers industry share and is expected to leave a significant footprint on the product landscape in the years to come.

Glazing properties of the window also play a major role in deciding its insulation capabilities. In this regard, triple low-E and double glazing are the two chief window categories holding a prominence in the overall Europe warm edge spacer industry. The economic feasibility, high thermal insulation, and ease of installations are the prime drivers fueling the market size for double glazing Europe warm edge spacer market which is estimated to record a CAGR of 14% over the timeframe of 2016-2024.

The other category that is the triple low-E glazing window also gained a significant share of Europe Warm edge spacer industry in the past few years. Reportedly the segment accounted for 35% of the overall revenue in 2016. The demand for these windows in Northern Europe was observed to be 20% higher than their demand in Western, Southern, and Central Europe. These windows certainly are marching toward a heavy deployment rate with UK strategies of constructing zero carbon building by installing the triple low-E glazing windows.

With reference to the regional landscape, all the member countries are actively partaking in Europe warm edge space industry share battle. The stringent norms by the government and regulatory bodies coupled with high demand for energy conservation are the factors driving the regional market dynamics. Germany will be a major region in Europe warm edge spacer market with a projected market size of 100 million meters by 2024. The march toward zero emission buildings and presence of leading distributors and manufacturers such as Technoform Glass Insulation Holding GmbH, etc.

Italy and Russia accounted for 6% and 15% of Europe warm edge spacer industry share respectively. UK in terms of volume is forecast to grow at a CAGR of 12% over the coming seven years, driven by its active participation in construction of green buildings. Poland having had a market size of 20 million meters in 2016, is estimated to witness a profitable growth chart over the coming timeframe. The Polish government has taken proactive measures to keep a check on the thermal transmittance of the building envelope. A thermo-modernization plan for refabricating the roofs, windows, and walls insulation has been launched in this regard by the country.

The aforementioned developments in Europe warm edge spacer market are undoubted to offer a wide spectrum of opportunities to the industry players including Alupro, Hygrade, Swisspacer, etc. The industry participants are investing heavily to expand their product portfolios from the technology perspective.

The government is also emphasizing on installing smart and sustainable products in the buildings to achieve zero energy buildings target. These stringent energy demands of the future are certain to draw an upward trajectory curve for Europe warm edge spacer market in the years ahead.