U.S. feed mycotoxin binders market to observe an appreciable momentum over 2017-2024, heavy expansion of the animal feed additive sector to expedite the global industry growth

Publisher : Fractovia | Published Date : 2018-01-04Request Sample

The competitive landscape of feed mycotoxin binders market has been famed to be rather consolidated, encompassing reputed names such as Alltech, Biomin, VisscherHolland, Selko, Bentoli, and Kemin. The consolidation, in recent years, has been further strengthened by means of companies feverishly focusing on distribution network expansion and engaged in enhancing their production capacities. Pivotal firms have also been involved in strategic M&As and novel product launches, for instance, Nutriad, one of the most prominent players in feed mycotoxin binders market, in 2016, launched MYCOMAN®, a web application that has been designed to complement the information obtained from mycotoxin analyses. Apparently, MYCOMAN is a management tool that would ensure total mycotoxin hazard assessment and manage every little detail essential for a product application depending on the mycotoxin contamination levels, effectively helping animal feed manufacturers to conveniently manage mycotoxins in animal feed.

U.S. Feed Mycotoxin Binders Market Size, By Livestock, 2016 & 2024 (USD Million)

The ongoing expansion in global animal feed additives market is undoubtedly one of the major driving forces of feed mycotoxin binders industry size, given the capability of these binders to coagulate and affix secondary metabolites in order to reduce their toxic impact on feed ingredients. As per estimates, animal feed additives market size will surpass the 25-billion-dollar frontier by 2024, thus opening up a plethora of opportunities for feed mycotoxin binders industry players. With improved standards in consumer lifestyles, dietary preferences and health awareness have observed a marked rise, leading to a paradigm shift toward protein-based diets. In consequence, this has led to an escalating demand for additive-based animal feed for nutrition, to obtain non-contaminated, healthy food of animal origin, thus propelling feed mycotoxin binders market share.

U.S. to be one of most lucrative growth grounds for feed mycotoxin binders industry expansion

The United States currently stands as one of paramount meat consumers, as is amply evidenced from reliable statistics, which indeed, as per experts, has evolved to be a vital driving force for the nation’s feed mycotoxin binders market. A survey undertaken recently claims that more than 95% of the population in the U.S. consumes meat – an astounding figure that sets the ground for the country being one of the most humongous poultry, ruminant, and livestock meat consumer across the globe. Some of the statistics that testify the prediction of U.S. likely to emerge as the most profitable growth ground for feed mycotoxin binders industry are enlisted below:

- The average American devours close to 193 pounds of meat (chicken/beef/pork) on an annual basis.

- In 2015, the per capita meat consumption in the U.S. rose by 5%, which is apparently the fastest growth rate witnessed in 40 years.

- By 2018 apparently, meat consumption may be recorded at a massive 200 pounds a year per capita.

These figures validate that the U.S. has remained a consistent hub for animal nutrition, to procure healthy meat, which has undeniably stimulated feed mycotoxin binders market trends.

It is prudent to mention that the U.S. government has a pivotal role to play in the growth of the regional feed mycotoxin binders industry. Regulatory bodies such as the FSA, FDA, and NSF have introduced stringent health and safety policies in order to standardize meat products and increase consumer awareness regarding the hazards of consuming meat obtained from animals fortified with toxic feed. The Federal Meat Inspection Act (FMIA) for instance, introduced in 1906, enlists a series of policies related to meat inspection, examination of animals prior to slaughtering, humane slaughtering methods, examination of carcasses, etc., that has proved to aid the expansion of the country’s feed mycotoxin binders market. The law also vividly claims that it is misbrand meat products being sold as food, while ensuring that meat is processed in a sanitized environment. With a strict regulatory frame of reference in place and increasing consumer consciousness regarding meat products, U.S. feed mycotoxin binders industry size has been forecast to cross USD 40 million by 2024.

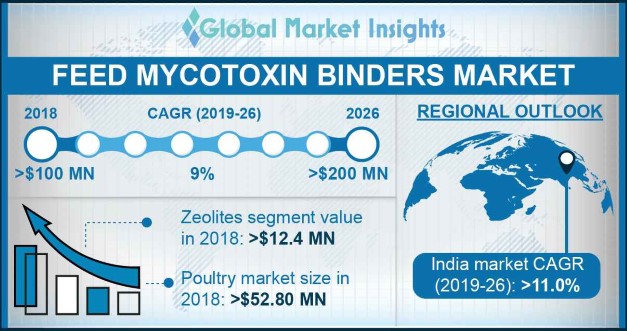

It is imperative to note that numerous initiatives have been undertaken with respect to enhancing feed for animal nutrition, by regional government bodies and private enterprises, which are undeniably slated to strengthen the profitability landscape of feed mycotoxin binders market. In a very recent survey for instance, an inference was drawn regarding the threatening effects of mycotoxins on animal health. The Alltech 37+ mycotoxin analytical services laboratory analyzed 40 individual mycotoxins, inclusive of five new mycotoxins in the European representative samples of maize silage, barley, wheat, grass silage, and maize, and concluded that fluctuating climatic conditions may have a profound effect on mold growth and plant health. Now that the significance of mycotoxin analysis has been confirmed, Alltech has introduced newer methods for toxin testing in animal feed, which are certain to help farmers diagnose the presence of these harmful toxic strains and deploy binders to lower their noxious effect. Eventually, these testing methodologies are certain to impel the revenue graph of feed mycotoxin binders market, given the pivotal role these binders play in eliminating the toxic effect of secondary metabolites. As per estimates compiled by Global Market Insights, Inc., feed mycotoxin binders market size is certain to cross USD 250 million by 2024.