F&B & Healthcare Sectors to Drive Flexible Packaging Market Growth Over 2016-2024

Publisher : Fractovia | Published Date : 2017-04-19Request Sample

Flexible Packaging Market is rapidly gaining momentum in the packaging industry validated from the market share records it made over the recent years. Flexible packaging held a 20% share of the overall packaging industry in 2015 which was then worth USD 400 billion. The growth trend is likely to continue in the years ahead with flexible packaging market size slated to surpass USD 250 billion by 2024, says Global Market Insights, Inc. The concept of flexible packaging is becoming prominent with the parallelly rising need of the manufacturers for a cost-effective, convenient, and less wastage involving packing techniques.

U.S. Flexible Packaging Market size, by application, 2013-2024 (USD Billion)

Asia Pacific has become one of the major grounds enhancing the flexible packaging market outlook. The expanding pharmaceutical and food & beverage industries base across APAC is the prime factor fueling the regional flexible packaging demand. In addition to this, the expanding e-commerce industry will also be a pivotal factor driving the market expansion. The rising demand for convenient packaging in terms of cost, storage, transport, and customer viewpoint by the e-commerce industry is providing a significant push to the flexible packaging market growth in APAC. As per the estimates, Asia Pacific Flexible Packaging industry is estimated to register a CAGR of 6% over the period of 2016-2024, having had a worth of USD 35 billion in 2015. India and China on account of the fast-paced economic developments in these regions are estimated to be the major revenue pockets for APAC. The aforementioned fact is quite evident by the plastic consumption statistics of both these countries. India is estimated to consume 40% of the regional plastic produced for packing purposes. Also, Alibaba, a Chinese e-commerce giant, made a record of shipping 12 million parcels per day in 2015, reflecting its massive influence on the flexible packaging industry.

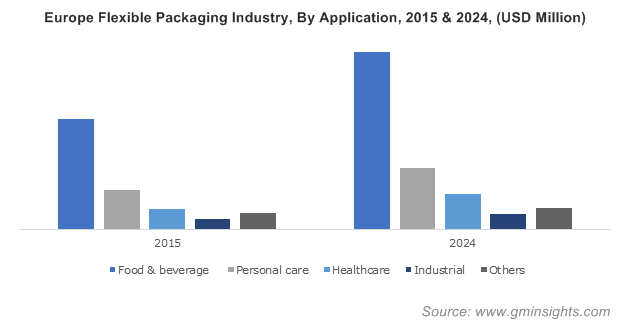

Food & Beverage sector is a prominent end-user of the flexible packaging industry. In 2015, F&B contributed to more than half of the global share. The growing consumer inclination towards hygiene and food safety along with the increasing spending capacity is promoting the flexible packaging demand in this industry. Moreover, the upswing in the demand for packaged and processed food with minimal contamination risks and longer shelf life is further providing a major push to the flexible packaging market share in the F&B industry. Pillow and Stand-up pouches are the major flexible packaging products used in the food & beverage industry, driven by their cost-effectiveness and longer shelf-life.

The pace at which the flexible packaging market is expanding in the healthcare space is indeed appreciable. It is estimated that healthcare industry will witness the highest gains over the coming seven years, with a CAGR projection of 5% over 2016-2024. Demand for sustainable packaging for the medical products will boost the application demand. Paper flexible packaging is the most commonly used packing material in the medical and pharmaceutical space in response to the minimal chances of contamination and infections through paper packings. Paper flexible packaging market was worth USD 15 billion in 2015 and is anticipated to register substantial growth in the coming years.

Polymers were the most popular material used in flexible packaging industry having had an overall share of 70% in 2015. Its cost-effectiveness and longevity are likely to maintain its growth trajectory in the coming years. However, a paradigm shift toward eco-friendly resources may offer the growth opportunities to biodegradable flexible packaging materials such as bioplastics and cellulosic.

When it comes to technological advancements, U.S. is by far the most active region leading the race. In this regard, the technological developments pertaining to the barrier materials is worth noticing. U.S. flexible packaging market held a revenue of USD 15 billion in 2015 and is forecast to display a strong growth trajectory over the coming years. The expanding food industry particularly the dairy product segment is another vital factor fueling flexible packaging market growth in the U.S.

Europe and Latin America flexible packaging industries are projected to record CAGR of 3.5% and 5% respectively over 2016-2024. The demand from cosmetics and F&B sectors and the expanding e-commerce industry are the respective driving factors for the Europe and LATAM business growth. Brazil & Argentina will substantially contribute to the Latin America flexible packaging market share.

Despite the threats to the industry growth by the strict government norms on polymer usage, flexible packaging market is set to attain remarkable value over the coming years. The industry holds the 2nd position in the overall packaging sector and is likely to display an appreciable demand with the wide array of applications across end-use sectors such as F&B, cosmetics, healthcare, etc. Key participants include Amcor Limited, Bemis Company, Sonoco Products Company, Constantia Flexibles Group, and Huhtamaki Group.