How will electronics and food packaging sectors drive the growth prospects of fluorinated ethylene propylene market?

Publisher : Fractovia | Published Date : 2019-06-10Request Sample

The global fluorinated ethylene propylene market is gaining commendable traction owing to the unique properties possessed by the polymer, making it compatible for usage across numerous applications and end use industries. The polymer has increasingly found its usage in verticals such as photovoltaic (PV), wire and cable, automotive and aerospace sectors due to its special chemical and physical properties like corrosion resistance, high dielectric strength and flexibility.

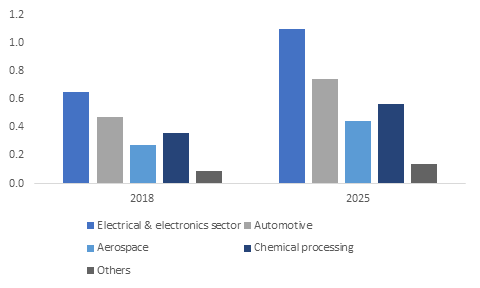

U.S. Granules Fluorinated Ethylene Propylene (FEP) Market Size, 2018 & 2025, (Kilo Tons)

The global consumption volume of fluoropolymers is growing tremendously which would, as per reliable estimates, result in fluorinated ethylene propylene market surpass a renumeration figure of USD 1.2 billion by the year 2025.

The worldwide growth of fluorinated ethylene propylene market can primarily be accredited to the food packaging sector. The high molecular weight of fluoropolymers prevents it from migrating into the food which makes it apt for food packaging. Some plastics get migrated to food while food processing but fluoropolymers, especially FEP, can endure high temperature which ranks it up among several packaging materials.

The United States Food and Drug Administration (USFDA) has also approved fluoropolymers to be used in food packaging provided they meet the extractable limits specified in the regulation. Various tests have also shown that FEP is apt for food packaging as it doesn’t adulterate food. These regulatory approvals encourage industry leaders to use the product more, fueling the revenue share of fluorinated ethylene propylene market.

Likewise, the European Food Safety Agency (EFSA) has also permitted use of fluorinated ethylene propylene in food packaging as it is anti-adhesive and chemically inert. The regulation has set a specific migration limit (SML), which is the maximum permitted amount of substance in food that has been determined not to pose a risk to human health. It is also attracting packaging industries due to its printability, non-stick wear resistance and transparency which can add profits to packaging industry as well. The EFSA regulatory approvals in favor of the polymers are likely to increase industrial landscape of fluorinated ethylene propylene.

The increasing usage of FEP in electrical and electronics sector

Besides its enormous applications in food processing, fluorinated ethylene propylene has huge demand in electric and electronics. From sensors to antenna, FEP has helped electrical and electronics sector to demonstrate next level advancements. There are several companies helping the market with new innovations by using fluoropolymers.

For instance, global fluoropolymer manufacturer Arkema has joined the Ultimaker Material Alliance Program, introducing a very high-performance polymer to the program. The new PVDF-based filament, named FluorX™, is specifically designed for printing highly technical 3D parts that require extreme performance. The company will make the FluorX™ filament print profile available to users of Ultimaker’s Cura, a free, print preparation software. Such innovations in the electrical and electronics sector will expand the revenue graph of fluorinated ethylene propylene industry.

Arkema being a global company has its footprints in North America, Europe and Asia Pacific. The company has 38 production sites in APAC with around 5000 employees contributing almost 10-31 percent of overall sales. There are many other fluoropolymer manufacturing companies present in APAC region which are witnessing an increase in sales. These companies are also promoting use of fluorinated ethylene propylene dispersions to treat glass fibers fabric by dipping and roasting, continuity film of non-pinhole by molding, and corrosive and adhesive resistance coatings by spraying.

In APAC, China alone contributed more than USD 1.6 million in the year 2018 to fluorinated ethylene propylene dispersion market which also backed FEP industry and is predicted to consistently upsurge the market.

Apart from China, India is also investing into fluorinated ethylene propylene industry through its Digital India Campaign. The country has indicated to adopt FEP LAN cables which warrant a VoP of a whopping 90%, have a much higher lifespan and deliver higher transmission performance. The fire protection standard of the USA has acclaimed it as the most efficient material for insulation of LAN cables to be used for plenum spaces as per the 1987 National Electrical Code Hierarchy. India is moving forward to have greater connectivity and a higher emphasis on security under the government’s mission of making India a $3 trillion digital economy.

Among various applications of fluorinated ethylene propylene propelling the FEP market growth, the aerospace industry is one of the prominent verticals. FEP has compatible and useful properties which can be leveraged by the industry for usage in outer space. The polymer can withstand against harsh radiation levels to survive in space, unlike many other plastics.

In this context, it is worth mentioning that FEP was found to be suitable for manufacturing components in the Hubble Space Telescope (HST) and the International Space Station (ISS). Apparently, the extraordinary properties of FEP will assist manufacturers in reaching out to more business verticals, essentially benefiting the renumeration portfolio of fluorinated ethylene propylene industry.

Fluorinated ethylene propylene has helped various industries, including electrical, electronics, aerospace etc., to innovate and enhance technologies. The excellent physical and chemical properties of the polymer are the major factors in widening its scope across a number of business sectors. The increasing demand for advanced plastics with exceptional properties will support the revenue graph of fluorinated ethylene propylene industry in the times to come.