How will the rising product demand in water fluoridation applications benefit fluorosilicic acid market share?

Publisher : Fractovia | Published Date : 2019-06-10Request Sample

The global fluorosilicic acid market share is depicting immense traction majorly due to the increasing demand of clean drinking water and the rise in product application in corrosion inhibitor industry. Fluorosilicic acid has increasingly reinforced its presence in the water fluoridation process due to its ease of application over competing chemicals. The acid is also used in hardening of masonry and ceramics, agricultural products, pH adjustment in industrial laundries, wood preservative, lead refining and fluorosilicate salt manufacturing.

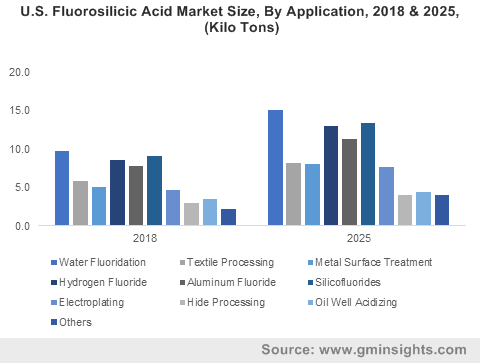

U.S. Fluorosilicic Acid Market Size, By Application, 2018 & 2025, (Kilo Tons)

Global economic development, government policy adjustment, related industrial dynamics, and competition among enterprises are also influencing the increase in fluorosilicic acid market share. According to a research report by Global Market Insights Inc., fluorosilicic acid market is expected to exceed revenue of USD 1 billion by the year 2025.

Generally, fluorosilicic acid is used for drinking water treatment as it helps to reduce tooth decay. U.S. cities and towns began regulating fluoride content in water about 70 years ago when research linked increased fluoride levels to improved dental health. Today, the number of communities and people who benefit from the use of fluorosilicic acid in water is continuing to grow. According to Centers for Disease Control and Prevention (CDC), this proficient public health intervention was introduced in the United States in 1945.

Later in the year 2014, 74.4 percent of the U.S. population on public water systems, or a total of 211,393,167 people, allegedly had access to fluoridated water. CDC has aimed to meet the Healthy People 2020 objective on community water fluoridation. The objective aims to provide water with the optimum level of fluoride recommended to 79.6 percent of population on public water systems preventing tooth decay. Apparently, it is anticipated that U.S. fluorosilicic acid market size may grow at a commendable pace in the upcoming years owing to its pervasive usage in water treatment plants.

In April of 2015, the U.S. Department of Health and Human Services updated its recommendation for the optimum fluoride level in drinking water to a single level of 0.7 milligrams per liter of water to avert tooth decay. Due to its property to reduce tooth decay, fluorosilicic acid is also used in toothpastes and mouthwash. There are several toothpaste manufacturing companies adding fluorosilicic acid to their toothpastes claiming to protect teeth from cavities. Over 95% of toothpastes now contain fluoride – a factor that has proliferated fluorosilicic acid market share.

In the U.S., the water departments are importing fluoride chemicals from China. It is becoming increasingly common to import fluoride compounds from Chinese countries for water fluoridation. The easy availability of raw materials for manufacturers to prepare the acid makes it cost-effective for both the countries. Along with the U.S., the revenue of China is also being supported by the export of this acid. In fact, China fluorosilicic acid market size is anticipated to register an annual growth rate of 6.5 percent over 2019-2025.

Besides water fluoridation, fluorosilicic acid also has its application as corrosion inhibitor. Mostly, water pipes are made up of metal and corrode due to certain properties of water. The use of fluorosilicates to fluoridate drinking water adds silica, a corrosion inhibitor, to the water and increases the silicates available for stabilizing the pipe surface, which contributes to reduced corrosion. Another reason to use fluorosilicic acid to reduce corrosion is that most of the corrosion inhibitors are less soluble in water with fluoride. The acid is also used to remove rust and clean automobile wheels to increase durability of automobile. According to estimates, corrosion inhibitors market size is set to surpass USD 8 billion by the year 2023 which will, in turn, help increase fluorosilicic acid industry share.

Fluorosilicic acid, also popular as hydrofluorosilicic acid, is also used in lead refining by electrolysis. A typical electrolyte contains 95 g/L free fluorosilicic acid. In the electrolytic refining of lead, the electrolyte contains 33% of the acid. The chemical process forms fluosilicic acid which is one of the most soluble salts reducing the danger of crystallization at any degree of concentration. The use of hydrofluorosilicic acid is widespread for lead refining and is likely to contribute toward the growth of fluorosilicic acid industry.

Apart from the aforementioned applications, there still exists a vast range of application of fluorosilicic acid. The acid is used in glass etching to make decorative pieces. It is also used in wood preservation, electroplating, tanning, sterilization of equipment, oil acidizing, cement hardening, fluorosilicate salt manufacturing, as anti-scaling agent etc. Driven by a massive application terrain, fluorosilicic acid industry size is likely to proliferate in the forthcoming years.