Combined cycle gas turbine market to witness remarkable proceeds over 2018-2024, power plants applications to majorly drive the industry growth

Publisher : Fractovia | Published Date : 2018-06-08Request Sample

Worldwide gas turbine market has witnessed quite a prominence in the energy ecosphere, primarily powered by the increasing focus of regulatory bodies and consumers towards energy optimization. Compelling the need for gas powered electricity generation is the availability of low-cost natural gas, rising awareness about sustainable energy adoption, and the mounting environmental regulations. Add to it, the continuous developments in industrial infrastructure demanding more power will further add a renewed dynamism to the gas turbine industry outlook.

Europe Gas Turbine Market Size, By Application, 2017 & 2024 (USD Million)

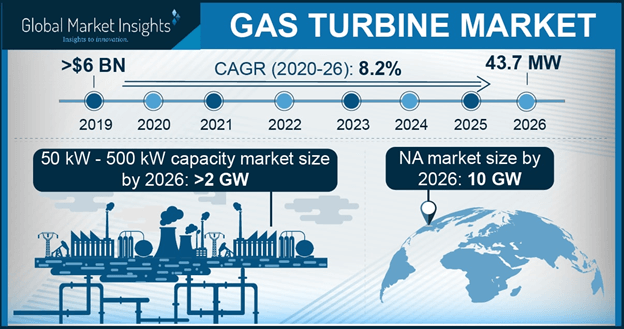

In the year 2017, the global gas turbine market size stood at $8 billion, with the power sector having stood as one of the most lucrative application arenas. Factoring the rising level of emissions and fuel prices, natural gas based distributed power generation is being preferred across process plants, aviation, oil & gas and other heavy industries. In the U.S. alone the natural gas-powered electricity generation contributed to more than 25% of overall power in 2015 and is further expected to cross 30% by 2025, according to EIA. The figure further validates the strong stance the U.S. holds in the global gas turbine market. As per estimates, the U.S. gas turbine market size in terms of annual installations will reach 5 GW by 2024.

Globally, there is an ongoing growth of the small and medium industrial sectors with constantly evolving energy needs. This has spurred the requirement of low capacity gas turbines, which are affordable and easily transported. The gas turbine market for less than 50 kW is slated to surpass 1 GW in annual installations by 2024. >200 kW capacity gas turbine segment will also show tremendous growth in the coming years owing to use in large manufacturing industries such as O&G that need power for various operations onshore and offshore.

In terms of products, aero derivative gas turbine market is slated to witness rapid growth in the coming timeframe, with an anticipated CAGR of 2% over 2018-2024. These turbines are operationally versatile and widely adopted for supplementing propulsion, small scale generation and mobile power requirements. Heavy-duty gas turbines, driven by their higher generation capacities and economic cost structure has also had a substantial influence in large scale industrial settings. These turbines are projected to witness robust demand in the coming years due to their preference in utility aided generation and heat recovery plants. The advancements in technology will further strengthen the penetration of these products in their respective areas of utilization.

Speaking of the technology advancements, the combined cycle gas turbine market accounts for a prominent chunk of the industry share. They need less input for power generation and minimize the energy losses due to dissipation. According to GE, a combined cycle power plant produces up to 50 percent more electricity than a simple cycle power plant with the same amount of gas, as the waste heat from the gas turbine is directed to an attached steam turbine to generate additional power. Driven by the associated benefits of energy optimization, combined cycle gas turbine market has stood as the prime investment focus for the industry players.

To emphasize the above fact, Scottish energy company SSE plc in collaboration with Siemens recently announced its million-dollar investments in a combined cycle power plant. Allegedly, the anticipated CCGT plant in the UK is claimed to be the world’s most efficient combined cycle power plant. Reportedly, the new power station will be built in Keadby 2 in Lincolnshire.

Elaborating further on the deal, SSE will invest £350 million in the power plant construction with an estimated capacity of 840 MW and 63% efficiency. Siemens is scheduled to provide a complete turnkey solution for the plant, including the deployment of the 50 Hz version of SGT – 9000HL gas turbine. Reportedly, the deal is marked as a first long-term HL gas turbine program in Europe. The project also includes the deployment of advanced digital solutions like remote monitoring which will help enhance the reliability, availability, and performance of the new power plant. Not to mention, the deal not only underlines the growth prospects for the Europe gas turbine market but also vividly highlights the technological interventions in pipeline for the product landscape of this fraternity.

All in all, with the world treading along the path of optimal energy utilization and environmental sustainability, gas turbine market stands to witness major proceeds from a slew of industry verticals. Global expansion approach and product innovations through massive R&D investments remain the top-notch strategies forming the competitive landscape of gas turbine industry. For the record, some of the renowned gas turbine market share contenders are General Electric, Siemens, Solar Turbines, Kawasaki Heavy Industries, Capstone Turbines, Hitachi Power systems, and BHEL.