MEA GRP (Glass Reinforced Plastic) Piping market to witness the fastest growth over 2018-2024, oil & gas sector to witness massive product demand

Publisher : Fractovia | Published Date : 2018-07-24Request Sample

Glass Reinforced Plastic GRP piping market has generated a substantial momentum in the polymer space over the recent years, with the product being widely recognized as a preferred substitute for metal piping segment. This can be mainly attributed to the non-corrosive nature and extended performance life of GRP pipes. Known to be five times lighter than ductile pipes and four times lighter than steel pipes, the GRP alternatives exhibit better impact bearing strength, resistance to chemicals and excellent resistance against wear and tear. Apportioning over USD 5.8 billion in 2017, the glass reinforced plastic piping market is believed to be a key future component in the development of enhanced water conveyance in cities, sewage systems in emerging economies and the evolution of renewable, smart energy grids across the globe. As an outcome of the mounting pressure on governments to cater to an exponentially growing population, the massive urbanization schemes spread over wide areas will surely warrant the need for extensive pipeline networks, favoring the GRP piping market.

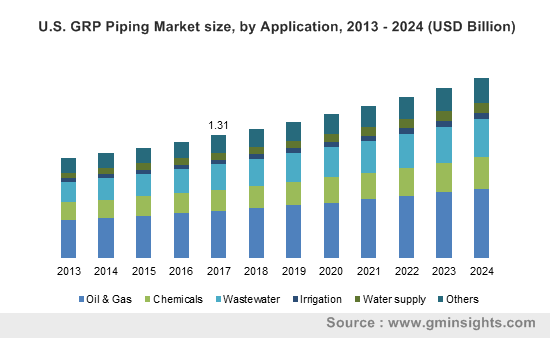

U.S. GRP Piping Market size, by Application, 2013 - 2024 (USD Billion)

Combining population explosion with rapid industrial development, there will be a great demand for cost-efficient piping to supply energy and utilities intended for large scale consumption. Amongst all the industry verticals, the oil and gas segment in 2017 grabbed the majority share of 30% in the GRP piping market worldwide, with applications in oil exploration, refineries, crude oil transfer and sub-sea piping. The non-reactive nature of GRP makes it ideal for transmitting crude or processed oil, natural gas and other byproducts associated with the segment. The continuous exertions by oil corporations to expand their capacities, especially in the Middle-East and Africa region, has permitted the glass reinforced plastic piping industry to invade the infrastructure landscape of leading nations in the region.

Elaborating on the penetration of GRP piping in the Middle-East & Africa, not only the oil & gas sector but irrigation projects also accrue a significant advantage by installing GRP pipes. The Ayd?n Koçarl? – Ba?aras? Irrigation Project in Turkey is a prime example of incorporating GRP in water supply networks. The venture is aimed at irrigating over 13,000 ha land through a 31.5 km pipeline from the Çine Dam, and in 2017 had completed successful field tests. The project consisted of pipes supplied by Superlit, that have superior hydraulic properties and are abrasion-resistant besides being compatible with other materials as well. These GRP pipes can be used at high or low temperatures and enable quick installation even in challenging terrains. Adoption of advanced GRP pipes in this determined undertaking to supply necessary water to remote areas, indicates the assertive outlook and awareness of nations in respect of the glass reinforced plastic piping market.

A distinguished step towards the progress of GRP pipes was the commissioning of a factory in the Dubai Industrial city for the manufacturing of fiberglass pipes and fittings, that are to be used in oil & gas, water and other industrial segments. The 176,720 m2 factory was to be built at a cost of USD 45 million by the Gulf Eternit Industries, a Future Pipe Group member, with a capacity to produce up to 600 km of pipes annually. The endeavor denotes an important milestone for the GRP piping market as UAE and other nearby countries could present a vital source of revenue, owing to the fast paced growth of the region and a commitment to devote resources for extending energy supply grids. Add to it, the vast number of water desalination plants constructed to meet the region’s water demand prove to be crucial in the escalation of the Middle-East and Africa GRP piping market, which is predicted to display the fastest growth rate between 2018 and 2024.

With the world treading towards more sustainable manufacturing practices, companies are working with research firms and organizations for eco-friendly materials to make plastic. As such, the glass reinforced plastic piping industry is also set to feel the impact of this change with accomplishments being made in innovating bio-based GRP. Finnish based Arctic Biomaterial’s award winning glass reinforced PLA is one such innovation which allows bio-based plastic to be applicable in situations where high durability is required and also is able to decompose at the end of its life. Similar technologies are being pursued worldwide and can reinvigorate the GRP piping market.

Overall, the low cost of GRP piping in comparison with other non-corrosive solutions like rubber lining, titanium and stainless steel materials has placed the segment in an extremely profitable position. The eminent names in the industry include Saudi Arabian Amiantit Company (SAAC), HOBAS, Future Pipe Industries, Superlit, Fibrex and Smithline Reinforced Composites. Derived from the advanced properties of GRP, the need for efficient water supply and easy energy transition, the GRP (glass reinforced plastic) piping market is estimated to record a 5% CAGR over 2018-204.