Gourmet salt market to revolutionize the traditional salt business space, Europe to drive the regional landscape

Publisher : Fractovia | Published Date : 2017-09-19Request Sample

Gourmet salt market has undoubtedly embarked on a profitable path over the recent past years, with restaurateurs and chefs seeking to unveil its culinary potential. There has been a paradigm shift in the business model of the hospitality sector, where consumers are not only interested in the taste factor, but also are equally concerned regarding the heath quotient of the ingredients. The gaining popularity of gourmet salt industry can be majorly grounded to this fundamental aspect. Gourmet salt are hand harvested, pertaining to which it contains less sodium and high mineral content. Undeniably, this unique blend of health and savour quotient adds an extra mark to their market value. As long as competitive landscape is concerned, investors are highly eager to capitalize the lucrative opportunities that gourmet salt market is likely to offer in the coming years.

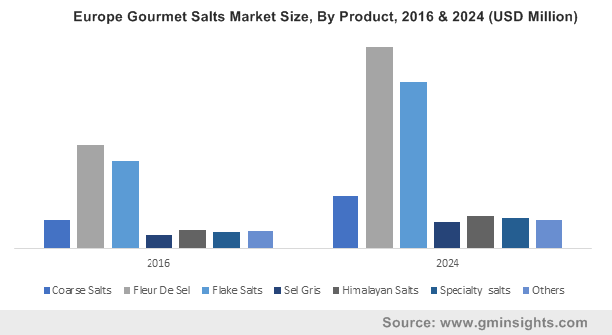

Europe Gourmet Salts Market Size, By Product, 2016 & 2024 (USD Million)

Another disruptive trend that is impacting Gourmet salt industry dynamics to a large extent is the global trend of reducing sodium intake in food items prevalent over the recent years. Large number of initiatives have been undertaken worldwide to spread awareness regarding the health risks associated with high sodium consumption. In 2016, FDA has released a guidance for food manufacturers and restaurateurs to optimize salt utilization in food items. Concurrently, WHO has also taken a mission of limiting salt intake by 30% within 2025. These aforesaid statistics and data draw quite an evidence of the growth potential of gourmet salt industry in the ensuing years.

Global gourmet salt market enrolled its name into billion-dollar business fraternity in 2016, which itself is a testimony of the humongous contribution it has made in the food and beverage industry. In this regard, it is important to note that food and beverage has undergone a huge transition over the past decade, with regards to consumers’ food choices, escalating food commodity price trends, and above all the increased competition in the business space. However, all these changing trends have observed to act in favour of Gourmet salt market penetration. For instance, the upsurge of westernized food culture along with growing indulgence of the consumers toward exotic food items have substantially upscaled artisanal cuisines demand, which by extension has impelled gourmet salt industry share.

Encompassing a diversified product landscape including Sel gris, Himalayan salts, flake salts, fleur De Sel, and Specialty Gourmet salts, Gourmet salt market in terms of volume is expected to exceed USD 120 kilotons by 2024. Out of all these, fleur De Sel marks its presence in the industry as the most highly priced salts harvested across the Brittany coast of France. As per estimates, fleur de Sel procured a sizable portion of the overall Gourmet salt industry in 2016, having accounted for 35% of the global revenue. Subject to its varied application scope as a garnish in salads, fresh vegetables, grilled meats, fleur de Sel is slated to experience a global upswing in the years ahead.

Considering the regional aspect, Europe stands out as a forerunner in the global business space. With Germany and U.K. at the growth front, Europe gourmet salt market represented 35% of the global share in 2016. Escalating demand for nutritional food products along with growing geriatric population are the major two factors enhancing the regional market demand. Another profound belt actively partaking in Gourmet salt industry is Asia Pacific. APAC market has been remarkably swayed by the processed meat application. In fact, estimates depict that in the year 2015, Asia accounted for almost 65% of the global meat demand. Upsurge in meat consumption especially in China has substantially driven APAC gourmet salt market, with China alone accounting for USD 50 million in 2016. Speaking along the similar lines, overall meat and poultry processing application is estimated to surpass USD 500 million by 2024.

In comparison with conventional table salts, Gourmet salt are more expensive. This can be grounded on the fact that these salts are hand harvested from exotic sources. While this exactly cannot be considered a road block, it is certainly one of the major factors hampering gourmet salt market penetration. However, leading companies like Cargill, San Francisco Saltsworks, Amagansett, Maldon Crystal, Alaska, and Infosa are taking continuous effort to increase the production so that high price trends can be somewhat addressed. Though still at its infancy, the growth curve of Gourmet salt industry is forecast to experience an upswing in the coming years, with a target valuation of over USD 1.5 billion by 2024, claim estimates.