High Barrier Pouches Market to accrue lucrative proceeds via food & beverage applications over 2017-2024, Europe to emerge as a major growth avenue

Publisher : Fractovia | Published Date : 2017-11-01Request Sample

The escalating consumer inclination toward flexible packaging as opposed to rigid packaging is one of the key drivers of high barrier pouches market. Of late, there has been a rising preference for packaged fresh, processed, and frozen food items, subject to increasingly hectic consumer lifestyles, which has led to stand-up and vacuum pouches garnering mass popularity. With packaging claimed to be the 5th “P” of the marketing mix, it is expected that the demand for the high-barrier pouches across various sectors such as food & beverages, pharmaceuticals, and home & personal care sectors will gain momentum in the years ahead. The growing requirement to improve the shelf life of items across retail stores coupled with the demand for lightweight packaging has prompted the players across the packaging business to introduce innovative products, thereby augmenting high barrier pouches industry trends.

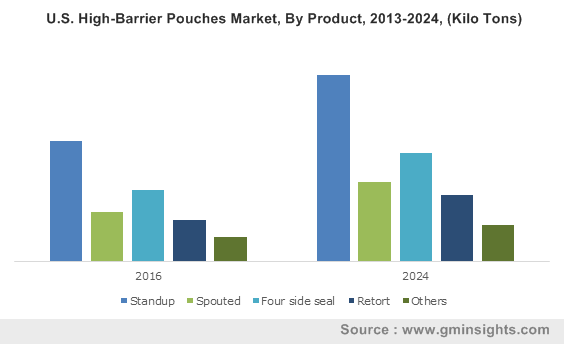

U.S. High-Barrier Pouches Market, By Product, 2013-2024, (Kilo Tons)

Myriad innovations, it is observed, remain the go-to strategy for firms partaking in high barrier pouches market share. In the third quarter of 2017 for instance, Toray Plastics launched two of its ultra-high barrier PET films, which are expected to provide enhanced shelf life and outstanding barrier performance across the eCommerce sector. In yet another development witnessed across high barrier pouches market, Sonoco Products Company has expanded its ClearGuard packaging portfolio with the inclusion of liquid pouches that have the ability to endure hot fill & retort cooking procedures.

High barrier pouches market demand may face slight constraints with regards to environmentalists’ concerns that the decomposition of plastic polymer materials used in packaging can cause ecological deterioration. This has led to the total ban on the use of plastic materials in countries such as France and other regions are likely to follow suit, which can adversely impact the revenue graph of high barrier pouches market. Nonetheless, firms have been observed to undertake stringent efforts to overcome these challenges by developing recyclable and biodegradable plastics.

The modern-day consumer is undeniably more health conscious than the yesteryear counterpart and prefers consuming fruit juices as a part of his daily diet, as per surveys. This is certain to stimulate the demand for pouch packaging, inherently impelling the high barrier pouches market share. Furthermore, the positive outlook toward the intake of energy drinks, wine, and dairy products has resulted in heavy product penetration across the beverages sector, which would undeniably augment high barrier pouches industry size from the beverages sector, slated to grow at a rate of 5.5% over the next seven years. Changing food patterns and wide intake of snacks & fast food is anticipated to create a greater demand for high barrier pouches across the food industry, which is projected to expand at a rate of 5% over 2017 to 2024.

Geographically, Europe high barrier pouches industry was a major contributor towards overall industry share in 2016 and is slated to generate a revenue of USD 1 billion by 2024. The high popularity of pouch packaging for storing baby food, pet food, and detergents over conventional modes of storage such as metal cans & bottles will expand the scope of high barrier pouches market in Europe. Furthermore, the region has been witnessing consumers leading fast-paced, hectic lifestyles, thereby increasing the product demand, which would further contribute toward the expansion of Europe high barrier pouches industry share.

With tremendous rise in the population and escalating demand for flexible packaging across the food sector, Asia Pacific high barrier pouches market is projected to experience a notable expansion over the years to come. The region had contributed more than USD 450 million toward high barrier pouches industry revenue in 2016.

High barrier pouches industry share is largely fragmented, with the presence of companies along the likes of The Vacuum Pouch Company Limited, Bischof + Klein SE & Co. KG, Ampac Holdings LLC, Elliot Packaging Limited, and Hood Packaging Corporation. These firms have made immense contributions towards the business landscape through automation of packaging processes, portfolio expansion, supply deals, and collaborations. Research studies affirm the vast expanse of high barrier pouches market, claiming this business space to accrue a valuation of USD 2.5 billion by 2024.