Asia Pacific highly reactive polyisobutylene (HR-PIB) market to drive the regional landscape, initiatives undertaken by industry behemoths to augment business expansion over 2017-2024

Publisher : Fractovia | Published Date : 2017-12-06Request Sample

The surging demand for HR-PIB across a wide range of applications is considerably driving highly reactive polyisobutylene (HR-PIB) market. HR-PIB is significantly used in metalworking, sealant, cosmetics, mining, grease and lubricant manufacturing, pertaining to its notable properties such as high tack in adhesive generation, good oxidative and thermal stability, low air, gas, and moisture permeability, and chemical resistance. In addition, low and medium molecular weight highly reactive polyisobutylene are prominently deployed as viscosity modifiers, lubricating oils, and fuel modifiers. Owing to its non-skin irritant characteristic, HR-PIB is also used in various medical applications such as transdermal systems and surgical tape adhesives, thus offering a widespread scope of investments for HR-PIB market players. Pertaining to its massive application spectrum, highly reactive polyisobutylene industry size, in 2016, was worth USD 200 million.

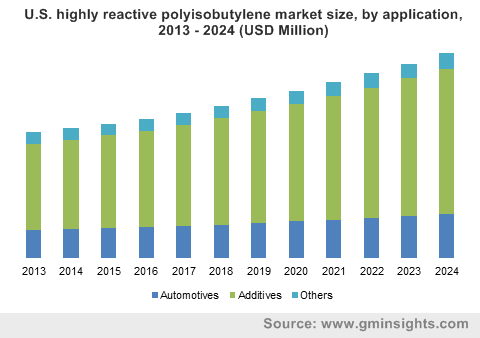

U.S. highly reactive polyisobutylene market size, by application, 2013 - 2024 (USD Million)

Taking into account the perpetually huge demand for HI-PIB, highly reactive polyisobutylene market giants have been investing heavily toward expanding the market scope. A brief outline of the impact of initiatives undertaken by HI-PIB producers on highly reactive polyisobutylene industry share is enlisted below:

BASF and Petronas

The well-known chemical manufacturing company, BASF, recently made it to the headlines for having teamed up with Petronas Chemicals to construct an HR-PIB production plant in Malaysia. This plant will apparently produce 50,000 tons of HR-PIB per annum, which can be supplied to manufacturers of lubricants and high-performance fuel additives. Moreover, in order to expand its business across the Asian zone, BASF is also looking forward to enhancing its product portfolio with the implementation of advanced technology at its plants, which may have a marginal but powerful impact on Asia Pacific HR-PIB industry share. As per statistics in fact, in 2016, Asia Pacific highly reactive polyisobutylene (HR-PIB) market size was worth USD 100 million, pertaining to the huge product demand across the ever-expanding automotive sector in APAC, mainly across China and India. Apart from this new production plant Singapore, BASF also has manufacturing plants in Germany, Belgium, and in China, in conjunction with Sinopec. BASF’s efforts toward the robust expansion of production facilities is likely to encourage other players to follow suit, thereby impelling highly reactive polyisobutylene (HR-PIB) market trends.

Texas Petrochemicals LP (TPC)

One of the leading providers of quality products catering to petrochemical-based and chemical companies, Texas Petrochemical had announced the expansion of its polyisobutylene production plant in Houston, back in 2005. Since 2000 apparently, TPC had made quite a name for itself in HR-PIB industry, having doubled its production capacity by 2005 through several expansion projects. Pertaining to its enhanced production capacity and the fact that TPC was the only merchant marketer of highly reactive PIB in North America back then, TPC’s clientele, primarily across the fuel additives and lube manufacturing sectors, had begun to traverse across a positive growth path, thereby impelling the regional HR-PIB market share. Speaking of which, owing to the exponentially growing medical packaging, construction, and automotive sectors, North America highly reactive polyisobutylene (HR-PIB) industry size is expected to register an annual growth rate of more than 4.5% over 2017-2024.

Lubrizol Corporation

A global leader in the specialty chemicals domain and one of the renowned players in highly reactive polyisobutylene market, Lubrizol Corporation recently announced its decision to expand its production capacity in order to fulfill customer demands and to carry out performance upgrades in fuels and lubricants. Lubrizol Corporation has also collaborated with Daelim Industrial Co., Ltd. to develop new polyisobutylene production facility at Deer Park, Texas. This new unit is likely to come into operation in 2019, the production volume of which would be significantly large. Through this enhanced production capacity, Lubrizol might soon emerge as a dominant player in highly reactive polyisobutylene market share by providing key raw material i.e. HR-PIB for next-generation lubricants and dispersant manufacturers. Encouraged by this turn of events, other giants in highly reactive polyisobutylene industry including TPC Group, Lanxess, RB Products, Inc., Kothari Petrochemicals, PETRONAS, Mayzo, and Janex are likely to upgrade their product manufacturing capabilities noticeably.

Considering how potentially advanced the specialty chemicals industry is, most of the participants in highly reactive polyisobutylene industry have been involving themselves in the marketing, manufacturing, upgrading, and sales of HI-PIB. For instance, PETRONAS Chemicals Group BHD is apparently planning to implement various development strategies in order to achieve operational excellence, innovative technology development, commercial excellence. Indeed, the surging adoption of growth tactics is certain to push highly reactive polyisobutylene market biggies ahead, thereby augmenting the revenue graph of HR-PIB industry. Furthermore, the growing number of construction activities across various regions of the globe is also expected to fuel the requirement of the product for roofing, fire protection, flooring, and insulation operations, which would undeniably have an appreciable impact on HR-PIB industry share.