Europe Hybrid Fabric Market to register substantial growth rate over 2019-2025, evolving automotive segment to drive the industry expansion

Publisher : Fractovia | Published Date : 2019-06-04Request Sample

A wide application scope and an increasing customer base has proliferated the global hybrid fabrics market, with augmented demand from the automotive, aerospace, energy, defense and sports industries. The superior properties of these materials, created by combining more than one kind of structural fiber, make them ideal to replace conventional materials like steel across various end-user segments. Carbon and glass fiber, for example, can be used to form a hybrid fabric suitable for different vehicle parts, airplane components and wind turbine blades owing to the resulting high tensile strength and stiffness, besides being lighter. Other fabric combinations like carbon & aramid and aramid & glass are also finding use in key application areas. As investments towards developing more efficient and eco-friendlier materials surge, the hybrid fabric market can be expected to gather significant momentum over the coming years.

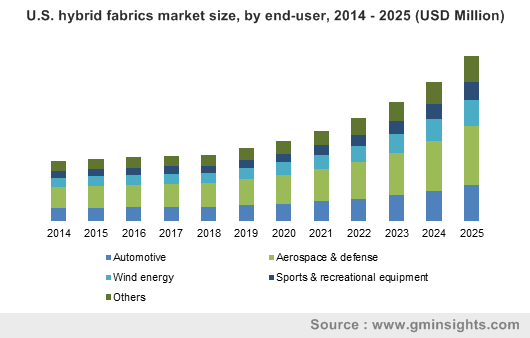

U.S. hybrid fabrics market size, by end-user, 2014 - 2025 (USD Million)

Essentially, hybrid fabrics exhibit better mechanical properties than their individual elements did, in addition to having high drapability. They are not only environment friendly but are suited as an alternative to composite reinforcements based on fiberglass. The hybrid fabrics market can also witness a fast-paced growth due to the cost-saving opportunities it can provide to businesses, since a hybrid fabric could be cheaper than utilizing only one expensive material like carbon fiber. A hybrid option apparently enables better customization according to requirements of the application. Subsequently, manufacturers are anticipated to move towards adoption of hybrid fabrics for making distinct parts of automobiles, aircrafts and wind turbines in regions like Europe, where enhancing structural materials attract vast amount of capital and industry support.

Elaborating further, major European players in the automotive sector have taken steps for finding ways that lower the overall weight of vehicles, and the swelling hybrid fabrics market can allow these efforts to take shape. Light-weight structural components are usually the preferred method for improving the vehicle efficiency, resulting to lower emissions and mitigation of environmental concerns. Carbon fibers, enormously deployed to replace steel parts in cars, entail high cost and currently are being used mostly for luxury vehicles. On the other hand, hybrid solutions can help reduce vehicle weight without the need for pouring in excessive capital. According to the OICA, in 2018 more than 11.8 million vehicles were made in the U.K., Germany, France and Spain combined, demonstrating the massive growth potential for the Europe hybrid fabric market from the consistent evolution of the automotive sector.

The European Commission has reportedly set down critical emission targets for new vehicles being produced in the region and automakers have been promised emission credits for vehicles that would come equipped with innovative technologies. The EC has also set a target for lowering the average emissions from heavy vehicles by 15% up to 2025 as compared to 2019 levels. These initiatives and associated regulations will soon compel all manufacturers to seek weight-reduction techniques, propagating the hybrid fabrics market. Europe is also home to some of the world’s leading chemical and composites producers such as Solvay, SGL Group, Gurit and Excel Composites, significantly influencing the regional industry dominance.

Speaking further on the prospects for the European hybrid fabrics industry, the region is witnessing a gradual exit of diesel fuel vehicles and rapid expansion of the electric vehicle segment. Weight of EVs are unquestionably an important feature that affect the overall performance of the cars and life of its components. High-performance hybrid fabrics would enable carmakers to realize lighter, safer and more efficient EVs, enhancing their demand and inadvertently benefiting the hybrid fabrics market. Notable initiatives, like Norway’s target to make all new vehicles emissions-free by 2025, will considerably boost the material consumption.

All in all, with the increasing need for light, safe and reliable auto parts for reducing vehicular emissions in Europe, the hybrid fabrics market is slated to experience accelerated growth between 2019 and 2025, supported by the increased purchasing power of consumers. The competitive hierarchy of the global industry is comprised of key participants like BGF Industries Inc., Excel Composites, Hexcel Corporation, Gurit, SGL Group and Solvay.