Global in-vitro colorectal cancer screening tests market share to surpass the billion-dollar benchmark by 2024, U.S. to witness remarkable proceeds

Publisher : Fractovia | Published Date : 2017-03-15Request Sample

CellMax Life’s recent announcement of bringing onboard Zenith evidently depicts the developments underlining in-vitro colorectal cancer screening tests market. Zenith, the U.S. clinical study claims to transform the way of detecting colorectal cancer by enabling diagnosis at treatable and early stages. For the record, the U.S. based cancer diagnostics company has been indeed famous for its affordable non-invasive blood tests. In the first phase of this study, the firm is apparently trying its hands at leading U.S. medical centers such as U.S. Department of Veterans Affairs Palo Alto Health Care System, University of Southern California, Stanford Medicine, and Johns Hopkins.

China In-Vitro Colorectal Cancer Screening Tests Market, By Test Type, 2013 - 2024 (USD Million)

Riding on the hallmark success of the Asian Trial that got revealed at ASCO Gastrointestinal Cancer Symposium in January this year, CellMax is apparently trying to foray in U.S. in-vitro colorectal cancer screening tests industry. Considering its detection accuracy rate in the early trial which ranged from 84% to 88%, it wouldn’t be incorrect to state that Zenith is undoubtedly one of the most futuristic initiatives taken in global in-vitro colorectal cancer screening tests market.

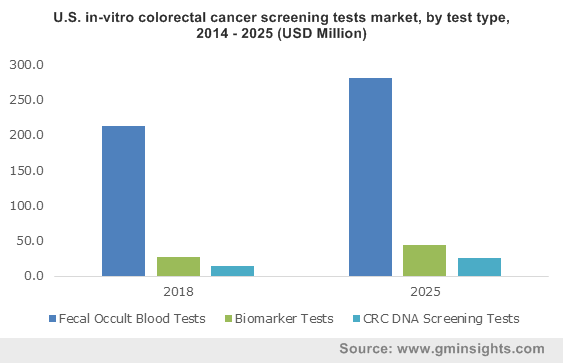

As per the latest report released by American Cancer Society- Colorectal cancer is touted to be the third most prevalent cancer in the U.S. The estimation claims that the country is likely to witness around 97,220 new cases of colon cancer and 43,030 cases of rectal cancer this year. Not just that, colorectal cancer related casualties in the nation is expected to reach 50,630 in 2018, depicting the increased demand for advanced non-invasive screening tests in the region, which would perpetually impact the U.S. in-vitro colorectal cancer screening tests market share. In fact, U.S. procured a prominent chunk of North America industry landscape in 2016.

Being one of the pivotal verticals of healthcare domain, in-vitro colorectal cancer screening tests industry is strictly regulatory driven. The FDA undoubtedly takes it upon itself to approve and reject any screening test, given the sensitivity of these tests and their critical impact on human body. Incidentally, Epi proColon is the first blood-based CRC screening test to officially receive FDA approval. This in-vitro diagnostic test is basically performed to detect methylated Septi9 DNA, the principal factor linked to colorectal cancer. This has pushed various other in-vitro colorectal cancer screening tests market players to experiment with advanced screening tests.

Another relevant instance depicting how the regulatory frame of reference is influencing companies to rethink their strategies is Exact Sciences’ plans to leverage maximum benefits from ACG’s new guidelines. As per the revised regulation, the recommended age for patients to get their first colorectal screening tests done has been lowered from 50 to 45. If reports are to be relied on, the company is presently working on the trial design for an FDA approval to expand the indicated age on its patent Cologuard’s label. For the record, Exact Sciences which is indeed a prominent name in the in-vitro colorectal cancer screening tests industry is deemed to witness positive and long-term benefits from ACS’s new set of guidelines.

The competitive spectrum of the business space is affluent with participation of some of the renowned giants like Siemens Healthcare, Alere, EMD Millipore, Beckman Coulter, and Qiagen. These players are heavily investing in extensive research activities to come up with highly advanced in-vitro screening tests that feature superior sensitivity and efficiency. Yet another growth strategy that is being implemented by the companies is product development via strategic alliances. Not to mention, affordable pricing is a vital factor determining the competitive hierarchy of the market players, which is further paving way for heavy R&D investments in this sector. All in all, aided by a strong product pipeline, expanding colorectal cancer patient base, and the growing awareness regarding molecular testing, in-vitro colorectal cancer screening tests industry is likely to carve a profitable roadmap in the years ahead. Global Market Insights, Inc., speculates the overall market size to surpass USD 1 billion 2024.