Industrial control systems (ICS) security market to register a double-digit CAGR over 2018-2024, rising urgency for critical infrastructure protection to augment market growth

Publisher : Fractovia | Published Date : 2018-07-13Request Sample

Industrial control systems (ICS) security market has rapidly gained momentum, ever since it was understood by critical industry operators, the extent of damage a cyber-attack can render to industrial systems. The first instance of such a kind was experienced in an Iranian nuclear plant in 2010 when the horrors of Stuxnet were unleased on the nuclear program. Stuxnet targeted the industrial control system and caused thousands of machines to simply degrade. The precedent was thus set, and the ICS security industry has been ever since reinforced with the demands for better technology that is designed to protect anything marked as critical infrastructure by the government.

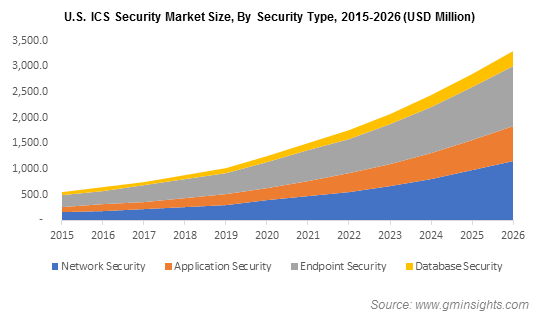

North America Industrial Control Systems (ICS) Security Market Size, By Security Type, 2017 & 2024 (USD Million)

The rapid proliferation of ICS security market has recently been witnessed when $60 million was raised by ICS security vendor Claroty in a Series B funding. The group of investors included notable industrial automation providers like Rockwell Automation as well as Schneider Electric and Siemens. Claroty provides security for industrial networks with real time monitoring among other security functions. The latest round of funding brings Claroty’s investment to $93 million which the company aims at using to extend its brand across the globe along with its sales and customer support.

Apart from power and energy, one of the other industries that will offer a broad growth avenue to the ICS security industry is the transportation sector. Experts anticipate the ICS security industry size from transportation applications to register a 26% CAGR over 2018-2024. Over the last thirty years ICS has majorly penetrated the transportation network and can now be found anywhere ranging from surface transport, aviation, highways to railways, subterranean tunnels and elevators in high rises. From the myriad examples of ICS vulnerabilities that have been recorded across various industries, it is rather overt that transportation has emerged as one of the crucial spheres for the application of ICS especially to maintain public safety.

The competitive landscape of the industry is fraught with investments, research and development programs targeting at technology enhancement. Various companies such as Cisco, ABB, Honeywell, Trend Micro, Claroty, Symantec, IBM, Kaspersky, Schneider Electric, McAfee, and Bayshore Networks are continuously vying with each other to occupy a greater share in the ICS security industry revenue.

To elaborate on the competitive landscape of the ICS security industry it will be worthy to mention Honeywell’s latest venture into the market with a security management solution for industrial cyber safety. The solution is particularly targeted at industrial customers who have to deal with diverse process control sites, networks and vendors. Honeywell’s multi-site solution for cybersecurity management is aimed at lowering security vulnerabilities and reducing operational risks.

Apart from private companies, even governments are pushing to implement and upgrade ICS security in various critical infrastructural fields, adding impetus to the ICS security market. After the cyberattack on Ukraine’s power grid in December 2015 which left 230,000 people without power during winter, governments of various nations have grown aware of the importance of implementing cybersecurity over energy infrastructure. This has prompted the US government to set a new office, namely, Cybersecurity, Energy Security, and Emergency Response (CESER) at the Department of Energy. CESER will focus on creating coordinated preparedness and security against man-made threats. President Trump’s FY19 budget funded the DOE with $96 million to advance the energy security project. CESER will focus on early stage activities such as development of next generation of cybersecurity control systems, devices and components for the greater ability to detect, prevent and recover data in care of cyberattacks, adding a new growth dimension to ICS security market.

European nations are also implementing legislations in the wake of cyberattacks such as NotPetya and WannaCry that crippled infrastructure networks by initiating operation shutdowns. The EU Network and Information Security (NIS) Directive is an example of such a legislation that is underway in the UK. Other bodies like the European Union Agency for Network and Information Security (ENISA) have been around for years, offering advice on securing ICS/SCADA systems, ICS testing and ICS attack mitigation.

Analysts recently pointed out that though most attacks on strategic and critical systems have been apprehended, the growing list of isolated success of attacks is enough to urge critical infrastructure and individual businesses to adopt ICS security. Powered by the increasing interconnectedness in the world and rising awareness towards the vulnerability to attacks the ICS security market is poised to register a massive CAGR of 20% over 2018-2024.