Unveiling industrial gas turbine market in terms of a regional spectrum: China to emerge as a lucrative growth ground by 2024

Publisher : Fractovia | Latest Update: 2018-12-12 | Published Date : 2017-04-06Request Sample

Shifting trends toward cogeneration and other gas operated technologies to fulfill the demand for electricity will fuel industrial gas turbine market over the years ahead. Stringent environmental norms regarding harmful GHG emissions have led to a high demand for sustainable technologies, which will augment the product demand. The government has been investing heavily in the development of new gas based cogeneration plants, which is expected to propel industrial gas turbine market size. Moreover, surging replacement of old systems with new advanced equipment will lead to considerable revenue generation for this industry. According to Global Market Insights, Inc., worldwide, industrial gas turbine market size is anticipated to cross 20 GW by 2024.

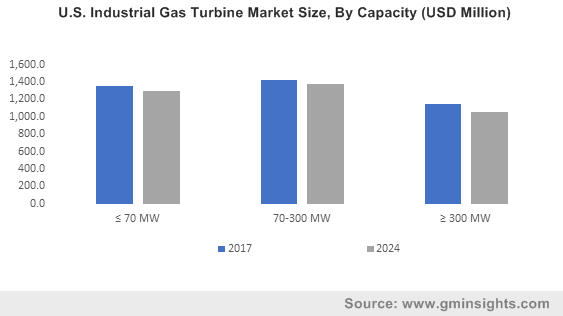

U.S. Industrial Gas Turbine Market Size, By Capacity (USD Million)

Unveiling industrial gas turbine market trends from the United States

The U.S. government is promoting the deployment of sustainable technologies by offering attractive financial benefits to private investors. Indeed, as per reliable estimates, the U.S. industrial gas turbine market size is expected to surpass an annual installation of close to 3 GW by the year 2024. In addition, oil & gas exploration activities across this region are growing significantly, which will also favor industrial gas turbine industry growth in the region. One of the primary reasons responsible for the expansion of the U.S. industrial gas turbine industry is the robust prevalence of research and development (R&D) investment reforms. That said, the region has also been experiencing a significantly high demand on account of the shifting focus towards deployment of combined cycle generation systems.

According to the ICF International, turbines manufactured by the U.S. based companies, in the year 2016, accounted for more than 70% of the operational natural gas-fired combined cycle projects across the nation. Reliable estimates also claim that the United States had fulfilled around 25% of the overall electricity demand with natural gas in 2015 and is planning to surpass the generation capacity over the years ahead. Surging investment in the replacement of coal and steam based power plants with sustainable natural gas power stations will thus boost the U.S. industrial gas turbine market.

Unveiling industrial gas turbine market trends from China

Yet another lucrative region that would contribute toward the propulsion of industrial gas turbines market is the emerging economy of China. One of the primary reasons responsible for China being tagged as a major regional contributor is the favorable regulatory prospects that the country is characterized by. Indeed, China is embroiled with the support of a government that seems keen on the development of a clean energy integration as well as huge gas-fired power projects across the nation.

Prominent manufacturers across the globe have also retained focus on China as a pivotal growth ground given the supportive regulatory spectrum and the robust expansion of key industries across the region. Citing an example of the same, Siemens, in the year 2018, went on to fetch major supply orders for its two H-class gas turbines, specifically for the CHD Guangzhou Zengcheng project.

It is pivotal to mention that the most recent industrial gas turbines developed are likely to receive major competition from the developing markets that are strongly dependent on imports. This is primarily on account of the fact that these markets are those that aren’t characterized by a stringent regulatory landscape or any sort of mandates related to curbing the levels of carbon emissions. However, the growth of the industrial gas turbine industry is also expected to rise in the years to come on account of massive technological proliferation in addition to the rising consumer inclination.

The notable participants in industrial gas turbine market are General Electric, Kawasaki Heavy Industries, Siemens, Solar Turbines Incorporated, Man Diesel & Turbo, Harbin Electric, Ansaldo Energia, Bharat Heavy Electricals Limited, Bharat Heavy Electricals Limited, Mitsubishi Hitachi Power Systems, Vericor Power Systems, Cryostar, NPO Saturn, Capstone Turbine, and OPRA Turbines.