Industrial solvents market to procure substantial returns from paints and coating applications, growing investments in the automotive and construction sectors to stimulate the product demand

Publisher : Fractovia | Published Date : 2018-12-26Request Sample

Industrial solvents market players have lately been experiencing a chapter what industry experts would marginally refer to as the ‘growth phase’. With the rising demand for solvents in the textile, rubber manufacturing, printing, ink manufacturing, woodworking, and construction sectors and the ever-growing investments in the construction and automotive sectors, industrial solvents market contenders have indeed been enjoying profitable returns.

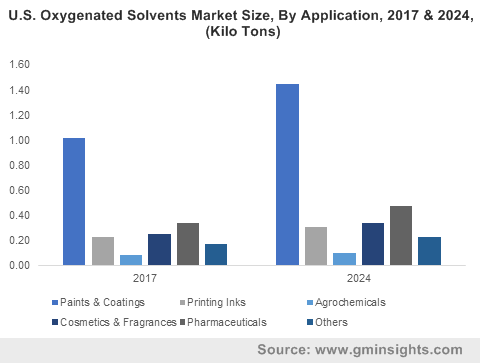

U.S. Oxygenated Solvents Market Size, By Application, 2017 & 2024, (Kilo Tons)

Considering the estimated scope of the industry, companies have also been leveraging numerous revenue generating opportunities, by introducing a new range of qualitative products. However, the deployment of strict regulatory norms for controlling the negative impact of industrial solvents on the environment have also encouraged companies to get involved in research and development activities to innovate green and biodegradable solvents.

In 2017, the renowned chemical manufacturer, BASF started its first automotive coating manufacturing facility located in ASEAN. At this newly started facility center, it has been producing waterborne and solvent-borne automotive coatings. The main motive behind this new establishment was to tap the growth prospects of the evolving automotive market across ASEAN.

On the same lines, BASF has also developed Coatings Technical Competence Center ASEAN in 2015. The introduction of such new chemical plants will help the company increase regional investments and expand their horizons. In fact, BASF has designed this recently developed facility in a such a way that it can make the capacity expansion plans in the future. The increasing flexibility of chemical product manufacturing companies to align with product requirements is likely to stimulate industrial solvents industry trends.

Over the last few years, the production of cars and commercial vehicles has grown tremendously and it is expected to increase in the coming years with the surging demand for vehicles across India, Iran, Brazil, Finland, China, and other developing countries. As per reports by the International Organization of Motor Vehicle Manufacturers (OICA), the total count of commercial vehicles and cars across the globe was 94,976,569 while in 2017 it reached to 97,302,53 with the average growth rate of 2.36%. The rise the production of vehicles is thus concurrently boosting the industrial solvents industry size owing to the increasing use of solvents in automotive paints and coatings.

The rising deployment of solvent-equipped paints has been specifically productive for Germany – one of the automotive nerve centers of the globe. Indeed, reports affirm that with the increasing demand for solvents and adhesives for automotive applications, Germany industrial solvents industry will surpass a revenue collection of USD 5 billion by the end of 2024.

As of now, the world has been a witness to the rapid infrastructural development activities related to the construction of commercial, residential, and industrial buildings, road, bridges, and renovation of old monuments. Given the rapid urbanization in the developing and developed countries mainly including India, China, and U.S., the demand for industrial solvents is expected to experience an undeniable upsurge in the years to come.

In the construction industry, the solvents are mainly used as carriers for surface coatings comprising adhesives, paints, and varnishes. 1-butanol, xylene, and white spirit are some of the most commonly used solvents in the construction applications.

The supportive role of regional government to the promote the infrastructure development activities is turning out to be rather opportunistic for the players in the industrial solvents market. In fact, the governments of several countries have been encouraging investments in the construction sector by normalizing investment norms. For instance, in 2015, for accelerating the investment in the real estate industry, the Government of India relaxed foreign direct investment norms. In addition, the government has allowed 100 percent foreign direct investment in housing, township, and built-up infrastructure to accelerate construction development activities.

It is noteworthy to mention that expanding use of solvents in the various industrial applications is likely to augment the market trends. The invention of next-generation vehicles along with involvement of several countries in the successful implementation of smart city projects will further propel the product demand. Reportedly, by the end of 2024, industrial solvents market is slated to generate a revenue of more than USD 35 billion.