Top 5 trends characterizing infant formula market: proliferating working women culture to be a major driving factor for the industry

Publisher : Fractovia | Published Date : 2019-06-11Request Sample

The global infant formula market is slated to procure substantial proceeds in the ensuing years owing to rising disposable income and changing lifestyles, especially in developing nations. Given that infant formula is intended to meet the distinct nutritional requirements of babies, increasing infant population is undeniably a positive indicator for the development of the market. A rise in birth rates throughout the world, especially in developing nations, will generate a huge demand for the product, contributing significantly to the global infant formula market growth in the ensuing years.

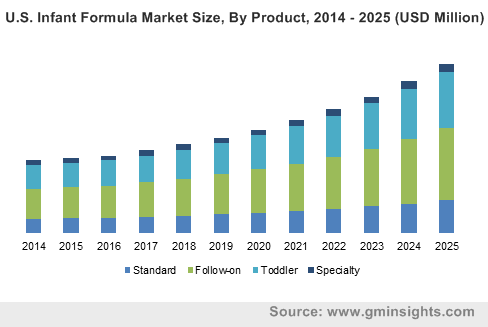

U.S. Infant Formula Market Size, By Product, 2014 - 2025 (USD Million)

Of late, developing nations have witnessed rapid urbanization paired with strong economic growth, which has boosted the awareness regarding infant care and branded nutrition products. According to Euromonitor International, Chinese baby formula retail sales grew 9 percent in 2018. Therefore, several international infant food brands are directing their focus on tapping a huge consumer base in emergent markets.

For instance, Nestle is planning to launch a new range of baby formula in China under an existing brand, for expanding in the smaller cities of the world’s biggest baby milk market. In addition to the penetration of big brands, the rising disposable income of the consumers along with rising awareness will fuel industry growth in emerging economies in the coming years. A research report in fact, projects the Asia Pacific to be the major revenue pocket for the global infant formula market, depicting a CAGR of 10% over 2019-2025.

Key factors triggering the expansion of the global infant formula market

Working women increasingly adopt infant formula products

The female workforce ratio throughout the world has witnessed dramatic growth in the past few years. As a result, women are increasingly shifting toward convenient baby care products which ensure effective infant care and also save time. Although a growing female workforce is beneficial to the society, it does pose some challenges for working mothers, especially during the infantile years of their children.

In such cases, infant formula serves as the perfect substitute for breast milk, since they are enriched with excessive amount of iron and proteins, necessary for baby’s healthy growth. Therefore, the growing population of working women will favor the global infant formula market growth in the coming years.

The comeback of former players

Beingmate Baby & Child Food, which was once China’s leading baby nutrition brand, has reentered the market last year after overcoming issues concerning distribution chaos and dispute with one of its significant stakeholders. The company recorded decent net profit in 2018, marking a successful retrieval in Chinese market. As prominent contenders mark their comeback into the mainstream, infant formula industry will record substantial momentum in the years ahead.

New partnerships and acquisitions

Bubs Australia has reportedly partnered with Fonterra to release a new line of Australian-made organic grass-fed baby formula. As a result of the newly entered supply agreement, Bubs Australia will be able to provide two nutritional option namely organic and goat, in a bid to tap into growing consumer trend toward organic, sustainable, and natural food production.

The tried-and-tested formula of forging innovative partnerships will have a commendable impact on the revenue graph of infant formula industry worldwide.

Reinventing distribution strategies

Ezaki Glico is apparently breaking the traditional methods of selling infant formula through supermarkets, retail outlets, and pharma stores. The Japanese food company will be selling its liquid infant formula through a vending machine in Hokkaido under the brand name Icreo Baby Milk.

Government support

The presence of a favorable regulatory scenario will have a prominent influence on infant formula industry. Bellamy’s Australia re-entered the China market recently by gaining government approval for cost-effective conventional baby formula. As per new regulations, all baby formulas require SAMR registration. The new regulation will enable Bellamy’s to sell a non-organic formula to offline channels in China.

All in all, growing working women culture, steady growth in birth rates, and burgeoning disposable income will propel global infant formula market growth. The launch of new products supported by government approvals will further amplify industry growth over the coming years. Estimates claim that the worldwide infant formula market valuation will exceed $98 billion by 2025.