LED lamp market to witness phenomenal growth via commercial applications, escalating demand for energy-efficient lighting solutions to stimulate the industry expansion

Publisher : Fractovia | Published Date : 2017-05-31Request Sample

In a relatively short time span, LED lamp market has become extremely competitive. The companies operating in this industry have given incessant emphasis on the development of lighting solutions. The transition from cheap incandescent bulbs to affordable LED lamps have opened up a plethora of opportunities for the market players to grab commendable gains. The global LED lamp market is dominated by three bulb manufacturing companies namely Philips, Osram, and GE. However, the enduring energy-efficient lighting revolution has disrupted the LED lamp market hierarchy to witness growing fragmentation and emergence of new manufacturers. These new entrants are seeking to capture certain market segments via product differentiation.

Based on the growing LED lamp market trends, U.S. and India are identified as the main growth centers, owing to rapid economic growth, mega urban projects, and favorable government policies in the region. Rising demand for lower energy bills and sustainable solutions have eventually made LED lights become a popular commodity of choice. The initiatives taken by the government of US and Canada to reduce the overall cost has made LED lamps the best affordable option in attempt to minimize the energy usage. Accounting for more than 25% of overall industry share in 2016, Europe LED lamp market is set to augment, owing to growing trends in smart lighting industry and smart homes industry.

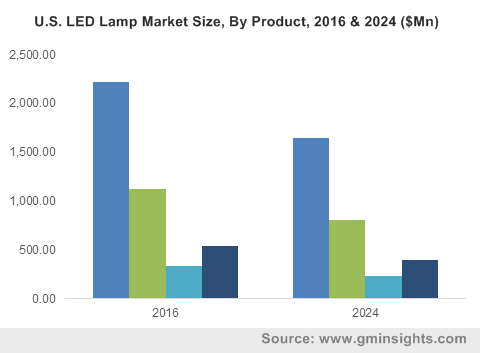

U.S. LED Lamp Market Size, By Product, 2016 & 2024 ($Mn)

A significant drop in LED lights and lamps prices have displayed a sharp rise in the demand for LED lamp market across the commercial and residential applications. The oversupply situation of 2012 due to increase in competition has caused average sales price of LEDs to plunge between 30% to 40%. As a consequence, a wide product adoption was also seen across the hospitality, retail, and healthcare sectors. General-purpose, decorative, and specialty product segment of LED lighting industry is estimated to witness heavy deployment in the coming seven years. The rapid pickup in demand have drastically benefited the direct marketing channels such as e-commerce, as items like bulbs and ballasts can be easily stocked and ordered.

Starlite- a UK based lighting company claims LED lights as the greatest development since 1880, when Thomas Edison presented the world with electric lamp. As per the estimates, the LED lamp market is anticipated to generate revenue worth USD 13.5 billion by 2024. Furthermore, the retailers and manufacturers of the dynamic LED lamp market are keen to bring their market strategies at play. Mergers and acquisitions and product diversification are the key strategies adopted by these market players to seize lucrative deals.

Lighting Deals

Lightech- the company which manufactures electronic drivers was acquired by General Electric Corporation in July 2011. Later in November 2012, GE also acquired a company involved in manufacturing fixtures - Albeo Technologies.

As the competition in the LED lamp market has increased, many of the LED chip and components manufacturers are moving down the value chain to grab incremental value in luminaries and energy-efficient lighting solutions. Two notable examples are the Osram’s acquisition of Siteco and Cree’s acquisition of Beta-Ruud Lighting.

Osram acquired its fellow lighting manufacturer Siteco in the year 2011. This acquisition allowed Osram to expand its market for luminaires and energy-efficient lighting systems, which opened up further growth potential for the LED lamp market to spur.

In the same financial year of 2011, the LED lamp industry also witness a similar acquisition of Cree purchasing Beta-Rudd Lighting, Inc. to accelerate the LED lighting revolution and expanding its market of LED systems.

Philips lighting division announced the launch of IPO float that would raise over USD 700 million in a bid to expand its global presence and penetrate its products in the soaring global LED lamp market. In addition, an Australian LED lighting company- LEDified sharply penetrated their eco-friendly and low price based sales model into the local market to inflate their industry share.

The venture capitalist funding in US was also doubled from USD 167 million in 2010 to USD 305 million in 2011. In a timeframe of only 12 months, the VC funding witnessed a raise over 80% as LED providers became more competitive due to aggressive entry of new businesses in LED lamp industry. For instance, major technology companies such as Toshiba, Samsung, and Sharp entered the market to compete with both traditional lighting industry players and LED chip manufacturers. Moreover, the government funding also helped these players to optimize their global footprint across Asia, including Taiwan, Singapore, Malaysia, and China.

The favorable government norms, aggressive competition, and rising production capacity and manufacturing capability in the emerging economies are expected to scale up LED lamp industry share over the years ahead.